UK Flexible Office Market Report 2024

Greater London remained the dominant market, while cities like Cambridge, Manchester, and Bristol showed evolving trends in occupancy and desk pricing. The average agreement term reached 9.6 months, with a typical team size of seven people and a monthly desk rate of £307.

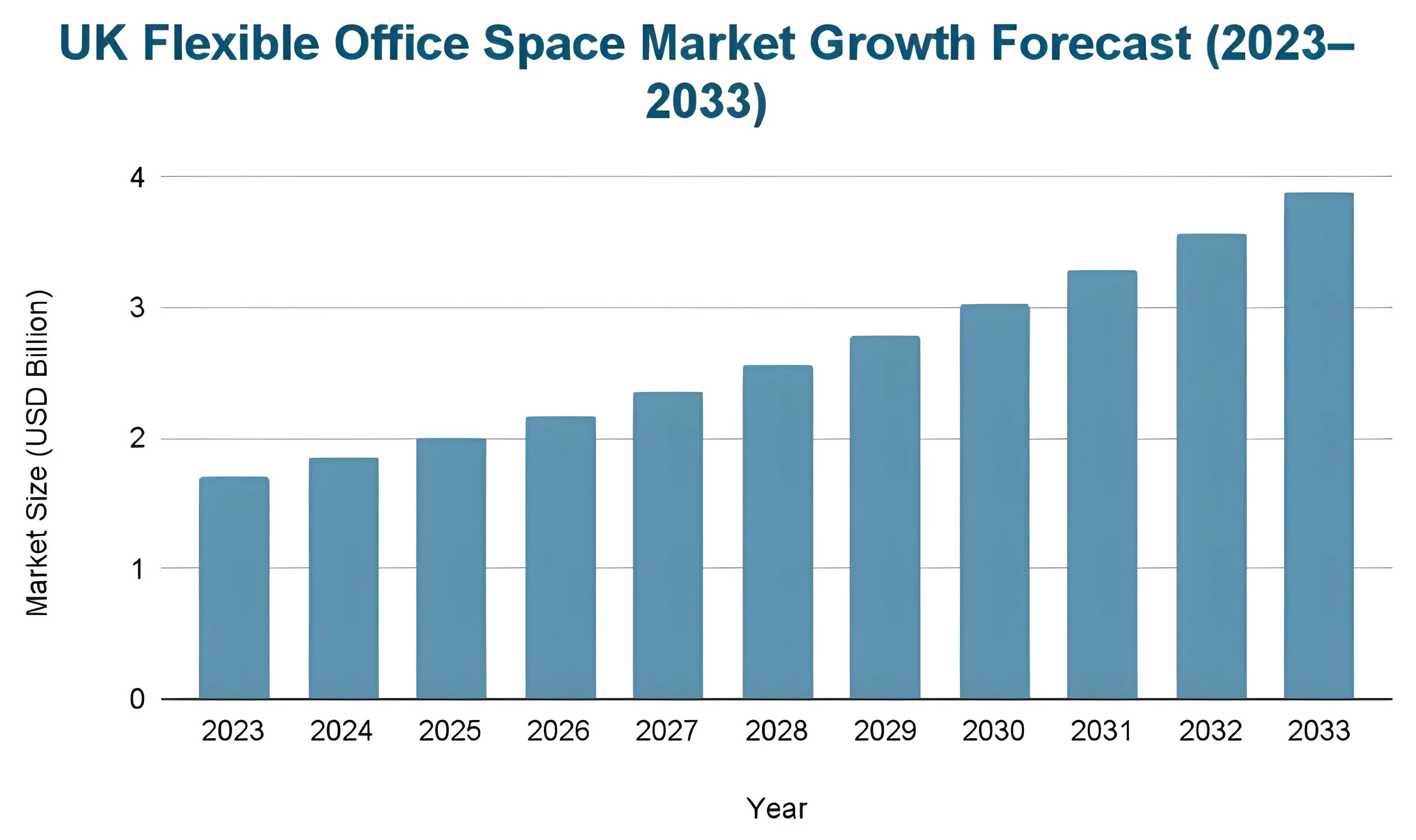

Forecasts suggest the market will surpass USD 3.89 billion by 2033, with a projected CAGR of 8.63%. The future of UK flexible offices looks promising, as more landlords adapt to flexible formats and drive a demand for well-designed, amenity-rich spaces.

Table of contents

- The Growth of Flexible Office Spaces in the UK

- 2024 Supply of Flexible Offices in the UK

- Office Hub Insights: Market Snapshot of UK Flexible Offices in 2024

- 2024 Demand for Flexible Offices in the UK

- Why People Move to Flexible Offices in the UK?

- Top Features and Facilities People Look for in the UK Flexible Office Market in 2024

- Regional Breakdown of UK Flexible Office Space Market (2024)

- Inquiry-to-Deal Summary for the UK Flexible Workspace Market (2024)

- The Future of Flexible Offices in the UK

The Growth of Flexible Office Spaces in the UK

The UK’s flexible office market has shown remarkable resilience and growth in 2024, driven by the ongoing demand for scalable workspaces. Savills reported that operator take-up reached 839,000 sq ft at the end of Q3 2024, marking the strongest performance recorded in a year since 2019.

While London remains a key hub, The Instant Group found that the city has experienced a negative 11% CAGR over the past three years, highlighting challenges in the flexible office market such as market saturation and evolving occupier preferences. However, London maintains its global prominence, driven by rising demand for managed offerings. Areas like the West End and outer London zones are also gaining momentum, catering to businesses seeking more personalised workspaces.

Cities like Reading, Aberdeen, and Cambridge are becoming emerging hotspots outside the capital, benefiting from strong local demand. Nottingham has also shown notable growth, adding to the diverse regional appeal.

2024 Supply of Flexible Offices in the UK

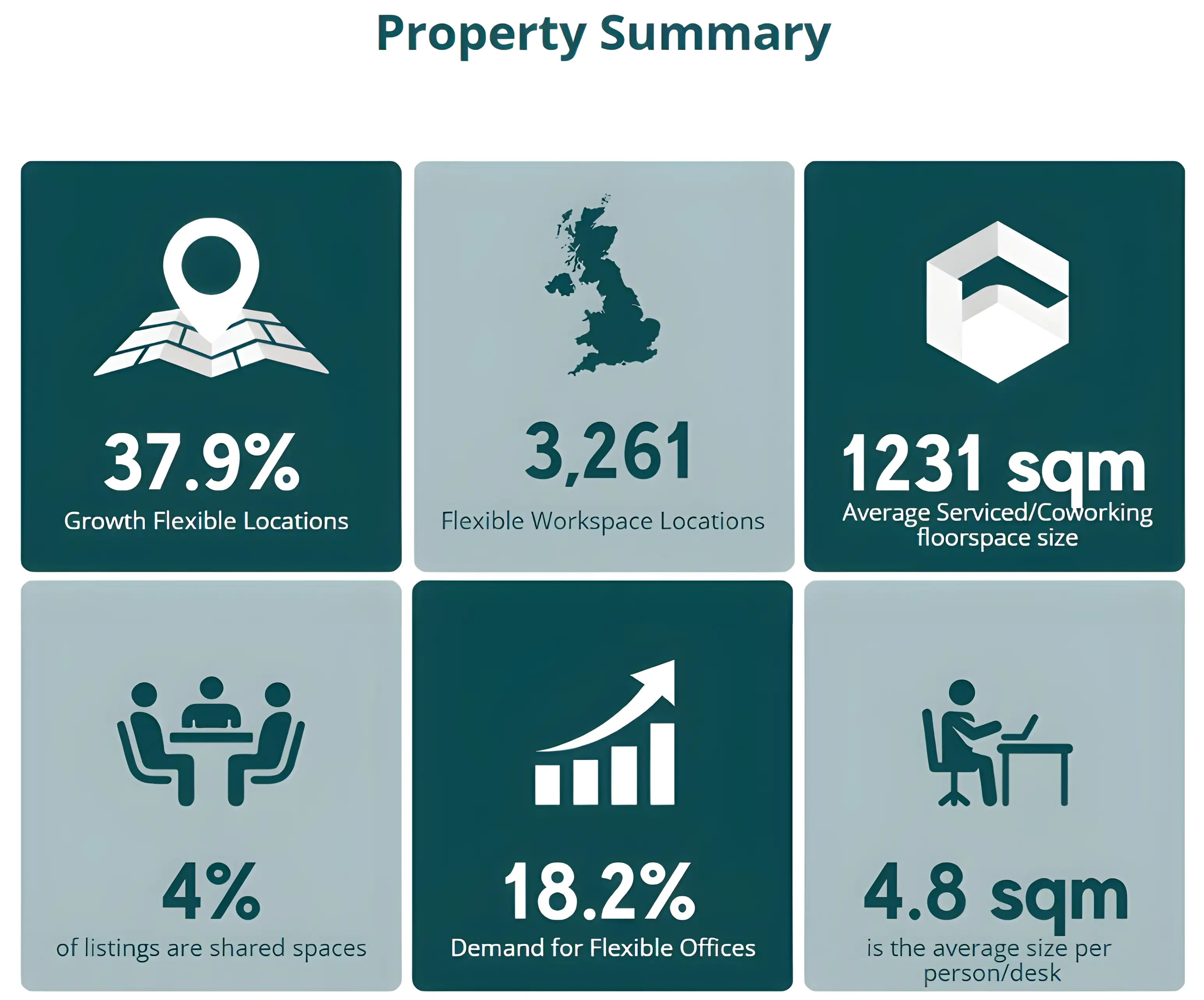

In 2024, the supply of flexible office space across the UK grew by 37.9% compared to the previous year. This surge highlights a growing shift among landlords and operators to meet the rising demand for adaptable, hybrid-friendly work environments.

