2024 Hong Kong Flexible Office Market Report | Trends & Analysis

The Hong Kong flexible office market demonstrated significant demand growth in 2024 despite prevailing challenges in the broader commercial real estate sector.

Data indicates a notable increase in flexible workspace locations and inquiries from companies seeking such solutions. Serviced offices and coworking spaces maintained their dominance in the market, with a strong preference observed for private office setups within the flexible framework.

While the overall office market experienced headwinds such as high vacancy rates and declining rents, the flexible office segment showcased resilience and an increasing appeal to businesses seeking agile workspace solutions.

This report delves into the supply and demand dynamics, pricing trends, tenant preferences, and future outlook of the Hong Kong flexible office market in 2024, providing a comprehensive analysis for stakeholders.

1. The Rise of Flexible Workspaces: A Global Perspective with a Hong Kong Focus

The global work landscape has transformed significantly in recent years, resulting in a high demand for flexible office spaces. This shift is driven by various factors, including the normalisation of remote work practices, businesses' pursuit of cost efficiency, and the growing need for operational agility in a rapidly evolving economic environment.

Hong Kong stands out as a key market for flexible office solutions within the Asia Pacific region, owing to its global business hub and high concentration of multinational corporations and dynamic startups.

2. 2024: A Year of Dynamic Shifts in Hong Kong's Commercial Real Estate

2024 presented a complex scenario for Hong Kong's commercial real estate market. According to JLL, it has been a challenging period for the overall Grade A office market, marked by a high 13.1% vacancy rate and a decline in rental values.

This situation was due to the completion of new offices in Central and other districts, intensifying competition among landlords. Despite these headwinds in the traditional office sector, the flexible office market exhibited different dynamics.

Flexible workspaces' inherent flexibility and shorter-term commitments may have made them a more attractive option for businesses facing economic uncertainties and evolving workplace strategies.

3. Key Highlights of the 2024 Flexible Office Market in Hong Kong

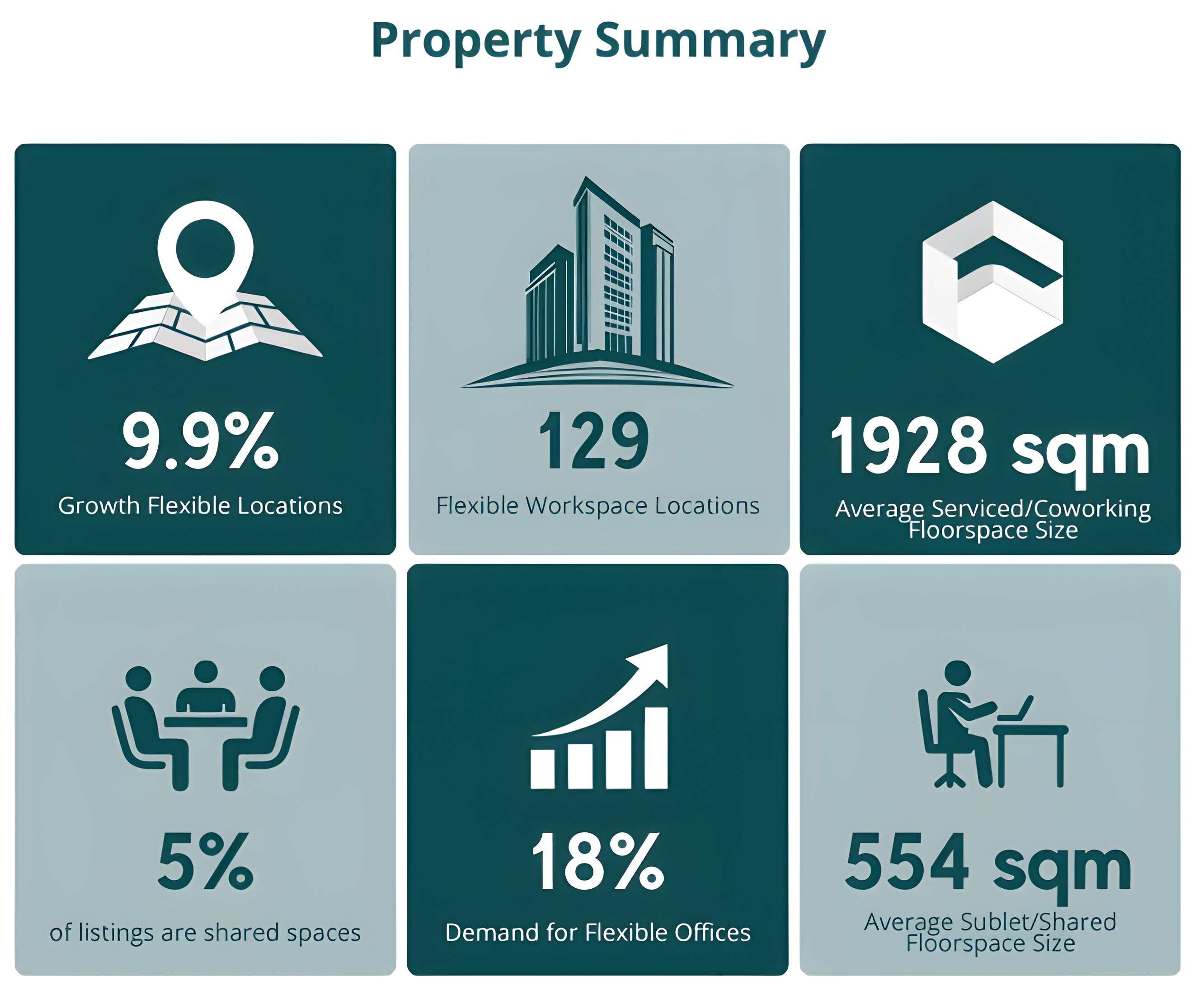

In 2024, the number of available flex workspaces for rent increased by 9.9% compared to the previous year, and demand surged with a 17.7% annual rise in inquiries from companies seeking flexible options. Serviced offices and coworking spaces were the most common, with 123 out of 129 locations. Sublet offices and shared workspaces were less prevalent, totalling only six locations.

Similarly, private offices were the top choice among tenants, making up 90% of inquiries. Sublet and shared workspaces averaged 554 square meters, significantly smaller than the 1928 square meter average for serviced offices and coworking spaces.

