2024 London Flex Office Market hits highest take-up since 2019

- Central London accounted for 64% of UK flexible workspace take-up in 2024.

- Desk prices in London rose 8.8% YoY to £514/month in Q1 2024.

- Occupancy in London’s flex spaces reached 83%, with Southwark peaking at 88%.

- Outer London and Zone 2 areas saw rising interest post-COVID.

- Over 58% of landlords expect flexible formats to make up 26 %+ of their portfolios by 2030.

- London may need $43 billion in upgrades to prevent office space obsolescence in 2025.

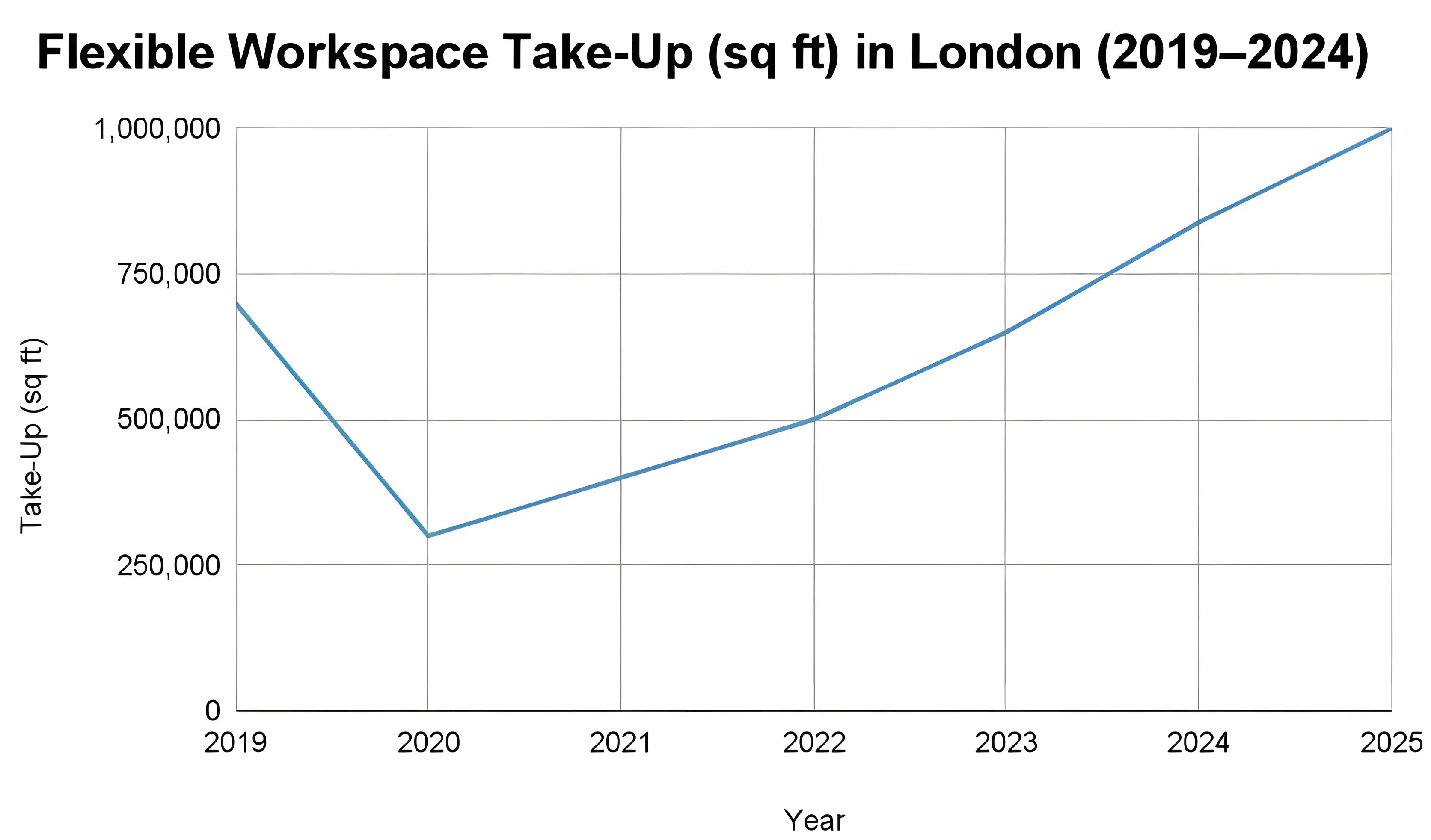

London’s flexible office market is showing strong signs of recovery, with demand levels rebounding in 2024. According to Savills, operator take-up in the capital reached 839,000 square feet at the end of Q3 2024—the highest level recorded at this stage of the year since 2019. Experts suggested that this figure could surpass 1 million sq ft by the end of 2025, marking a notable post-pandemic milestone and reaffirming the sector’s steady expansion.

Central London continues to lead the UK flexible workspace market, accounting for 64% of national take-up. However, evolving work patterns and hybrid models are encouraging businesses to broaden their location strategies. As a result, interest is steadily growing in outer London and Zone 2 areas, where companies seek high-quality yet flexible workspaces that better align with the needs of a decentralised workforce.

Flight to Quality’ fuels flex space market momentum

According to Savills, enquiries for flexible offices rose 14% year-on-year (YoY) in Q1 2024, a massive 206% increase over pre-COVID levels. Despite an overall 10% drop in demand, transaction volumes surged by 35%, highlighting a trend toward high-quality office deals. This "flight to quality" is also reflected in contract terms—average lease durations extended to 15.8 months, up from 13.1 months in 2023.

Meanwhile, The Instant Group said that flexible office pricing in London climbed 8.8% YoY, with average desk rates now at £514/month in Q1 2024. Premium locations command even higher rates—up to £1,170 per desk/month. Occupancy rates are robust at 83%, with hotspots like Southwark and the City of London reaching 88%.

UK regional office centres gain traction

While London remains dominant, Savills discovered that regional cities are gaining traction. Flexible operators acquired 252,000 sq ft across major regional centres by Q3 2024—a 150% increase compared to 2023. Examples include Cubo’s 59,000 sq ft deal at No.1 Spinningfields, Manchester, and Gilbanks’ 34,000 sq ft lease at No.1 St Michaels.

A structural change within the industry has been the shift toward management agreements, now comprising 41% of all operator deals, up from just 9% pre-COVID. These agreements allow landlords to control their amenities while benefiting from operator expertise.

Experts urge office upgrades to make them viable

The office space crunch is intensifying. According to JLL, more than 9 million sq m of London office space needs significant upgrades to remain viable. Vacancy for new space is dropping sharply—London’s West End has just a 1.7% vacancy rate for newly built properties. Experts said the capital could face widespread office obsolescence without urgent renovation in 2025.

JLL estimates over $43 billion in upgrades will be required to align ageing stock with modern standards. New builds remain limited, representing less than 15% of available inventory since 2020. Experts noted that this has intensified competition, further boosting the value of well-located, flexible, and future-ready offices.

Meanwhile, The Instant Group said the London flexible office market appears well-positioned for continued growth. Landlords are optimistic, with 58% expecting flexible formats to represent over 26% of their portfolios by 2030. Strategic partnerships between landlords and operators are increasingly common, supported by rising interest in amenity-rich spaces.

With stable pricing, strong operator resilience, and a growing demand for quality-driven solutions, London’s flexible workspace market is set for a strong 2025. Operators and landlords who adapt quickly will be best positioned to capitalise on this evolving landscape.