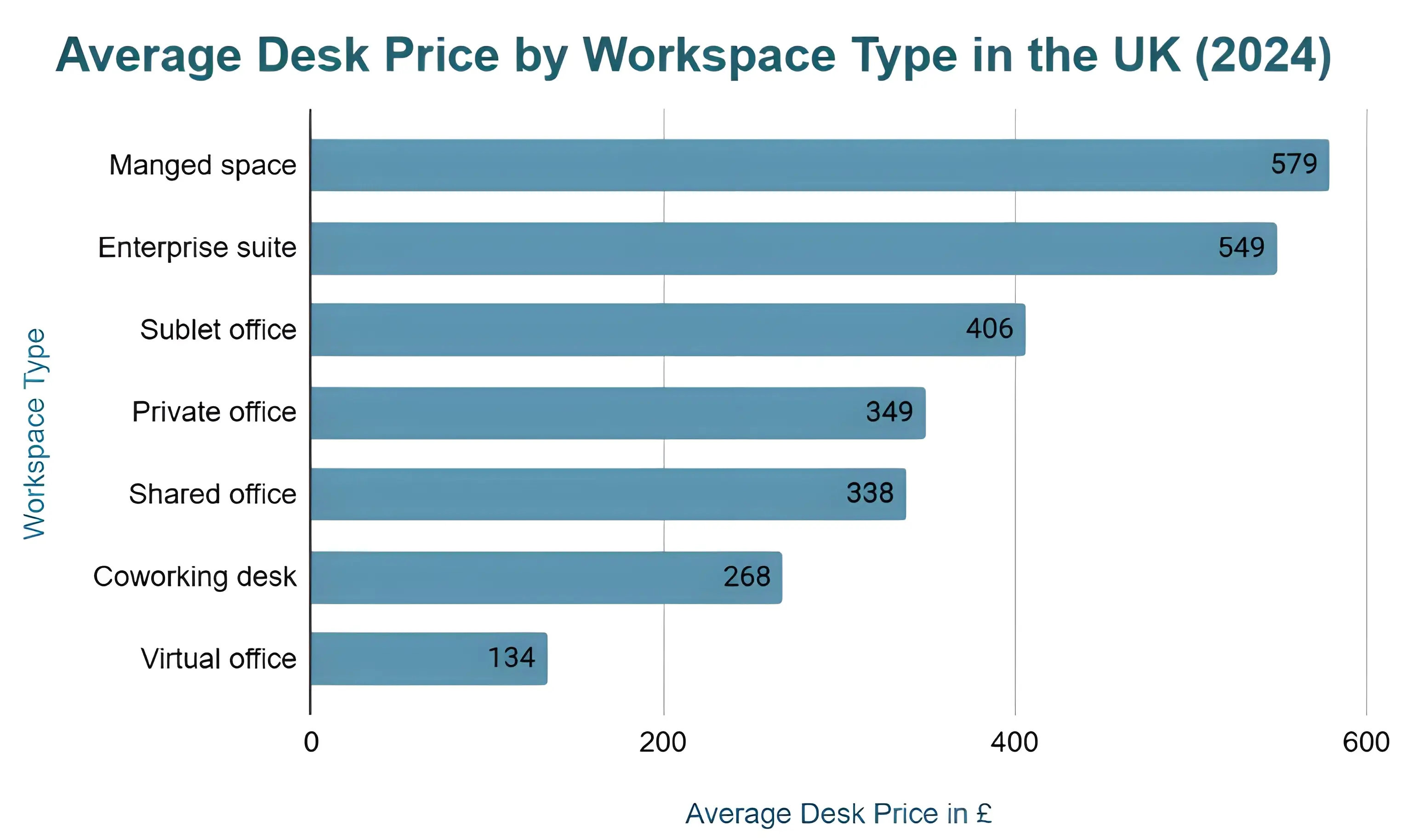

Average Desk Price Per Workspace Type

In the UK flexible office market, managed spaces command the highest monthly average desk price at £579 in 2024, followed by enterprise suites at £549. Sublet and private offices are mid-range options, priced at £406 and £349 per desk per month, respectively. Shared offices average £338 each desk per month, while coworking desks offer a more budget-friendly choice at £268. Virtual offices remain the most cost-effective solution, averaging just £134 per month.

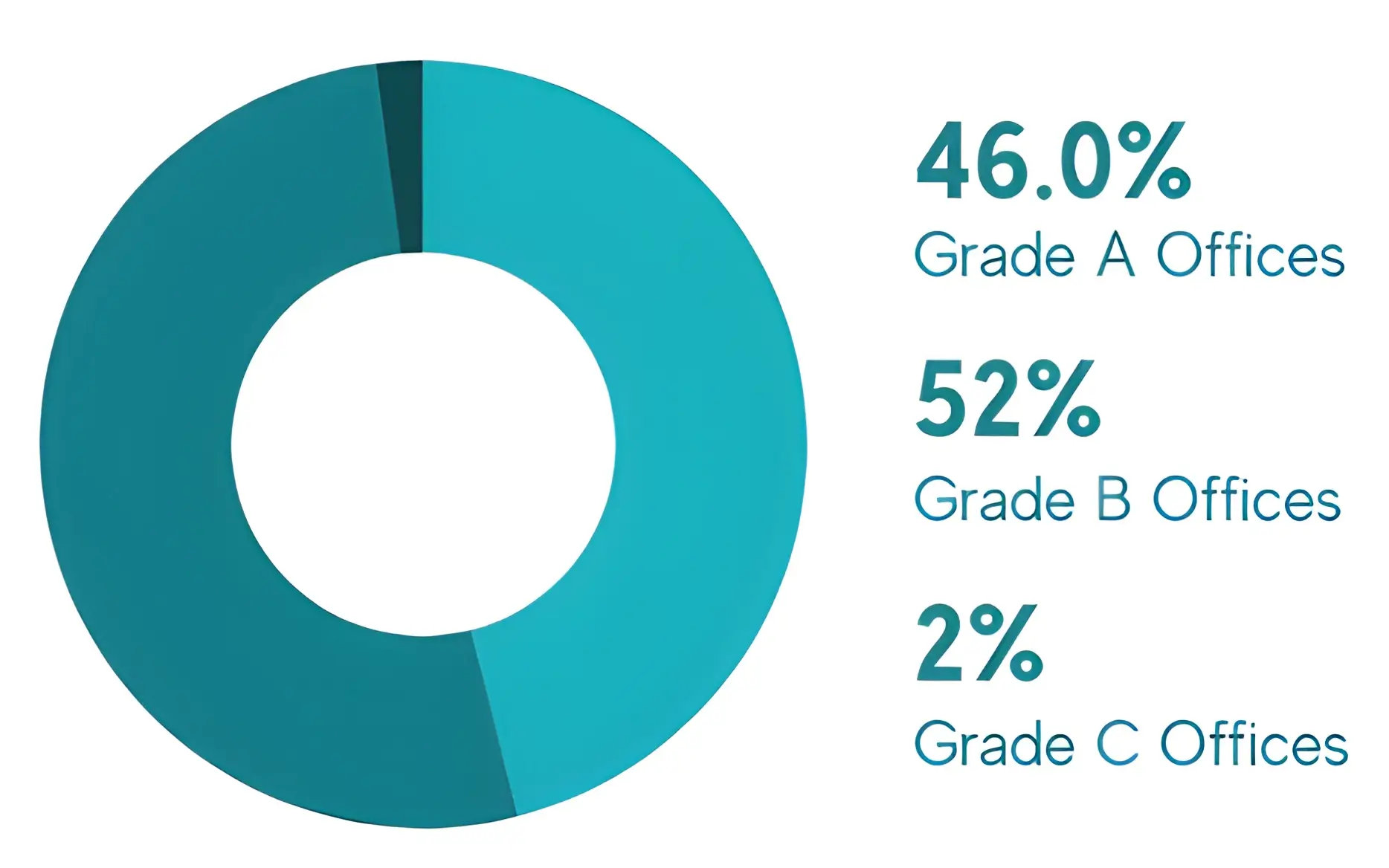

Building Grade

In 2024, flexible offices in the UK are primarily located in B-grade buildings, making up 52.0% of the supply. A-grade buildings account for 46.0%, while C-grade buildings represent just 2.0% of the market. This shows a strong focus on quality spaces, with the majority in higher-grade buildings.