4. Analysing the Supply Side: What Did Hong Kong's Flexible Office Landscape Look Like in 2024?

Workspace Classification: A Grade Buildings Lead the Supply

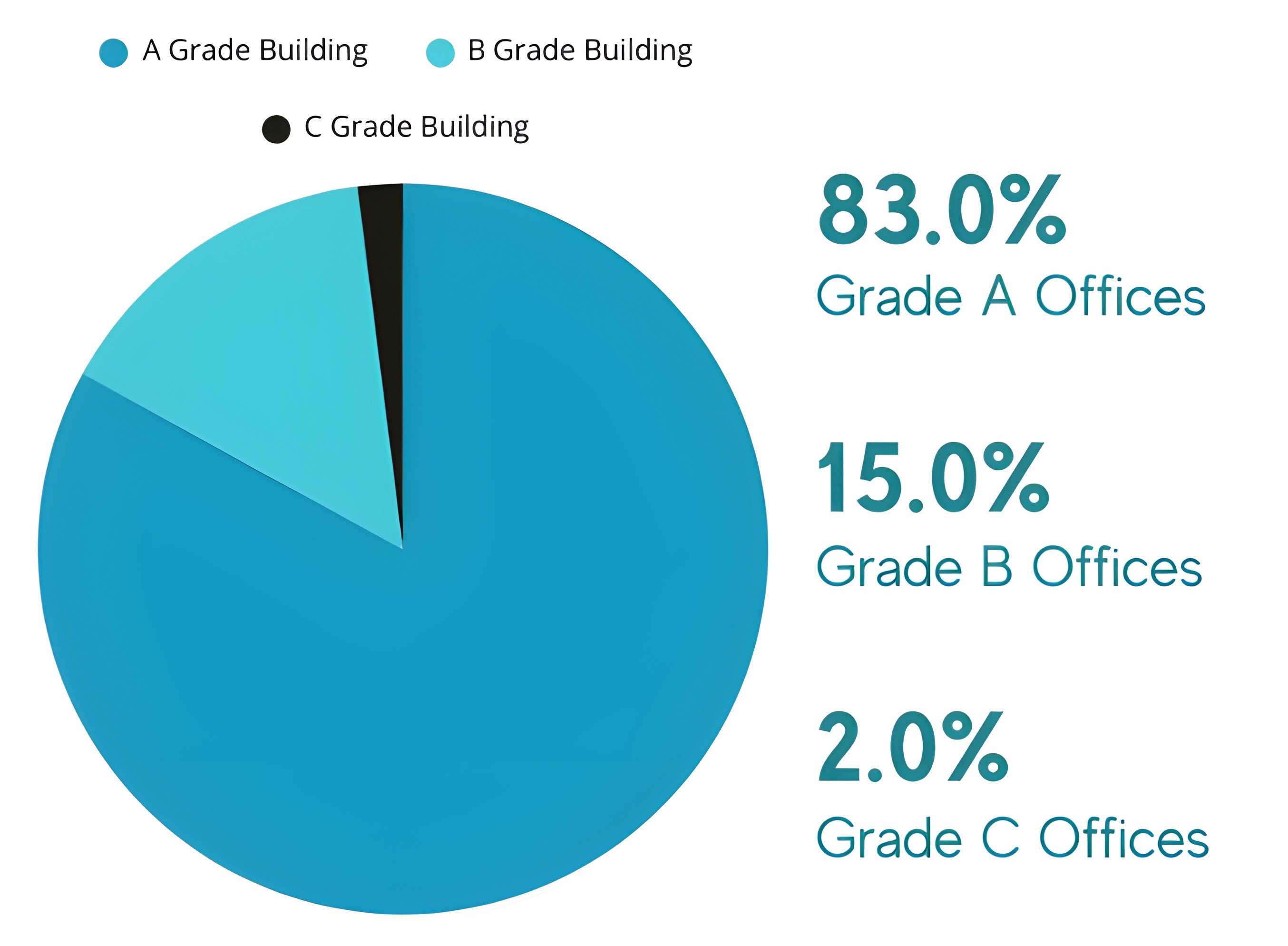

The distribution of flexible offices across different building grades in Hong Kong during 2024 reveals a clear concentration in higher-quality properties. According to data gathered by Office Hub, 83% of flexible workspaces were located in Grade A buildings. Grade B buildings accounted for 15% of the supply, while Grade C buildings represented a minimal 2%.

This concentration in premium buildings suggests a strategic move by flexible office operators to align themselves with businesses that typically seek prime locations, superior infrastructure, and comprehensive amenities.

Grade A buildings are associated with prestige and better facilities, making them attractive to various companies, primarily those in the finance, technology, and professional sectors.

