Manchester’s Flex Office Market 2024 sees 34.5% rebound driven by startup demand

- Flexible office take-up in Manchester rose by 34.5% in 2024, reaching 280,598 sq ft, up from 208,595 sq ft in 2023.

- 40% of workspace enquiries were for 1–2 person offices, while 35% targeted 5–10 sqm spaces, reflecting strong demand from startups and solo entrepreneurs.

- 25% of physical office rentals in 2024 were coworking desks, while 75% were private offices, indicating a hybrid preference for flexibility and privacy.

- Major deals included BNY Mellon leasing 35,000 sq ft at 4 Angel Square in the NOMA district, reinforcing Manchester’s appeal to global firms.

- The average preferred space size was 64 sqm, showing a shift toward compact, cost-effective footprints.

- Manchester's average monthly desk rate is £360, far below London’s £600, making the city highly attractive for scaling businesses.

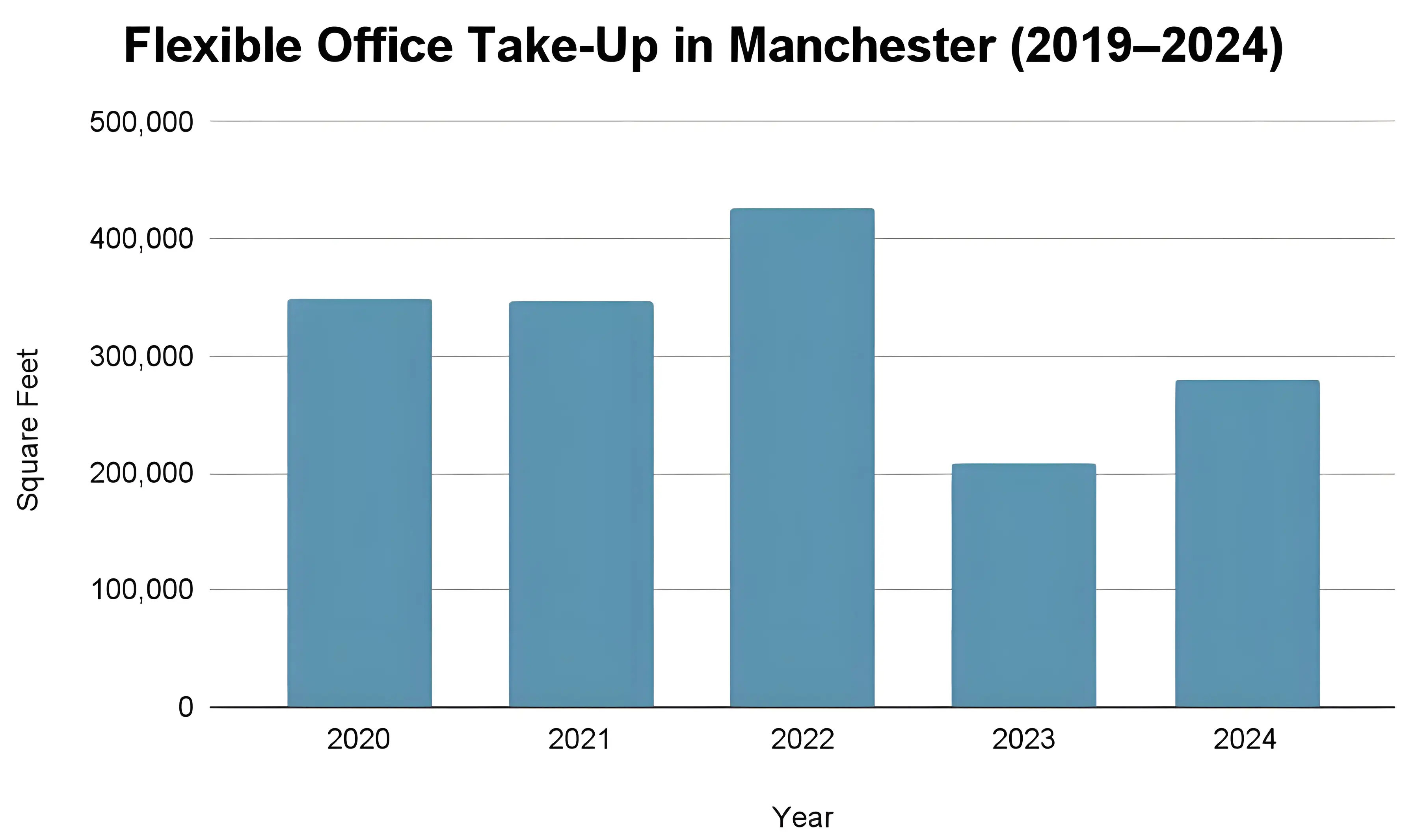

Manchester’s flexible office market regained footing in 2024, recording a rebound in leasing activity after a dip in the previous year. Total flexible office take-up climbed to 280,598 square feet, up 34.5% from 2023’s 208,595 sq ft, reflecting rising demand across sectors seeking agile, cost-effective workspace solutions.

Although still below the 2022 figure of 426,872 sq ft, the recovery marks a stabilisation phase for Manchester’s flexible office landscape, now shaped by shifting workplace expectations. Businesses—particularly startups, entrepreneurs, and SMEs—increasingly prefer flexible leasing terms and smaller footprints that offer high utility without long-term commitments.

Data from Office Hub Co Stats 2024 offers further insight into this behavioural shift. An estimated 40% of all workspace enquiries in Manchester were for 1–2 person setups, while 35% of demand targeted offices around 5–10 square metres.

These figures highlight the growing appetite for compact, cost-effective workspaces catering to solopreneurs, consultants, and micro-teams. The average preferred space size in Manchester stood at 64 square metres, a metric that further reinforces the trend toward compact, tailored spaces.

Moreover, the actual office space rented through Office Hub in 2024 consisted of 25% coworking spaces and 75% private offices. Experts suggested that this illustrates that while shared environments remain attractive, privacy and control remain important for many tenants. This blend is particularly evident in Manchester’s coworking hubs like Bruntwood Works, Orega, Regus, and Landmark, where hybrid setups offer the best open and closed environments.