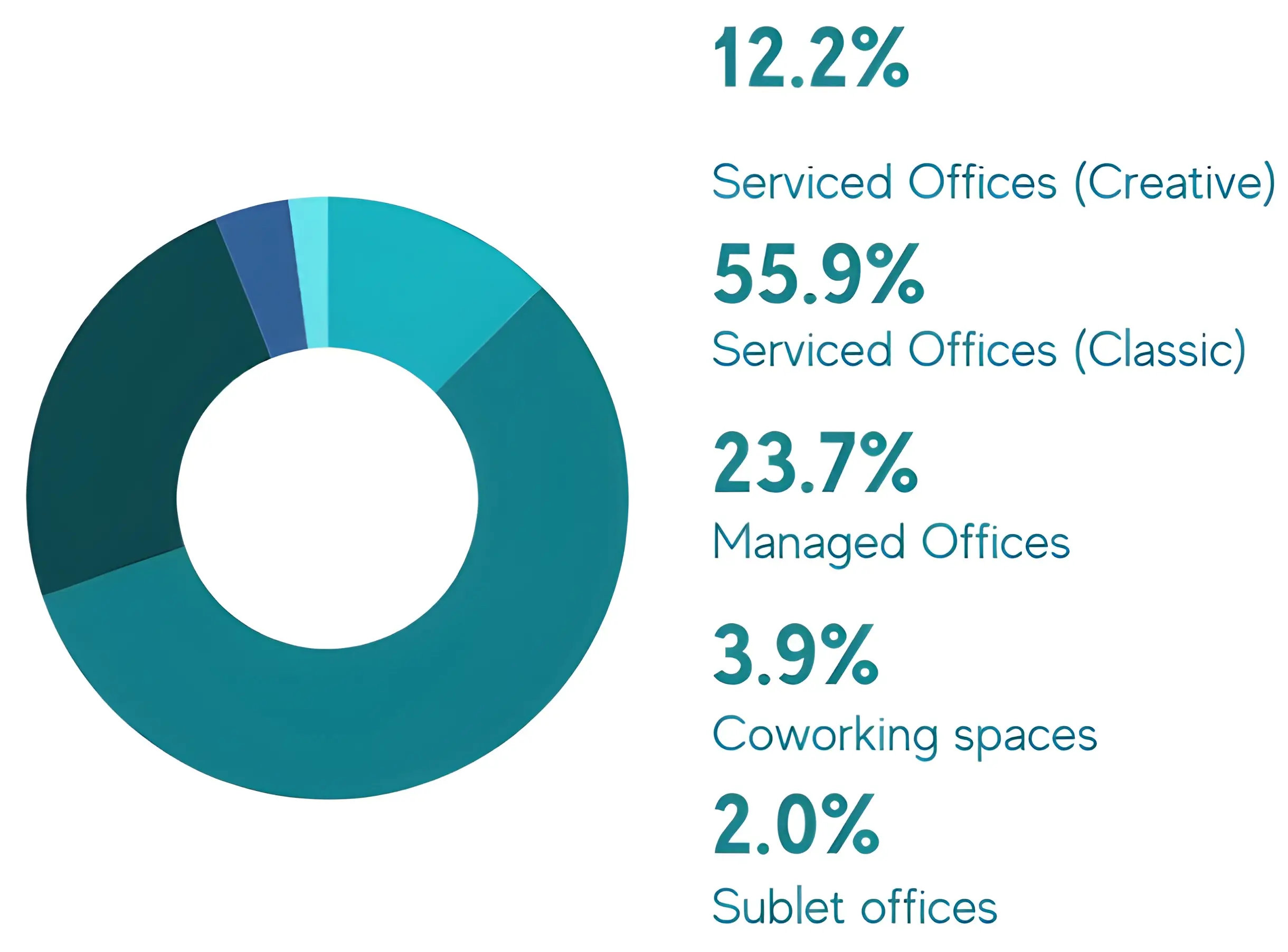

Workspace Type

The UK's largest flexible office share is held by serviced offices (classic), accounting for 55.9% of the supply. Managed offices follow at 23.7%, and serviced (creative) make up 12.2%. Coworking spaces and sublet offices are less common, at 3.9% and 2.0%, respectively.

Average floorspace

In the UK, the average floorspace for sublet or shared workspaces is 359 sqm. In contrast, serviced and coworking spaces are significantly larger, averaging 1,230 square meters per site, which highlights their scale and dominance in the flexible office sector.

Supply Trends: Strong Growth in UK Flexible Office Market

Post-Pandemic Market Recovery

The UK's flexible workspace market has made a strong post-pandemic comeback. The Instant Group reported that supply grew by 11% in 2019, but this momentum slowed to just 4% in early 2020 due to the impact of COVID-19. Since then, the market has rebounded significantly.

Flexible Office Footprint Nearly Doubles

According to Mordor Intelligence, the total volume of flexible office space in the UK nearly doubled between 2019 and 2023, reaching 167 million square feet. This rapid growth underscores the growing importance of flex spaces in the country’s commercial real estate market.

UK Experiences Record Growth in 2024

In 2024 alone, the United Kingdom saw a 37.9% annual increase in available workspaces renting out their space compared to the previous year. An increasing shift toward flexible, hybrid-friendly solutions drives this rapid supply expansion.

More Listings, More Options

Office Hub reported a 31% annual increase in flexible workspace listings across the UK. This reflects both increased provider participation and a strong effort to cater to the evolving demands of today’s mobile and hybrid workforce.

Office Hub Insights: Market Snapshot of UK Flexible Offices in 2024

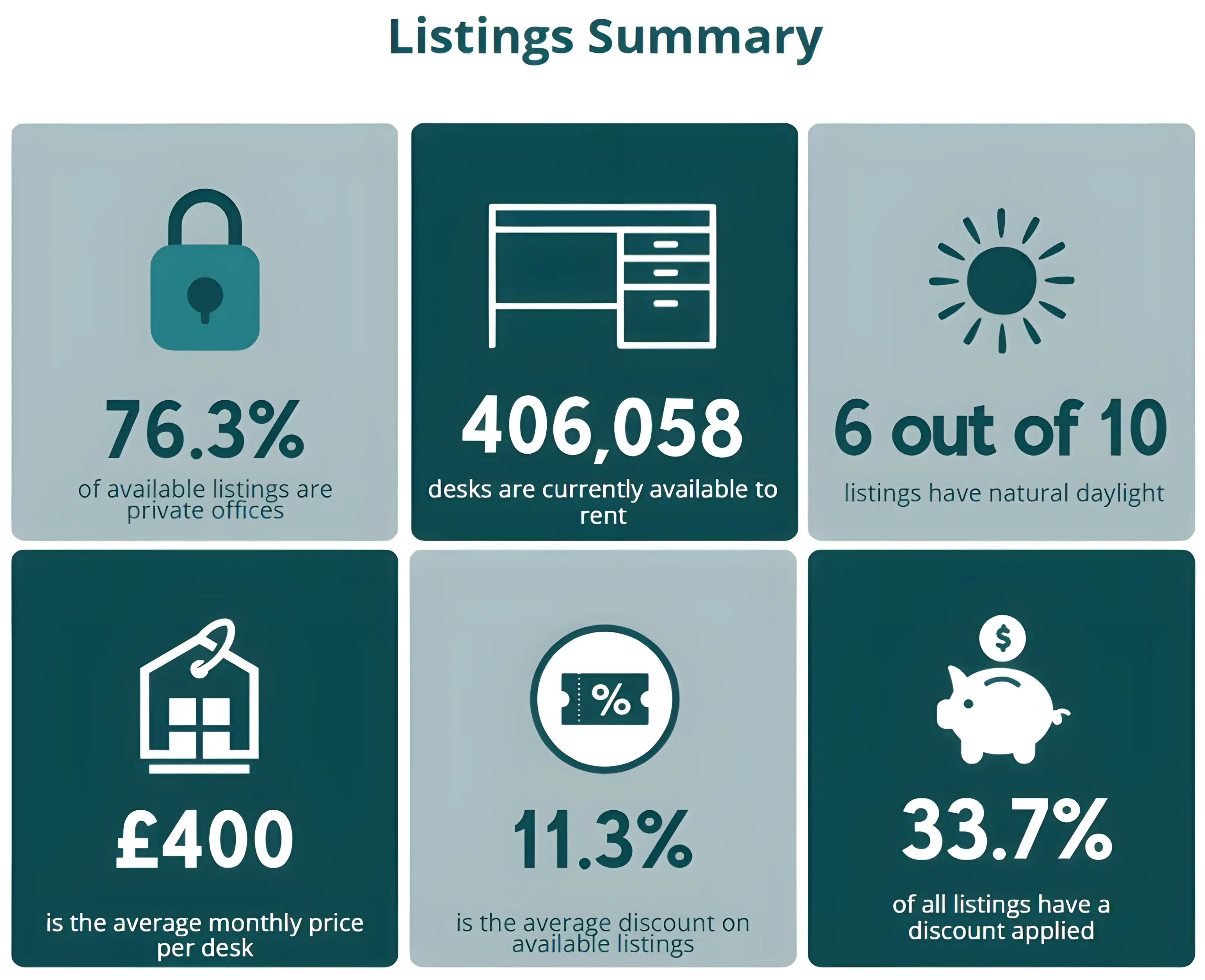

- There are 406,058 desks available to rent through Office Hub. Approximately 76.3% of these are private offices.

- The average desk price is £400 per month, reflecting a broad mix of premium and budget listings. Nationwide, prices range between £200 and £1,400 per person per month, depending on location and amenities.