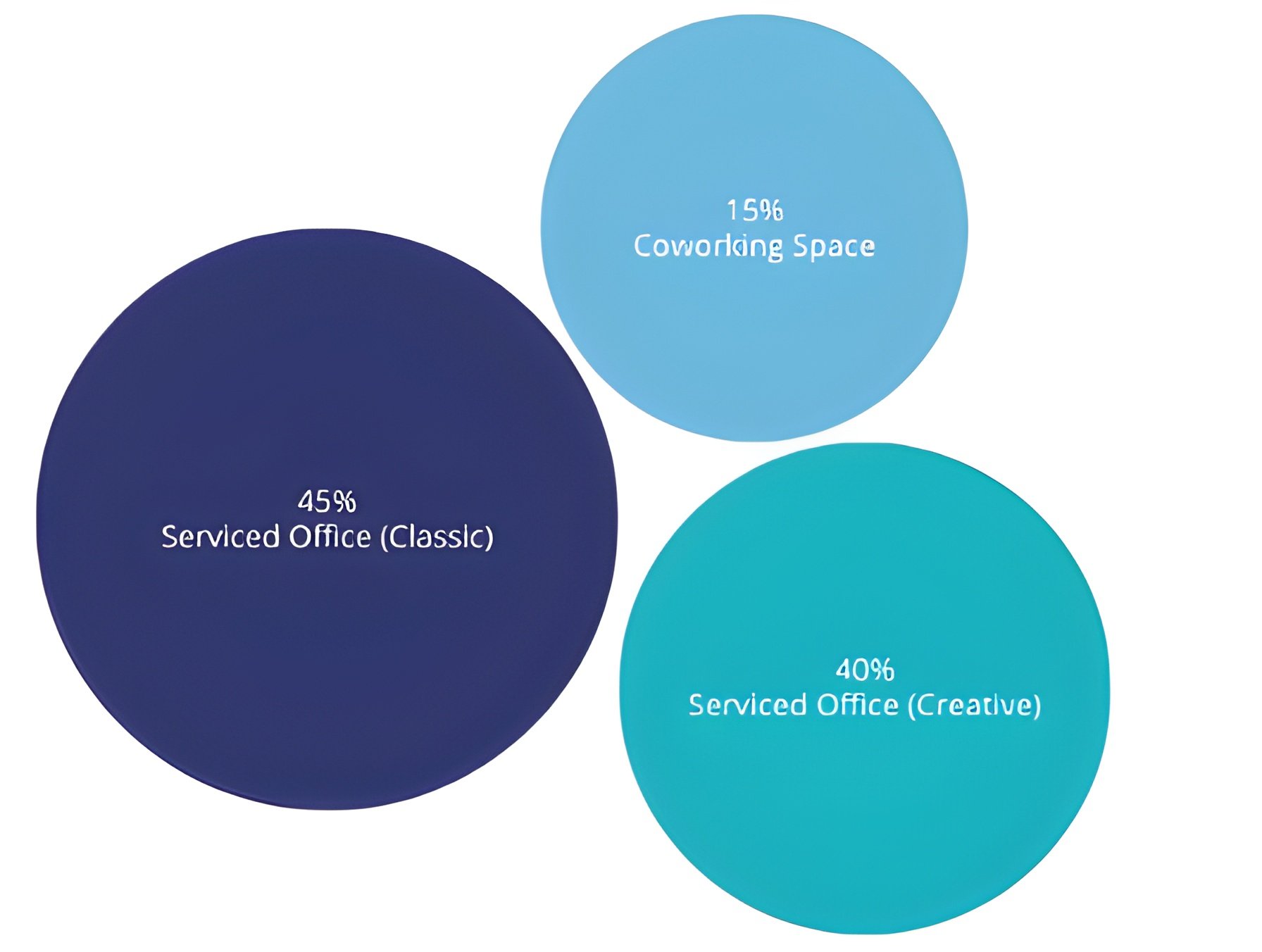

Dominant Flexible Workspaces: Serviced Offices and Coworking Spaces

The composition of the flexible office supply by type in Hong Kong in 2024 was heavily skewed towards serviced offices and coworking spaces. These two categories comprised most of the market, with 123 locations out of 129.

In contrast, sublet and shared workspaces represented a much smaller segment, with only six locations. Further emphasising this dominance, shared office spaces accounted for just 5% of all available listings.

This also indicates that serviced office and coworking models are the prevalent forms of flexible workspace solutions in Hong Kong. They cater to a broad spectrum of businesses, from startups and SMEs to larger corporations seeking flexible expansion options.

Average Desk Prices Across Workspace Types

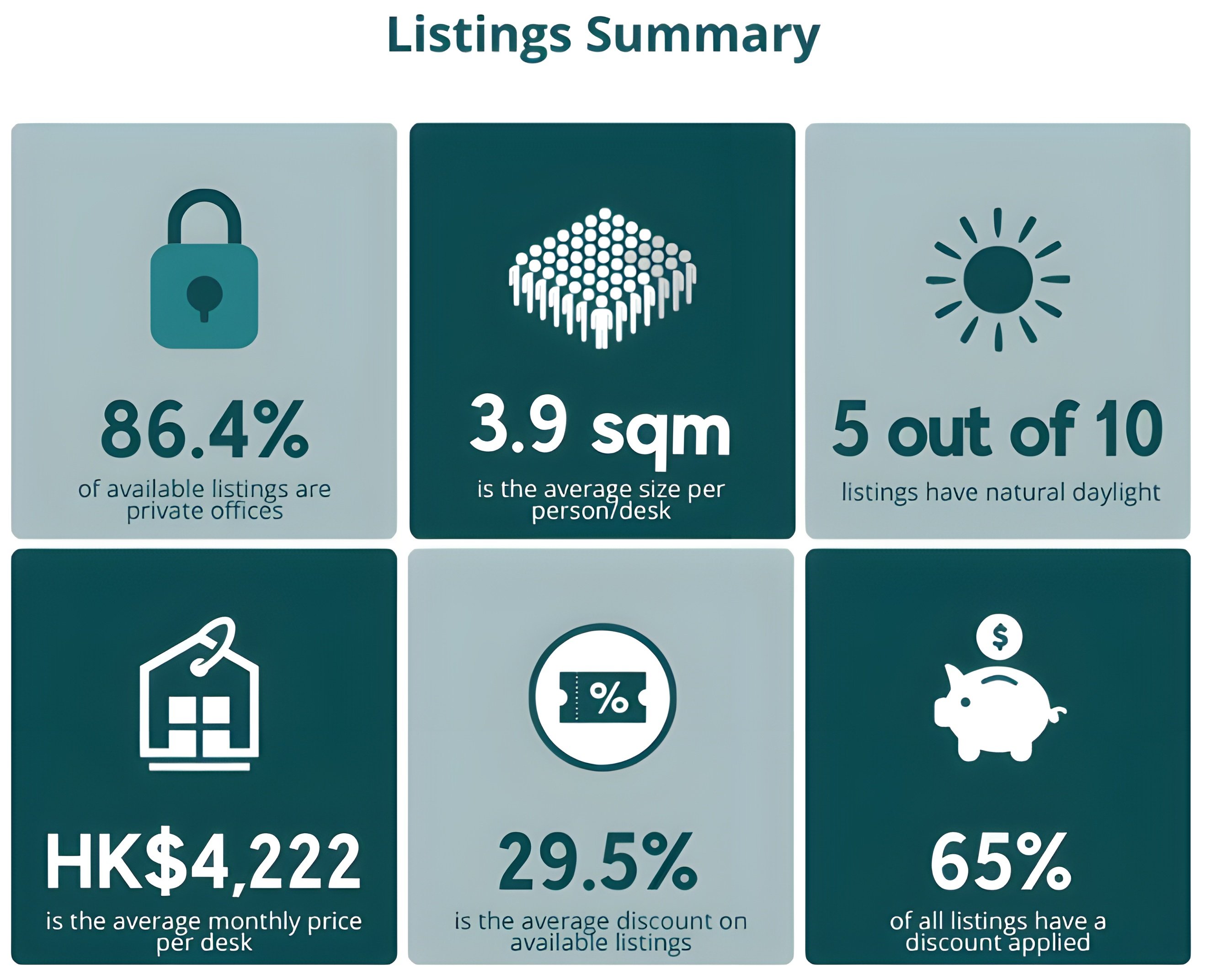

According to the data presented by flexperts at Office Hub, the average monthly desk prices for various types of flexible workspaces in Hong Kong are:

- Private Office: HK$4,640 per desk/month

- Coworking Desk: HK$4,057 per desk/month

- Shared Office: HK$3,867 per desk/month

- Sublet Office: HK$5,179 per desk/month

- Managed Space: HK$4,498 per desk/month

- Virtual Office: HK$1,427 per month

Factors Influencing Supply: A Multifaceted Landscape

Various factors influence the growth of Hong Kong's flexible office supply in 2024. While the Asia Pacific flexible workspace market experienced a slower overall growth of 2% over the past five years, with operators prioritising profitability, Hong Kong is an exception with a more commendable expansion. This could be attributed to the city's strong business fundamentals and continued demand for flexible solutions.