Savills said that this surge in demand aligns with a broader recovery in the Technology, Media, and Telecommunications (TMT) sector, which remained the leading contributor to office occupancy in Manchester during 2024. TMT companies accounted for nearly a quarter of total city centre office take-up, with notable lettings including a major deal at 4 Angel Square in the NOMA district, where BNY Mellon secured a 35,000 sq ft space earlier this year.

Located north of Manchester city centre, NOMA is one of the UK’s largest mixed-use regeneration projects. With a blend of heritage-listed buildings and modern workspaces, it has attracted both multinational firms and fast-scaling tech startups. The district continues to benefit from proximity to transport links, green public spaces, and ESG-conscious building design—features now high on tenant priority lists.

Meanwhile, the availability of Grade A office space in the city continues to narrow. According to Savills, the vacancy rate for prime buildings stood at just 5.9% by the end of 2024, compared to 12.1% overall. However, instead of aggressive development cycles, landlords and operators focus on refurbishments and ESG upgrades to match the evolving expectations of incoming tenants.

The prices of office spaces in Manchester also remained relatively attractive. The average desk rate hovered around £400 per month, which is more affordable than London’s average of £600. This pricing advantage, combined with Manchester’s deepening talent pool and improved infrastructure, continues to make it a magnet for early-stage companies and regional expansions.

Another layer of competitiveness has come from increased platformisation in the leasing process. Platforms like Office Hub now streamline bookings, compare space formats, and allow for shorter commitments—all crucial tools in today’s unpredictable economic environment.

While some market challenges remain—including the constrained supply of newly built premium offices and the rising cost of fit-outs—the overall trajectory in 2024 has been one of measured recovery. The sharp rebound in demand, especially from entrepreneurs and small teams, signals renewed confidence in physical workspaces, albeit with new priorities: flexibility, affordability, and purpose-fit design.

As Manchester heads into 2025, experts predicted that landlords and flexible workspace operators will likely shift their focus toward hybrid service models, smarter amenity packages, and digital integrations that meet tenant expectations. With its prime regional status, strong university pipeline, and evolving property landscape, Manchester is well-positioned to lead the UK’s regional coworking revival.