- Active listings offer an 11.3% average discount, and 33.7% have discounts applied.

2024 Demand for Flexible Offices in the UK

In 2024, demand for flexible office space in the UK has risen sharply as companies started to adopt hybrid work models. Businesses are prioritising agility and cost-efficiency, driving increased enquiries for serviced offices, coworking spaces, and short-term leases across key UK markets.

Rising Demand for Flexible Offices in the UK

The flexible office market is seeing strong demand as businesses shift away from pandemic-era policies. In 2022, Coworking Insights found that the demand for flexible workspaces surged by 22%, setting the tone for continued momentum.

Meanwhile, Savills reported a 14% year-on-year increase in enquiries, with levels now 206% higher than pre-COVID figures, by mid-2024. This indicates evolving workplace strategies and growing interest in hybrid models.

Stable Occupancy Rate Underscores UK Flexible Market Strength in 2024

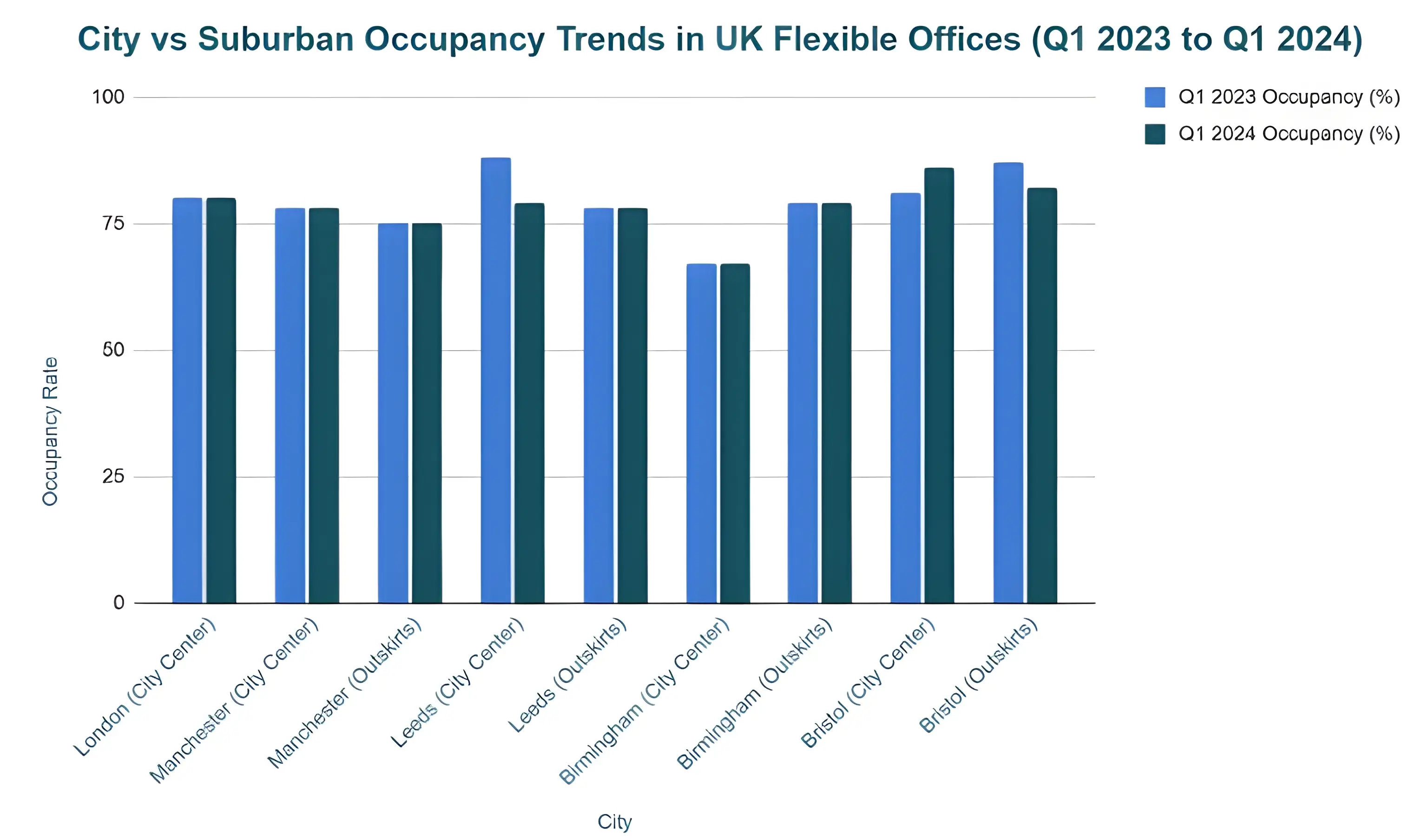

According to The Instant Group’s data, flexible workspaces in the UK continue to perform strongly. In Q1 2024, occupancy levels averaged 80%, slightly up from 79% during the same period last year. Nearly 39% of workspaces are over 90% occupied, indicating sustained demand for flexible, hybrid-ready environments. In 2023, the sector achieved a record 83% average occupancy, with 42% of spaces reaching 90% capacity.

As hybrid work continues to shape office needs, flexibility remains a strategic priority across urban and suburban locations, with Bristol’s city centre leading at 86%.

City vs. Suburban: Shifting Occupancy Trends in UK Flexible Offices

Across the UK, flexible workspace occupancy continues to reveal a complex urban-suburban dynamic. In Q1 2024, The Instant Group reported that London maintained a steady 80% occupancy rate, consistent with the previous year.

Manchester and Leeds saw city centres outperforming the suburbs, though the gap in Leeds has narrowed significantly.

Birmingham presents a reverse trend, with higher occupancy in suburban areas. Meanwhile, Bristol's city centre surged to 86%, surpassing the suburbs, which fell to 82%. These shifts suggest that businesses continue to adjust their hybrid strategies, while workers refine their ideal work patterns.

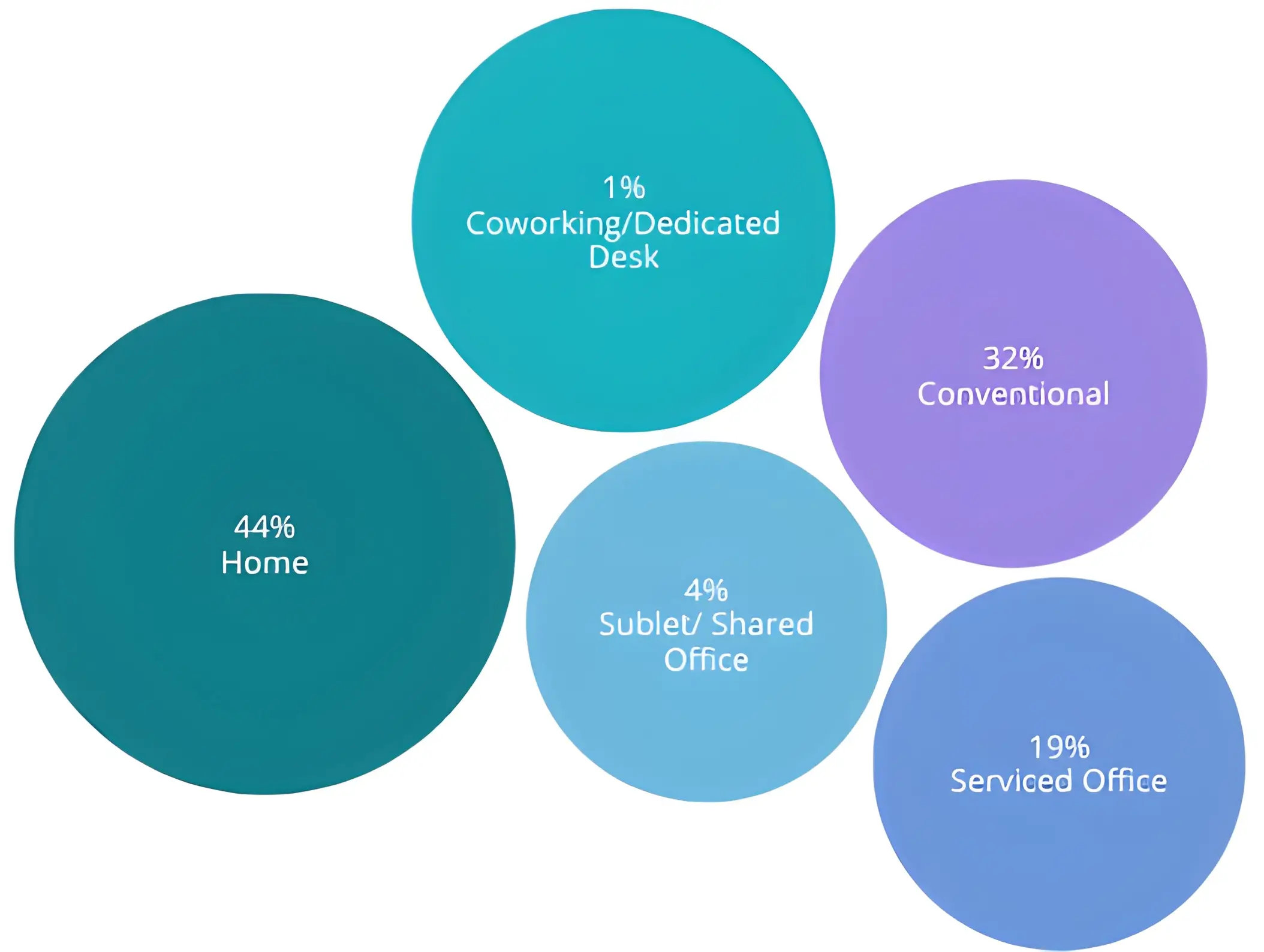

Current Workspace Type

An annual breakdown of workspace preferences among companies in the UK in 2024 shows that 32% still occupy conventional offices, while 44% operate from home. However, 19% have shifted to serviced offices, indicating growing demand for flexible, ready-to-use workspaces. Sublet/shared spaces and coworking models trail behind at 4% and 1%, respectively.