Notably, a significant percentage of operators across APAC are planning to increase their footprint in the near future, suggesting a potential for further supply growth in Hong Kong as well.

Further, the rising demand for flex space across the APAC region may influence operators to expand in key markets like Hong Kong. Similarly, the normalisation of expansion in the APAC flexible office market post-pandemic indicates a maturing sector where sustainable growth is a key focus.

Lastly, like their regional counterparts, Hong Kong operators look forward to balancing their expansion strategies with a keen focus on maintaining healthy occupancy rates and ensuring profitability, especially in the face of potentially rising operational costs.

5. Demand Drivers in Focus: Who Rented Flexible Offices in Hong Kong During 2024?

The Overall Demand Assessment for Flexible Options

According to The Instant Group, the Hong Kong flexible office market witnessed a substantial increase in demand in 2024, with a remarkable 17.7% annual growth in inquiries from companies seeking to rent flexible workspace. This significant surge highlights the growing appeal and adoption of flexible office solutions as a viable alternative to traditional long-term leases in Hong Kong's dynamic business environment.

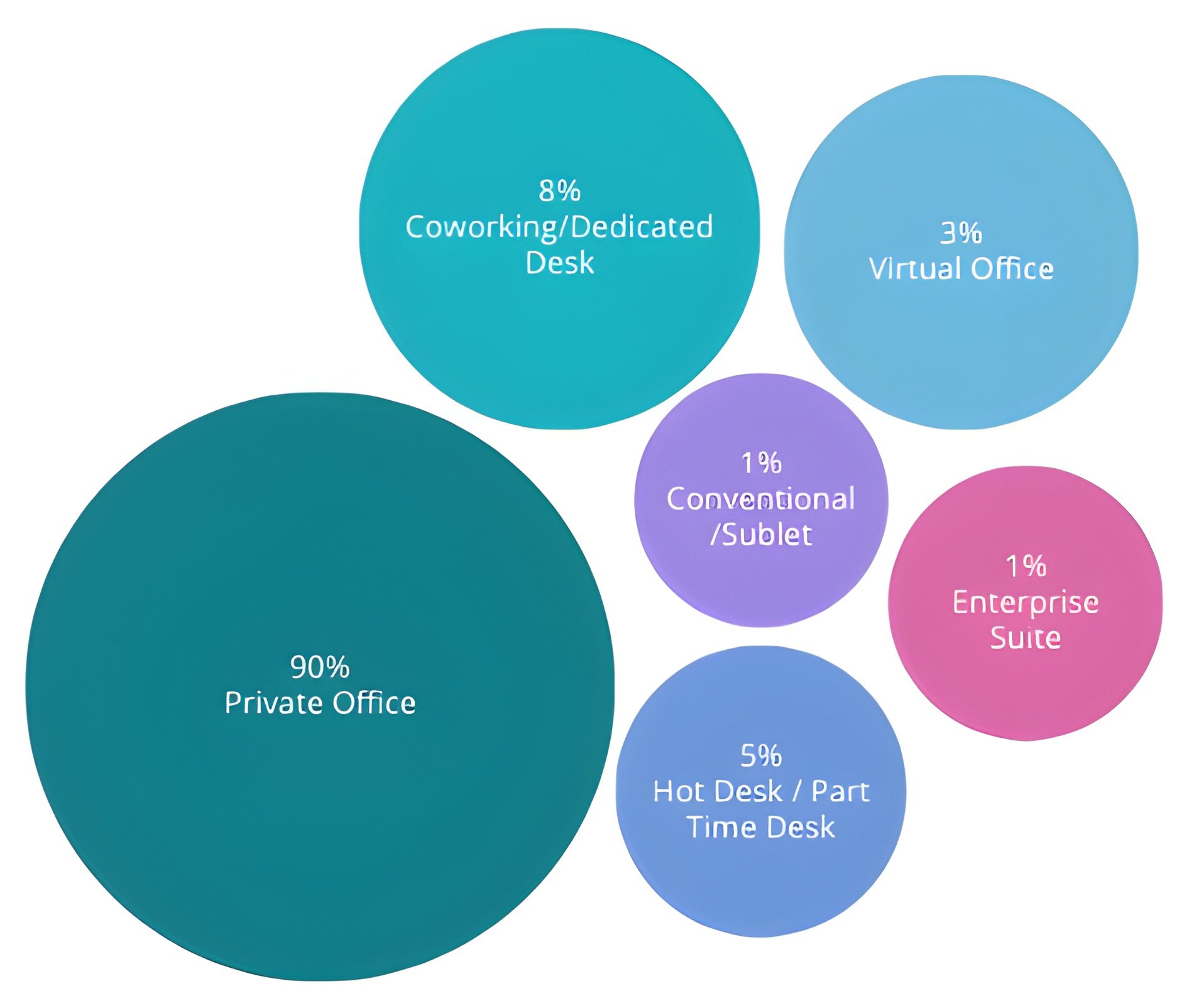

Among the tenants searching for flexible space, private offices emerged as the overwhelmingly preferred workspace type, accounting for 90% of all inquiries. Coworking and dedicated desks were the next most sought-after options, representing 8% of the demand, followed by virtual offices at 3%.

Other types of flexible arrangements, including conventional or sublet offices, enterprise suites, and hot desks or part-time desks, collectively made up the remaining 1% of inquiries.

Industry Segmentation: Who Were the Primary Users of Flexible Spaces?