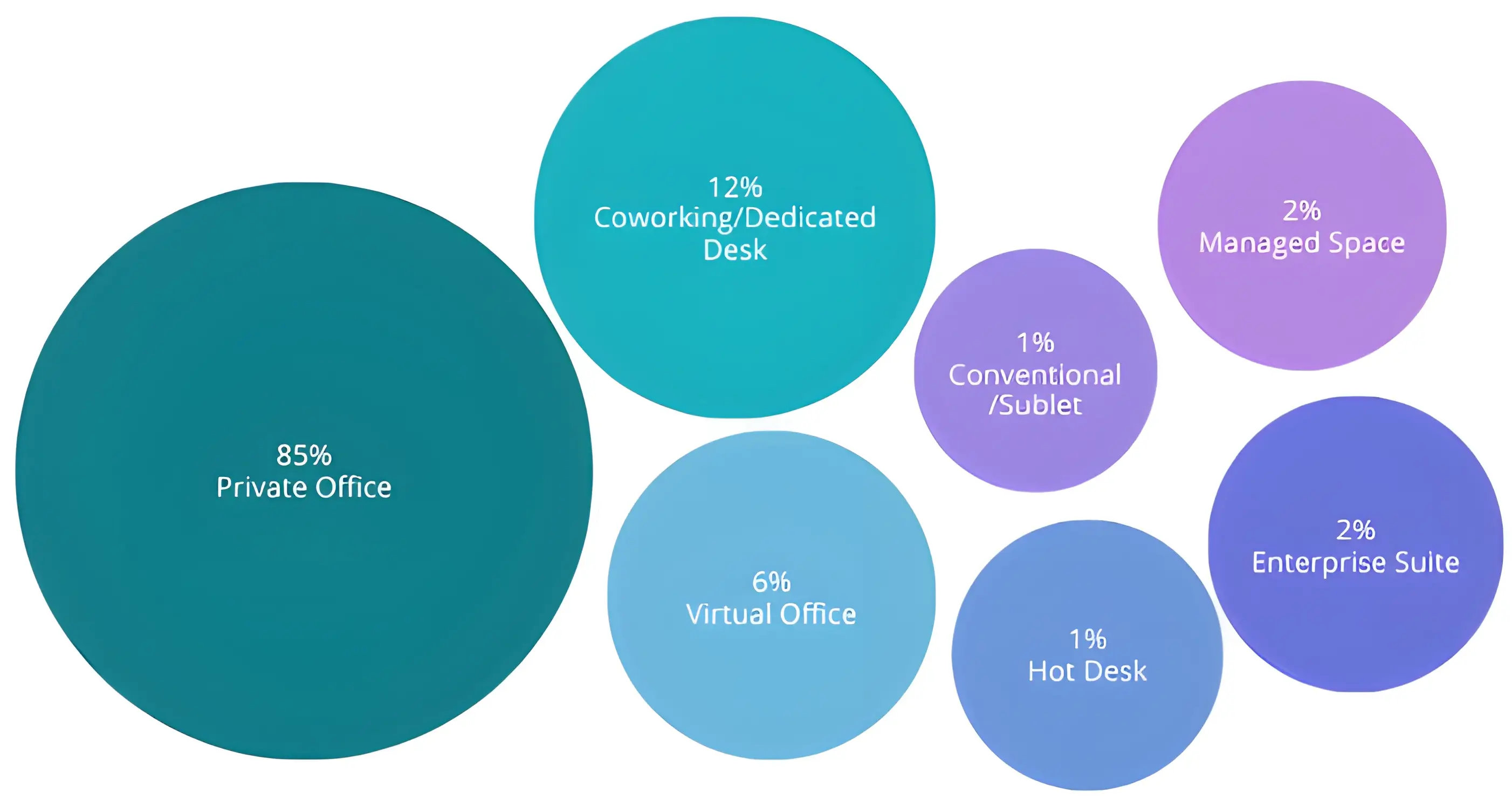

Preferred Workspace Type

An annual breakdown of tenant preferences in the UK reveals that private offices dominate demand at 85%, showing a strong preference for privacy and control. Coworking and virtual office setups follow at 12% and 6%, while more niche options like enterprise suites, managed spaces, and hot desks make up the remainder.

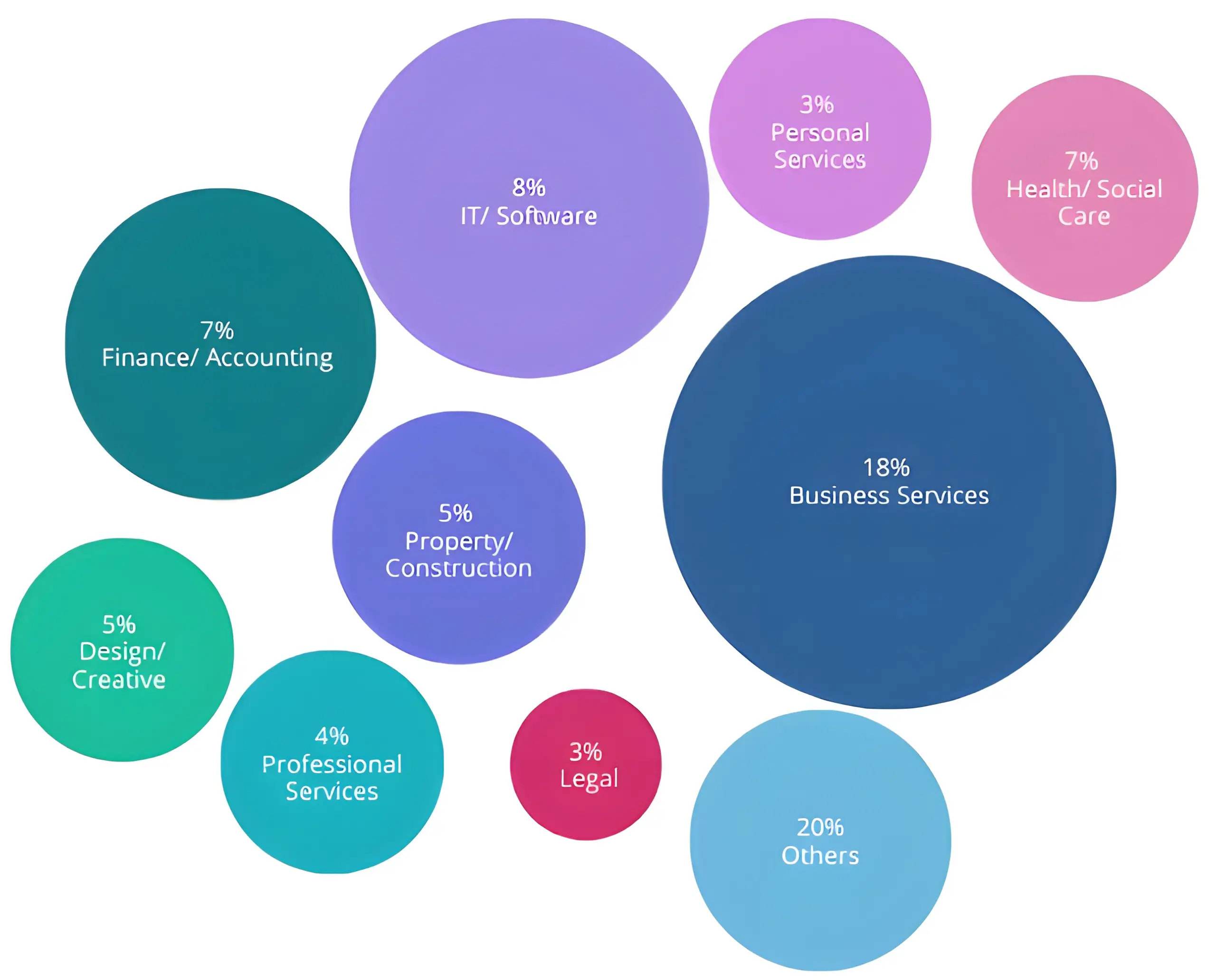

Market Demand Per Industry

The demand for flexible office space spans various industries, with business services leading at 18%, followed by IT/software at 8%, and finance and accounting at 7%. This reflects the growing shift towards flexible work environments across key professional sectors.

Why People Move to Flexible Offices in the UK?

According to BE News, over 50% of UK businesses now occupy flexible office space, highlighting a significant shift towards more adaptable work environments. This trend reflects the growing preference for flexibility and cost-effectiveness in modern businesses.

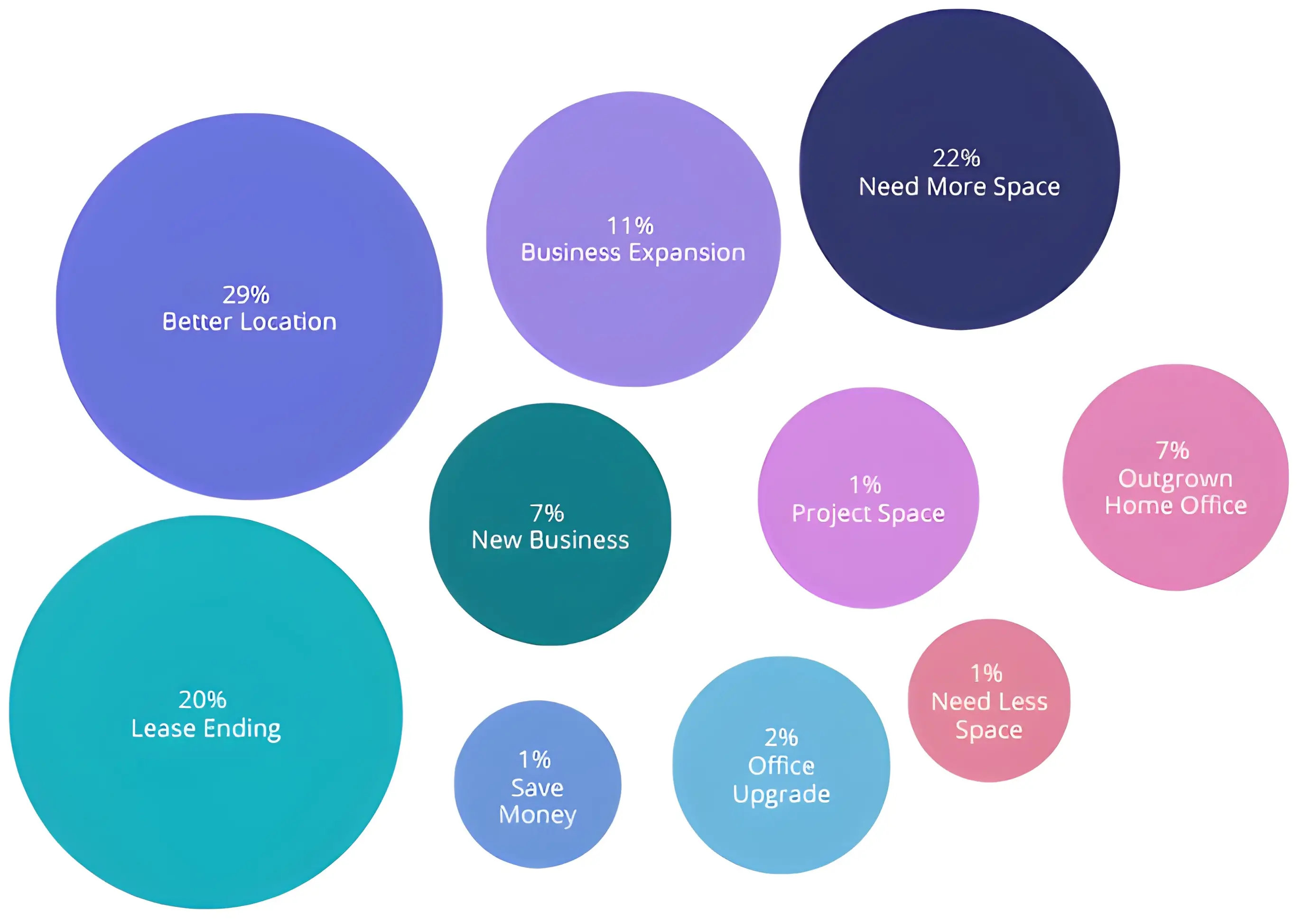

Motivation to Move

The leading motivations for moving offices in the UK are a better location (29%) and lease ending (20%). Other demanding key drivers include needing more space (22%) and business expansion (11%).

Tenant Requirements

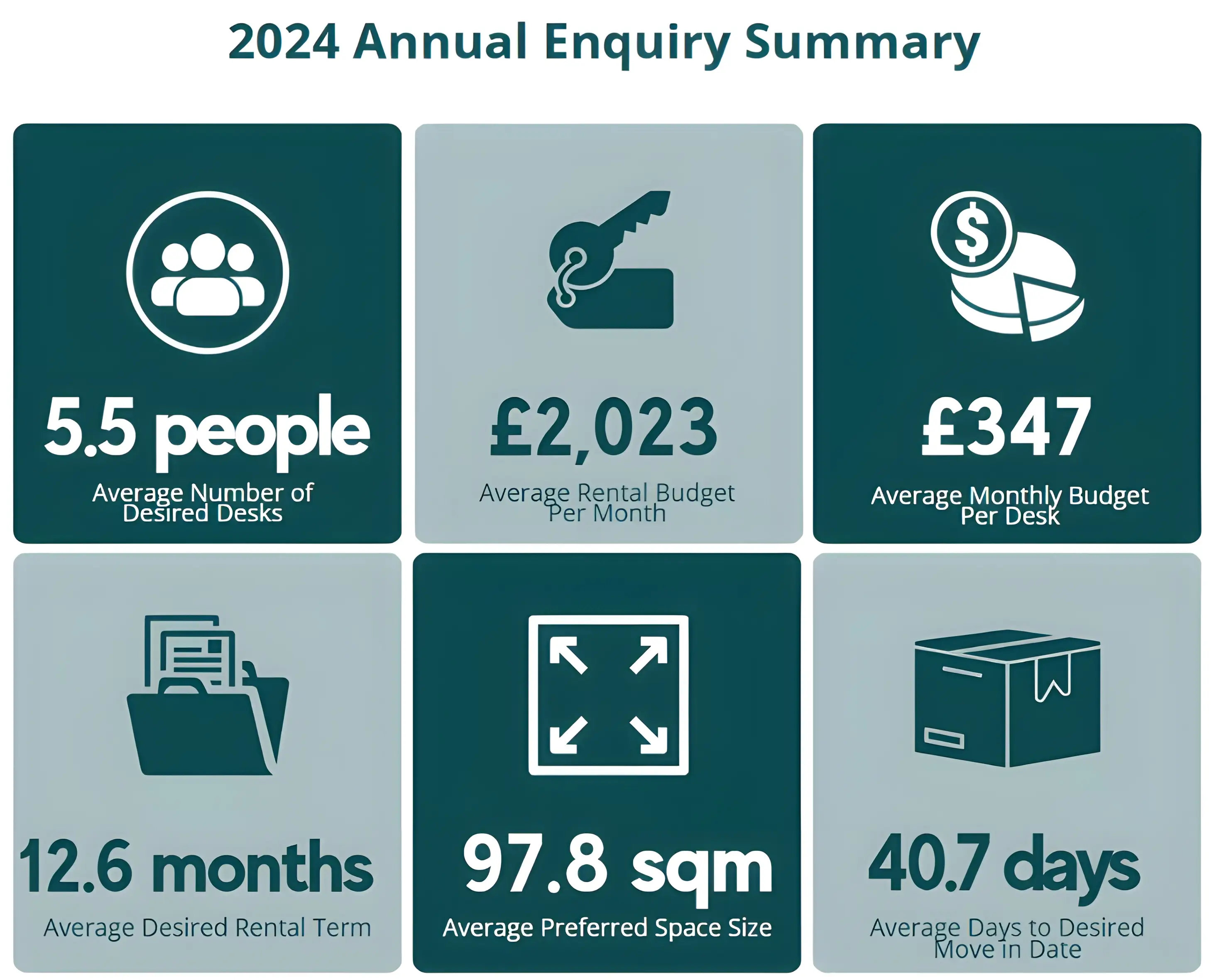

The annual comparison of enquiries for flexible office space in the UK is based on over 50,000 global submissions to the Office Hub platform in 2024. On average, tenants seek six desks with a monthly rental budget of £2,023.