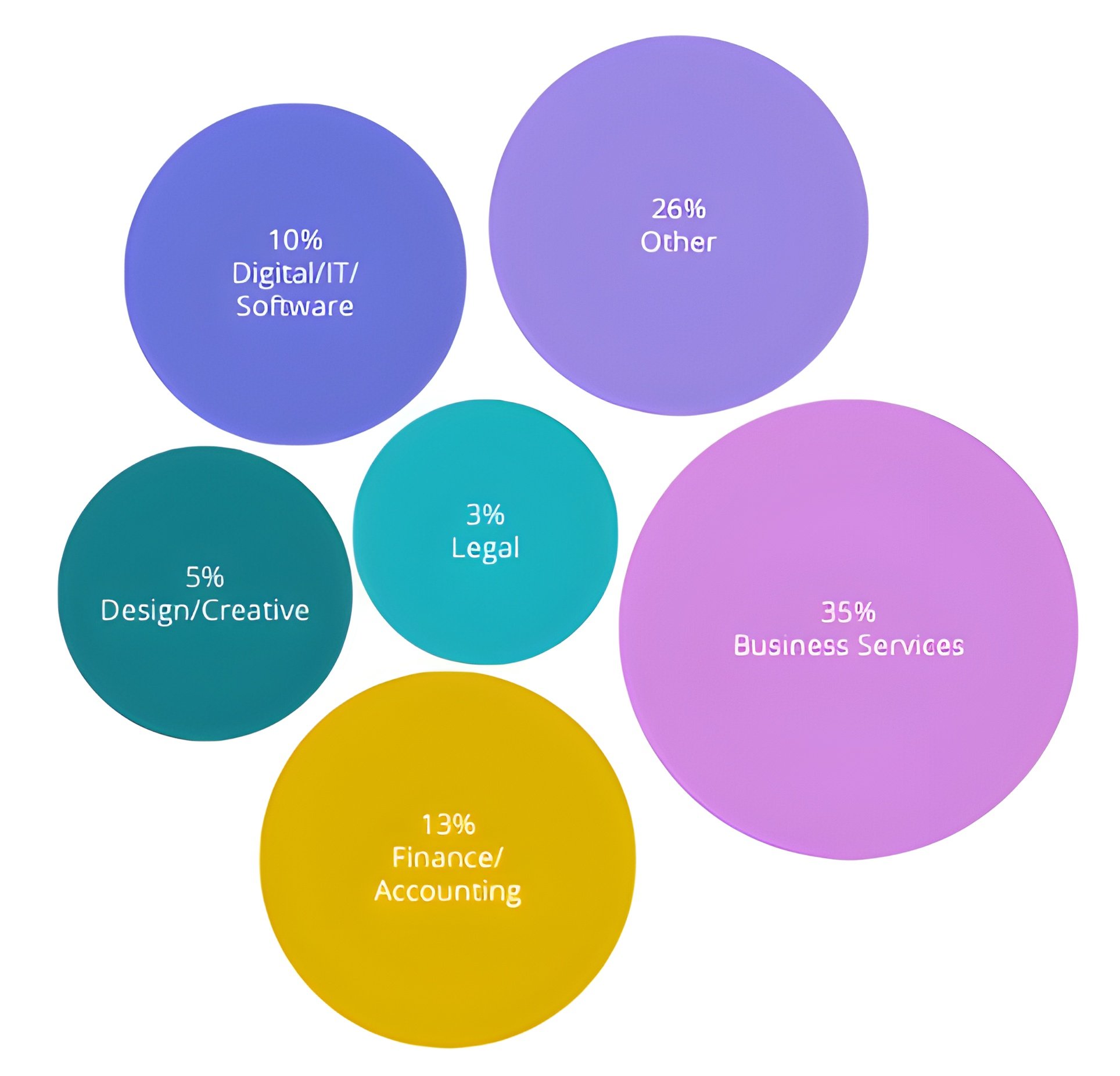

According to the data and analysis provided by Office Hub, the primary users of flexible spaces in Hong Kong for the year 2024 included:

6. The Motivation Behind the Shift to Flexible Offices in Hong Kong

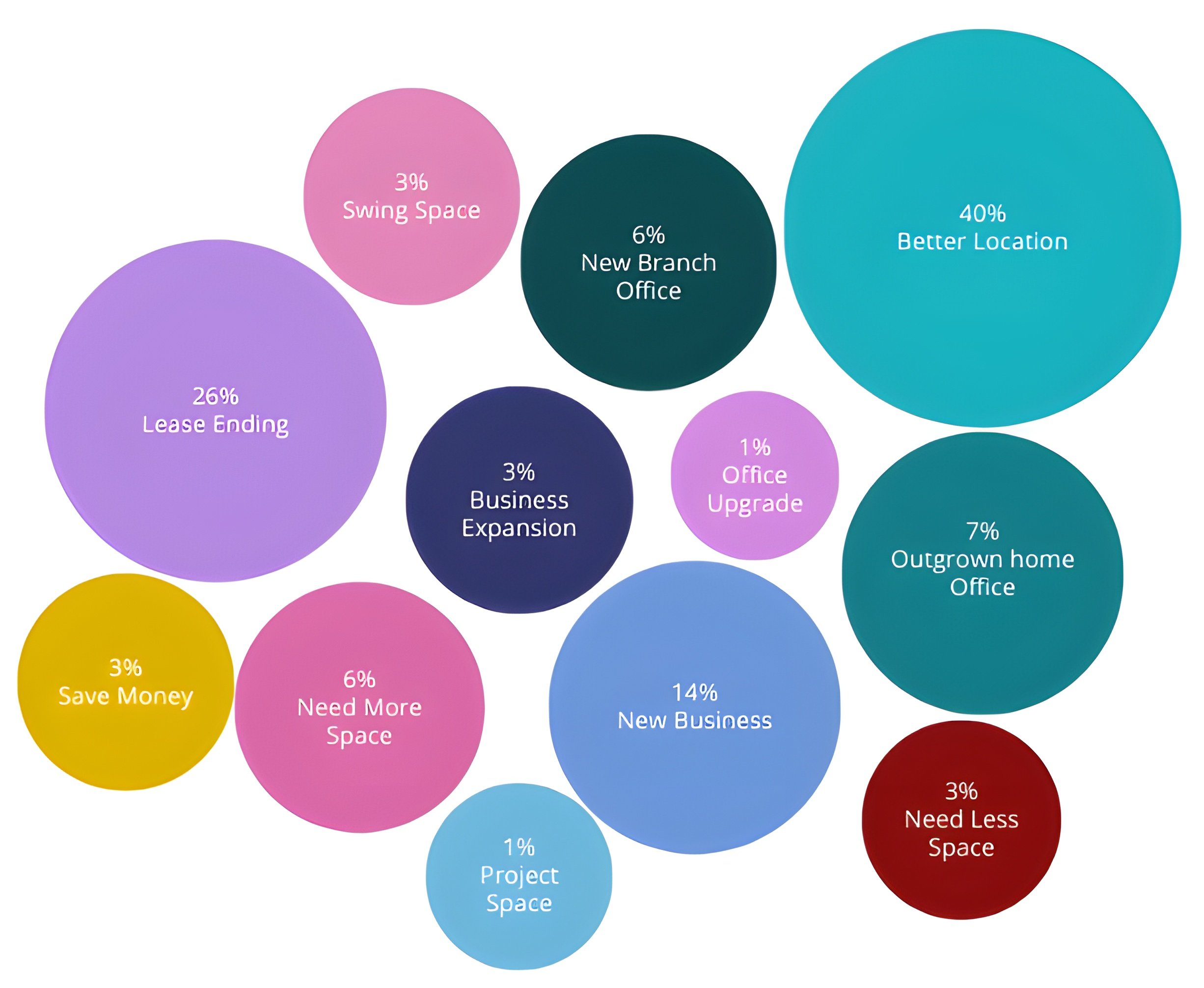

Moving on, the driving factors behind businesses and individuals opting for flexible offices in Hong Kong include:

Evolving Tenant Needs: Beyond Just a Desk

The demands of tenants seeking flexible office spaces in Hong Kong are evolving beyond basic workspace provisions.

According to Compass Offices, there’s a growing global emphasis on environmentally conscious practices. Many companies focus on their environmental footprint, which extends to their choice of workspace.

Flexible office operators who prioritise sustainable design and operational practices, such as energy efficiency and eco-friendly materials, may find themselves more attractive to a growing segment of environmentally aware tenants.

Furthermore, there is an emerging trend towards niche and industry-specific flexible workspaces. These specialised spaces cater to the unique requirements of particular sectors, boosting collaboration and innovation within those communities.

Similarly, even in Hong Kong, the demand for sustainable and niche-specific flexible office solutions is increasing, catering to sectors like technology startups, creative agencies, and financial services firms.

7. What are the Top Features and Facilities People Look For?

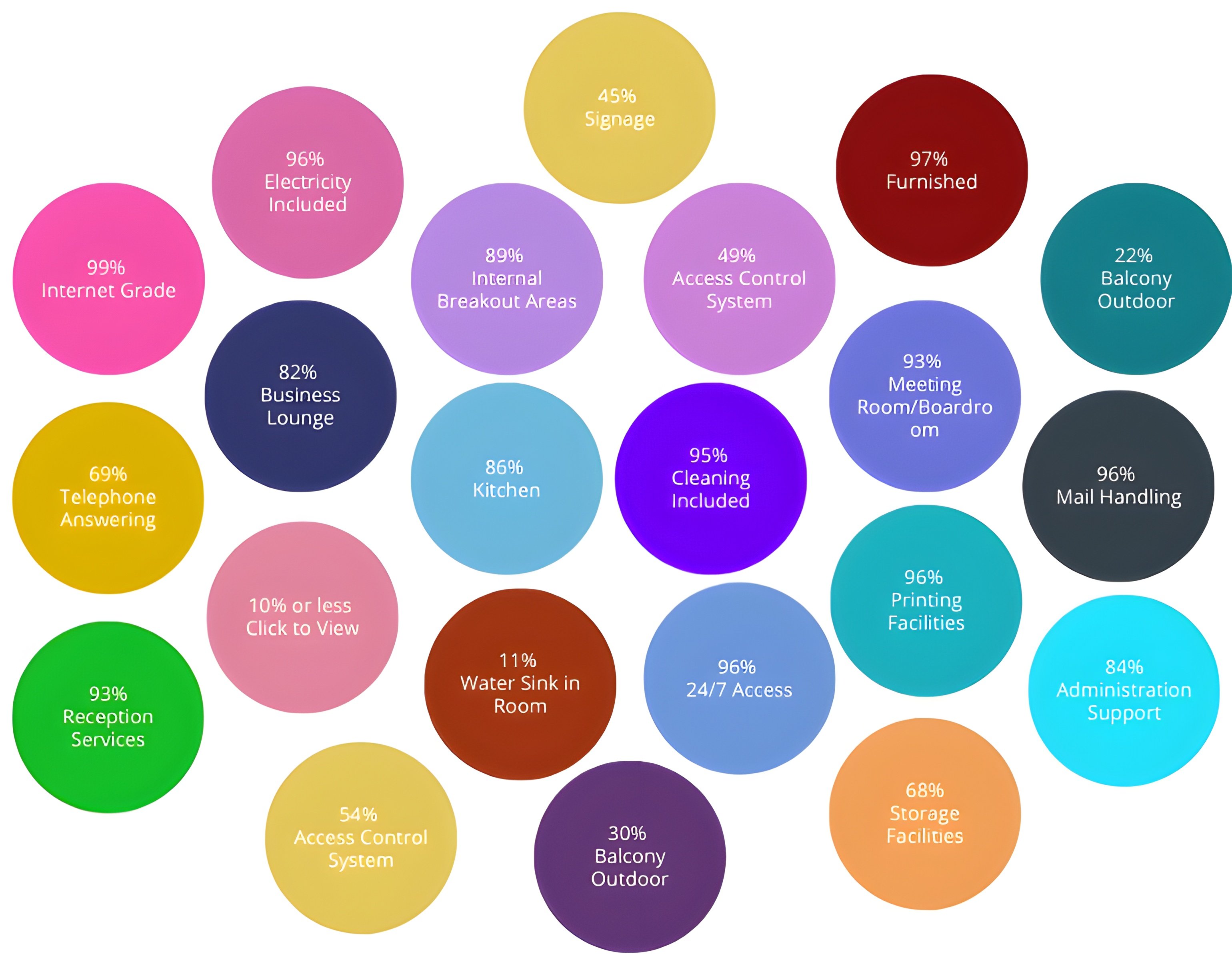

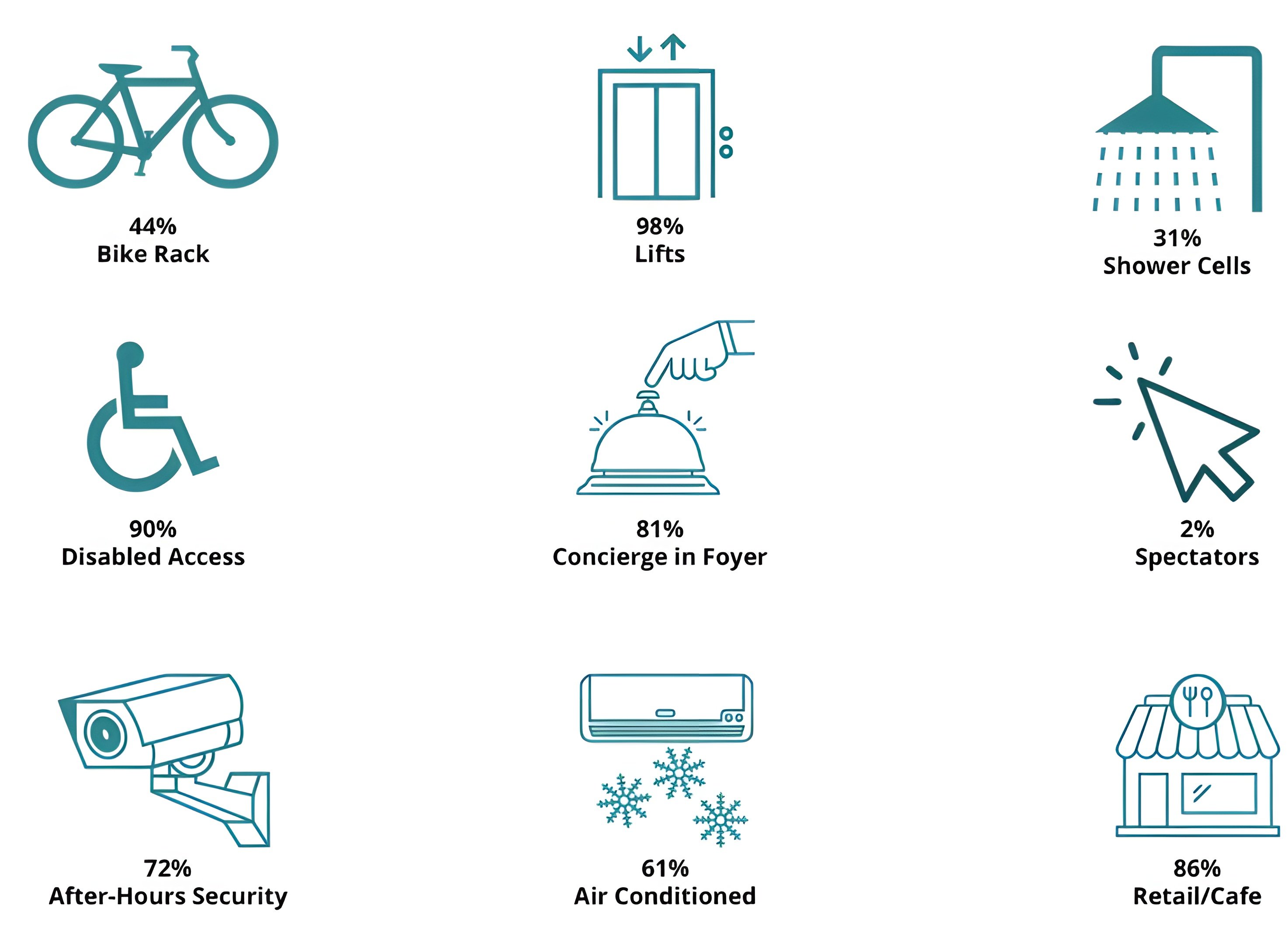

Office Hub has provided a comprehensive overview of the features and facilities that remain most important to businesses when renting flexible office space in Hong Kong in 2024– featured below:

Aside from the top features and facilities preferences in Hong Kong, many tenants also prioritise building amenities, which are featured below in the chart, along with preferred ratios.

8. Regional Breakdown of Hong Kong’s Flexible Office Rental Activity in 2024

Based on the overall office market dynamics in 2024 and the observed "flight to quality" trend, Central stands out as a primary district likely experiencing highly flexible office rental activity.

As Hong Kong's core central business district, Central is home to a high concentration of major financial institutions and legal firms, sectors that showed a particular inclination towards premium flexible office spaces.

Kowloon East also emerges as a significant district for flexible office rental activity. This area has been developing significantly as an emerging business hub, offering a potentially more cost-effective alternative to the prime CBD. The availability of newer buildings and a general trend of cost-conscious occupiers likely contributed to the demand for flexible options in Kowloon East.

Furthermore, Wan Chai and Causeway Bay established commercial areas with a vibrant mix of businesses and lifestyle amenities, likely witnessing considerable flexible office activity. These districts attract a diverse range of companies, including those in retail, food and beverage, and professional services. Many of them benefit from the flexible terms and locations offered by these workspaces.

Year-over-Year Demand Change for Flexible Office Space in Key APAC Cities (2024)