Shifting Trends: The Future of Flexible Offices in the UK

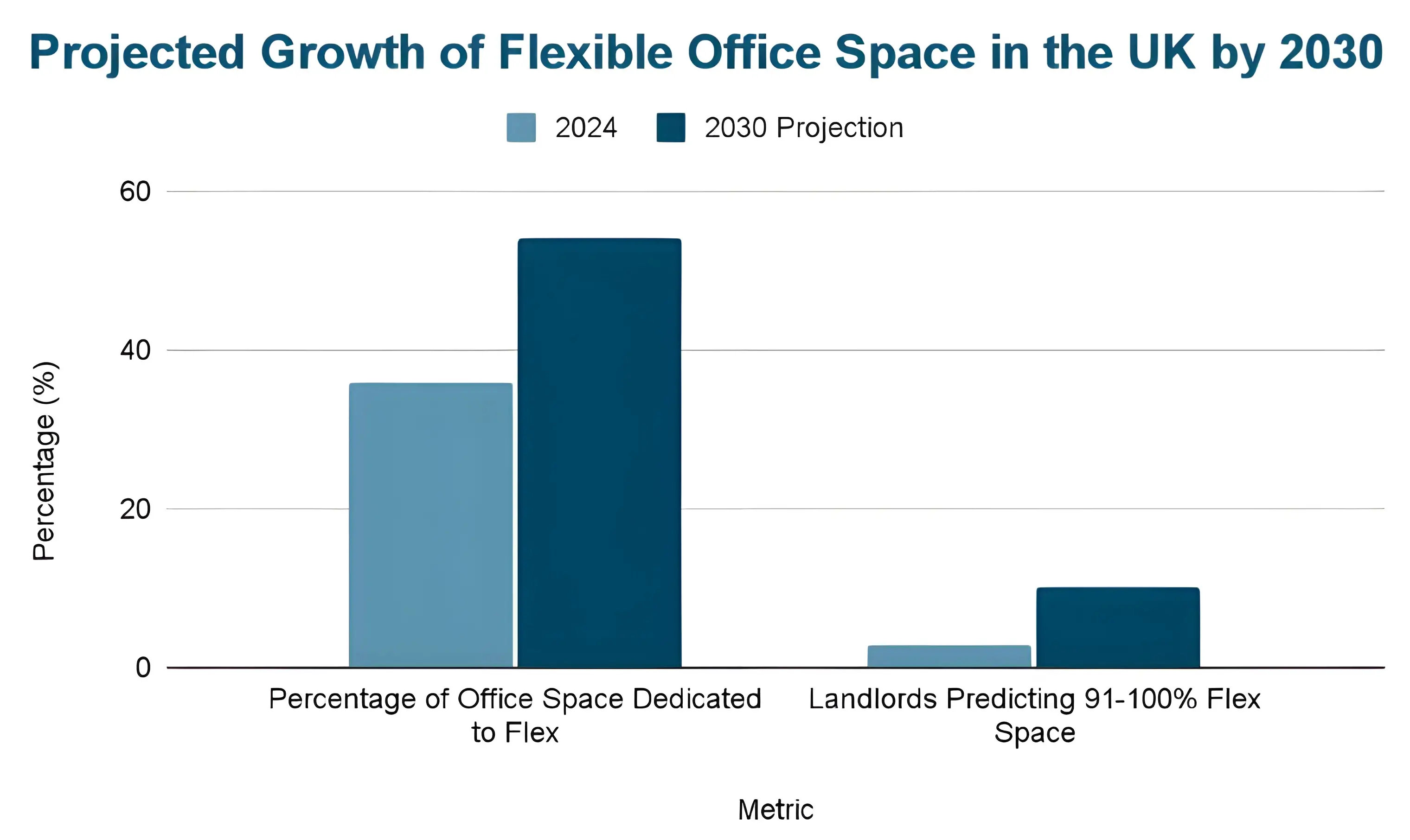

A recent survey of 250 UK office landlords reported by Facilities Management Journal reveals that 36% of office space is currently dedicated to flexible workspaces, with projections showing this will rise to 54% by 2030. Supporting this trend, infinitSpace notes that over half of landlords believe their buildings need redesigning to meet evolving tenant needs. Notably, 10% expect their portfolios to be almost entirely flexible by 2030, compared to just 3% in 2024.

Top Features and Facilities People Look for in the UK Flexible Office Market in 2024

Below are the features that tenants seek, reflecting the growing demand for collaborative workspaces.

Regional Breakdown of UK Flexible Office Space Market (2024)

A snapshot of average desk rates across major UK cities shows how local market dynamics, including supply, demand, and economic conditions, influence pricing trends.

|

City |

Average Desk Rate (June 2024) |

Change from Previous Quarter |

Comment |

|

Greater London |

£475 |

Decreased by 2.9% |

Strong demand, but affordability is strained |

|

Cambridge |

£725 |

Decreased from £775 |

Highest in the UK due to limited supply |

|

Manchester |

£360 |

No change |

Consistent demand supports stable pricing |

|

Bristol |

£375 |

Decreased by 9% |

Drop is linked to increased availability |

Inquiry-to-Deal Summary for the UK Flexible Workspace Market (2024)

In 2024, 8.9% of enquiries at Office Hub have converted into signed deals, reflecting a growing commitment to flexible spaces. The average lease term stands at 9.6 months, with teams of around 6.8 people and a typical monthly desk rate of £307. The average contract value reached £19,637, highlighting the continued strength of the UK’s flex office market.

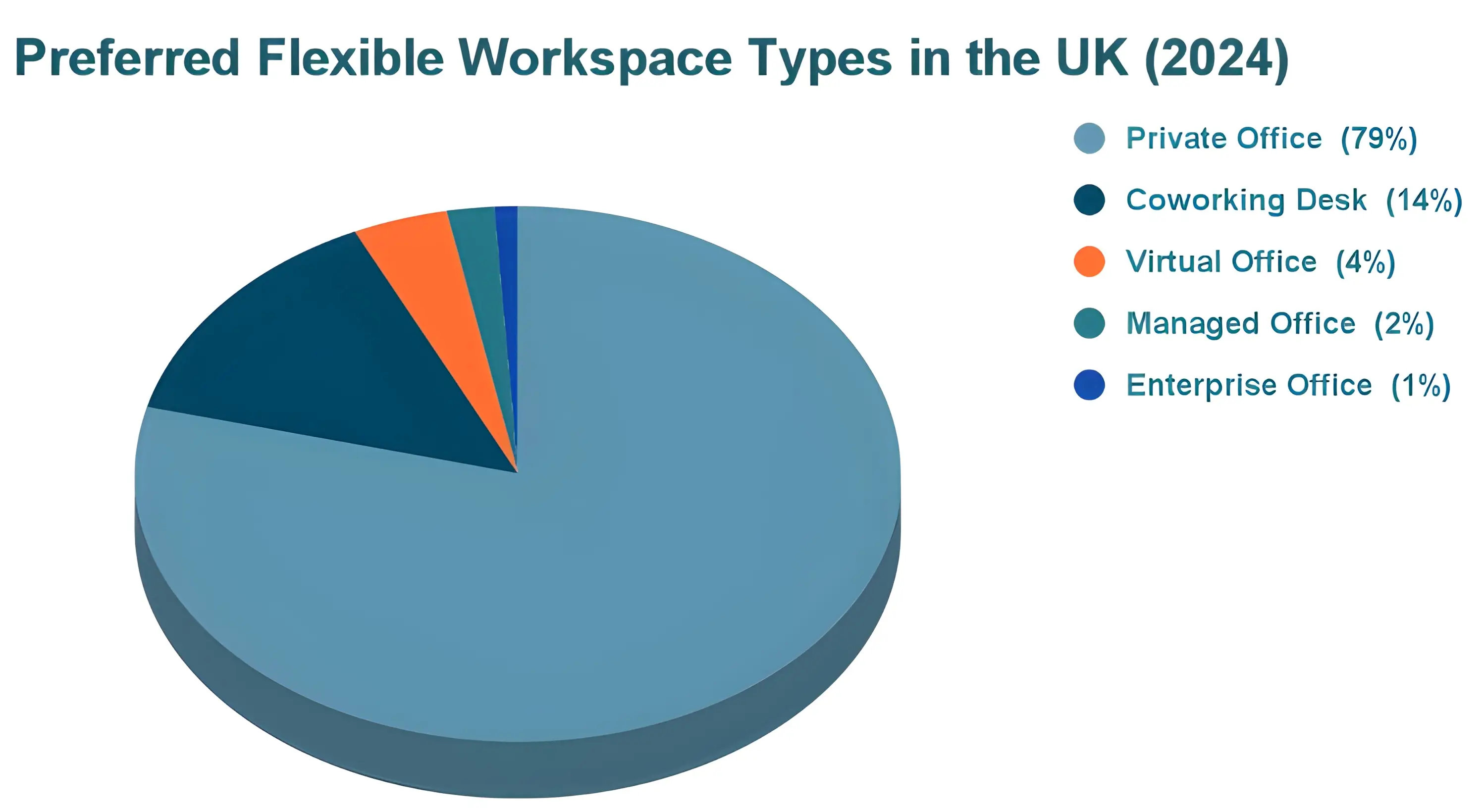

Most Sought-After Physical Space Types

Private offices are the most preferred type of workspace, accounting for 79% of all flexible workspace rentals in the UK. Coworking desks and virtual offices follow at 14% and 4% respectively, showing an apparent tilt toward enclosed, dedicated spaces that support focused, hybrid work.

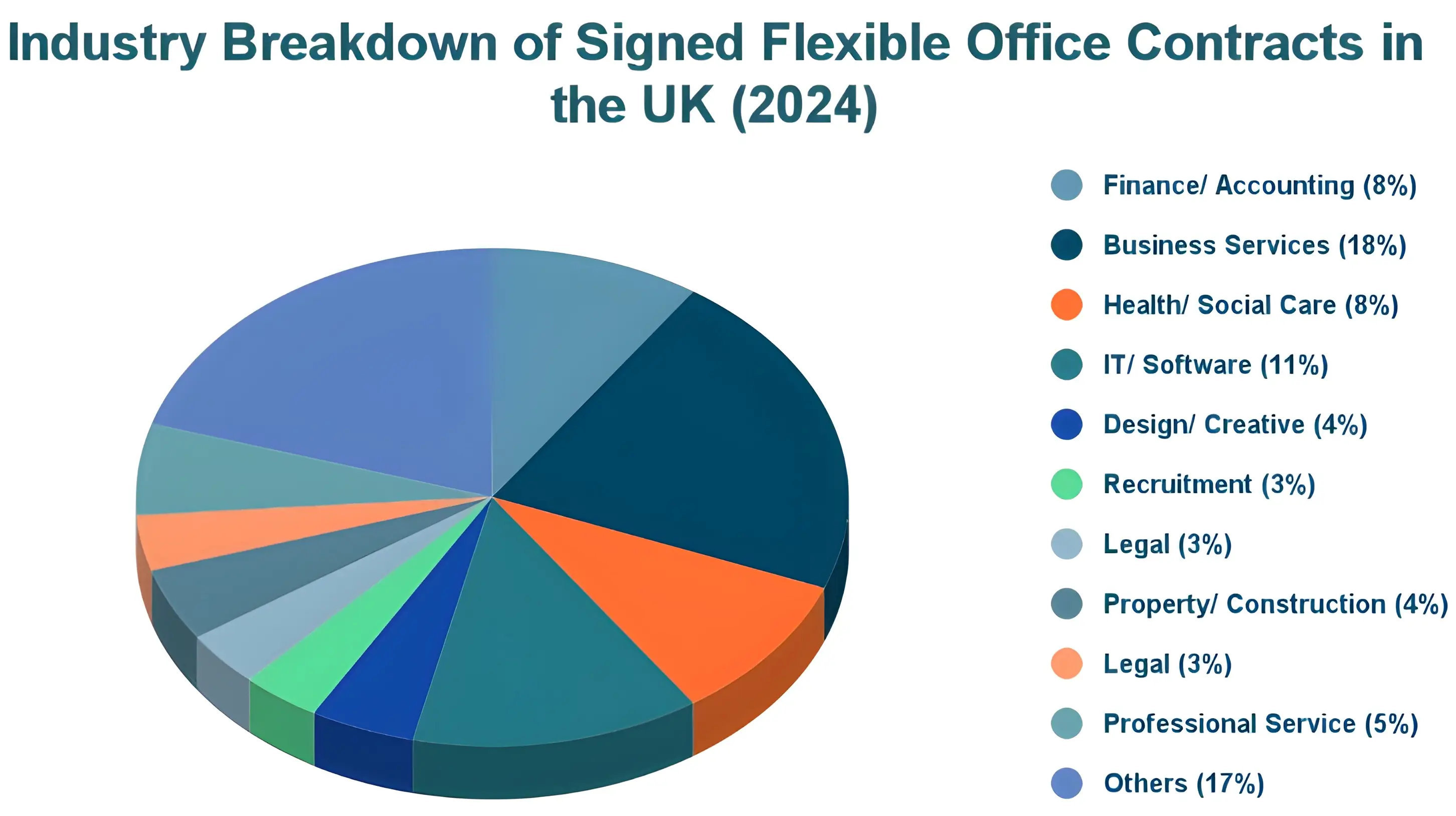

Signed Contracts by Industry Segment

Different industries are driving flexible office contracts in the UK. Business services lead the way at 18%, IT/software at 11%, and finance/accounting at 8%. This spread highlights the broad appeal of flexible workspaces across traditional and modern sectors in the UK.

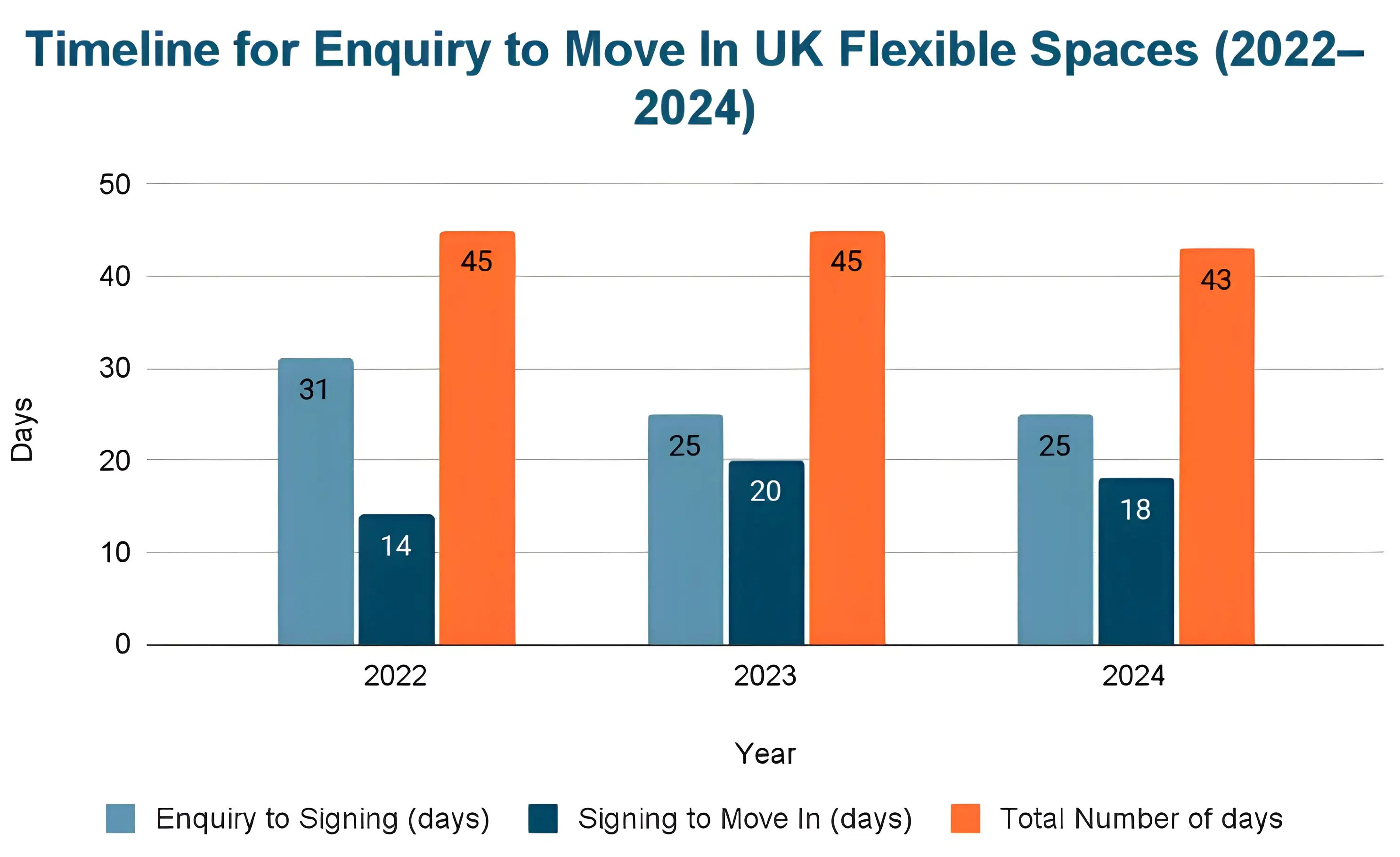

Move-In Timelines (2022–2024)

The average time from enquiry to move-in has become more efficient over the past three years. In 2024, tenants moved in within 18 days of signing, compared to 14 days in 2022, while the time from enquiry to signing dropped from 31 days in 2022 to 25 days in 2024, indicating faster decision-making in today’s flexible UK office market.

The Future of Flexible Offices in the UK

One of the most promising features shaping the future of flexible workspaces in the UK is hybrid working. It is becoming the top choice among employees. Additionally, demand for high-quality, well-equipped flexible spaces is growing across regional cities as the market expands beyond London.

Upcoming Trends of Flexible Offices in the UK

The upcoming trends of flexible offices in the UK are outlined below.

- Rise of Regional Flex Spaces: Flexible workspaces are expanding rapidly in regional hubs like Manchester, Bristol, and Cambridge, driven by demand for premium and affordable office solutions.

- Hybrid Work as the New Standard: Companies are adopting hybrid models, balancing remote and in-office work to offer employees flexibility while fostering collaboration.

- Experience-Driven Workspaces: Amenities like gyms, rooftop lounges, and wellness rooms are becoming key to attracting tenants and transforming offices into lifestyle-focused environments.

Forecasts for Flexible Offices in the UK

According to a report by Spherical Insights, the UK flexible office market is projected to exceed USD 3.89 billion by 2033, growing at a compound annual growth rate (CAGR) of 8.63% from 2023 to 2033. This growth is driven by rising demand for hybrid-friendly workspaces and landlords shifting their spaces to more flexible formats.

Conclusion

The UK flexible office market is adapting to hybrid work trends and growing demand. Flexible spaces are becoming essential for businesses of all sizes, and as companies look for more adaptable solutions, the market is set for continued growth.

For businesses seeking the right flexible office space, Office Hub offers an easy way to compare and secure tailored solutions, whether in London or beyond. Explore your options today at Office Hub. Contact us today and grab the best deals!