|

City |

YoY Demand Change (%) |

|

Sydney |

-11% |

|

Colombo |

+7% |

|

Bangalore |

+107% |

|

Makati |

+47% |

|

Kuala Lumpur |

+78% |

|

Mumbai |

+28% |

|

Hong Kong |

+11% |

9. Inquiry-to-Deal Summary for the 2024 Hong Kong Flexible Office Market

Conversion Efficiency: Strong Enquiry-to-Deal Ratio

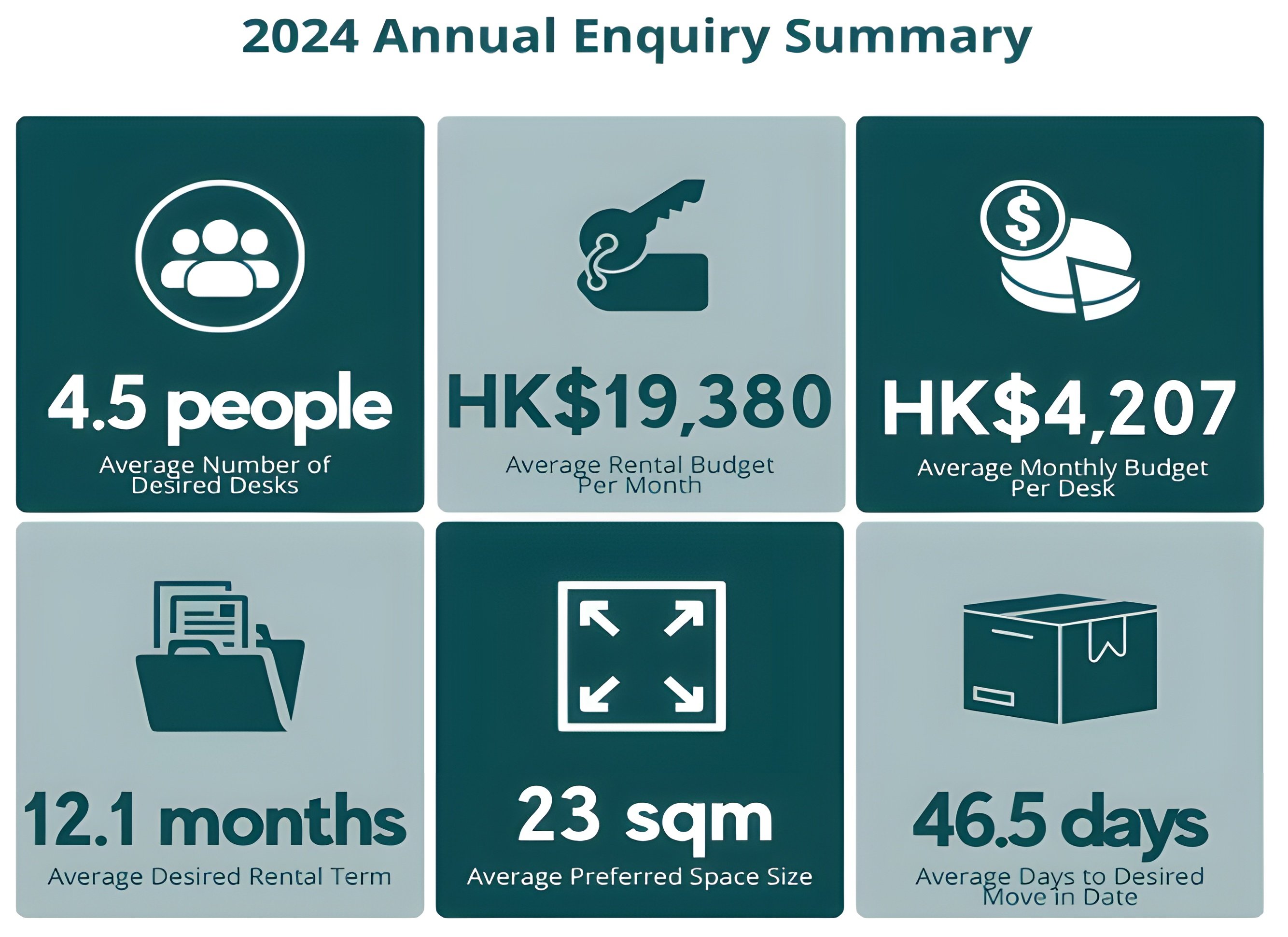

The Hong Kong flexible office market in 2024 demonstrated a stable conversion rate of enquiries into signed deals. According to Office Hub, the enquiry-to-signed deal ratio stood at 14.2%. This indicates that for every 100 enquiries received for flexible office space, approximately 14 resulted in a finalised lease agreement.

Time to Agreement: Efficient Deal Closure

The process of securing flexible office space in Hong Kong in 2024 was relatively efficient. On average, it took 19.6 days from the initial inquiry to the signing of the deal. Following the deal signing, the average time until the tenant's move-in date was 34.3 days.

These short timeframes highlight one of the key advantages of flexible office solutions: the ability for businesses to quickly secure and occupy workspace, catering to immediate or near-term needs with a streamlined process compared to the often more protracted timelines associated with traditional office leases.

Understanding Contractual Aspects

The average agreement term of 10.5 months suggests a preference for a medium-term commitment, offering a balance between short-term flexibility and longer-term stability. The average team size of 3.6 people indicates that the flexible office market in Hong Kong caters predominantly to smaller teams and businesses.

The average monthly desk rate for signed deals was HK$4,663, slightly higher than the average budget per desk indicated in the initial inquiries. The average contract value of HK$209,860 reflects the overall financial commitment associated with these flexible office agreements.

Notably, the average discount applied to signed deals was very low at 0.5%, suggesting that pricing in the market was relatively firm with limited negotiation on the quoted rates.

Insights into Property and Workspace Preferences

Based on the supply and demand data analysis, several insights can be drawn regarding the preferred choices in the Hong Kong flexible office market in 2024.

The prevalence of flexible offices in Grade A buildings suggests a preference for high-quality, well-located properties. Based on tenant inquiries, private offices were the most sought-after workspace type, indicating a strong demand for dedicated and secure workspaces even within a flexible framework.

Similarly, the nature of the users, as highlighted in the industry segmentation, includes a significant representation from business services, digital/IT/software, and finance/accounting sectors. This suggests that flexible offices particularly appeal to these businesses in Hong Kong.

Additionally, the data gathered by flexperts at Office Hub provides a detailed insight into the preferred workspace types and building amenities when renting locations across Hong Kong:

10. Market Challenges and Future Flexspace Trends to Watch

While the Hong Kong flexible office market demonstrated growth in 2024, it also faced potential challenges, such as increasing competition among operators to attract tenants in a growing supply of options. Broader economic conditions and uncertainties also influenced the sector's growth rate and overall performance.

The future of the flexible office market in Hong Kong appears promising, with several trends pointing towards continued growth and evolution. The 11% increase in demand observed in 2024 signals a sustained future for flexible workspace solutions in the city. This also aligns with a broader trend across the Asia Pacific region, where demand for flex space rises, and strong supply growth is anticipated.

Upcoming Flex Spaces Key Trends

Several key trends are expected to shape the market in the coming years. There will likely be an increased emphasis on wellness in flexible office design and operations, focusing on creating environments that promote employee well-being and productivity.

Technology will play an increasingly integral role, allowing personalised user experiences and enhancing the functionality of workspaces. The rise of niche and industry-specific flexible spaces catering to the unique needs of various sectors is also expected to continue.

Furthermore, sustainability in design and operations will become more important, with tenants increasingly seeking eco-friendly workspace options. The demand for more sustainable workspaces, increased support for employee well-being (including aspects like women's health and childcare), and the continued importance of community and culture within these spaces are also anticipated to be key trends.

Overall, these factors suggest that the flexible office market in Hong Kong will continue to adapt and expand, offering diverse solutions to meet the evolving needs of businesses in the region.

11. Conclusion

The Hong Kong flexible office market in 2024 saw significant growth, with increased demand and supply, making serviced private offices the most sought-after option. Companies favoured these flexible solutions due to the appeal of better locations, the need to address expiring lease agreements, and the advantage of enhanced scalability. The market also demonstrated a strong inquiry-to-deal conversion rate alongside efficient deal completion timelines.

The flexible office market in Hong Kong is further expected to continue its growth trajectory, driven by sustained demand and influenced by trends such as a greater emphasis on wellness, technology integration, the rise of niche spaces, and a focus on sustainability.

Looking for agile and cost-effective workspace solutions in a prime global business hub? The flexible office market in Hong Kong offers plenty of options you can explore on Office Hub. Whether you need the latest insights, browse flexible office spaces, or require expert advice on navigating the Hong Kong market, OH’s flexperts have got you covered! Contact us now!