Brisbane Flex Office Market beats national trends in 2024

- Brisbane's office market is expected to keep growing after experiencing strong growth in 2024 and outperforming national trends.

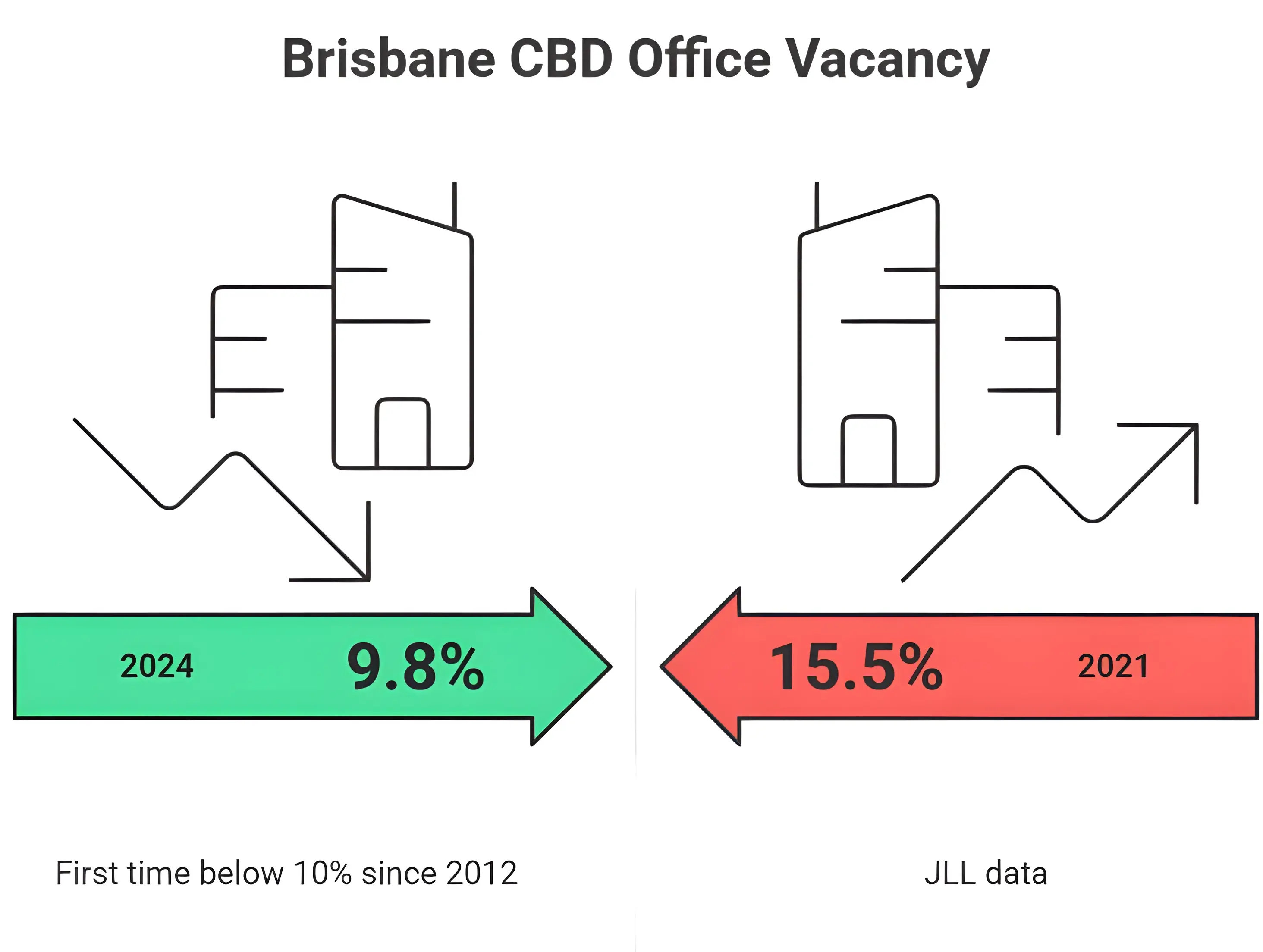

- Vacancy rates in Brisbane's CBD reached their lowest point since 2012 due to consistent demand over the past four years and a limited supply of new traditional office buildings.

- Queensland's influential economy and the increasing adoption of hybrid work models support the demand for flexible office spaces.

- Despite limited developments in traditional offices, new flexible office and coworking spaces are emerging to meet the growing demand.

- Investment in Brisbane's office market rebounded in 2024, indicating renewed investor confidence and a positive growth trajectory.

Brisbane's flexible office market outperformed the national market in 2024, driven by the economy’s surplus, a pause in new office construction, and increasing demand for flexible office spaces.

By the end of 2024, the number of empty office spaces in Brisbane's central business district (CBD) had dropped to 9.8%, the lowest since 2012, JLL reported. Research and Markets and Rubberdesk added that this rate had steadily decreased throughout the year, from 11.7% in January to 9.5% in July 2024.

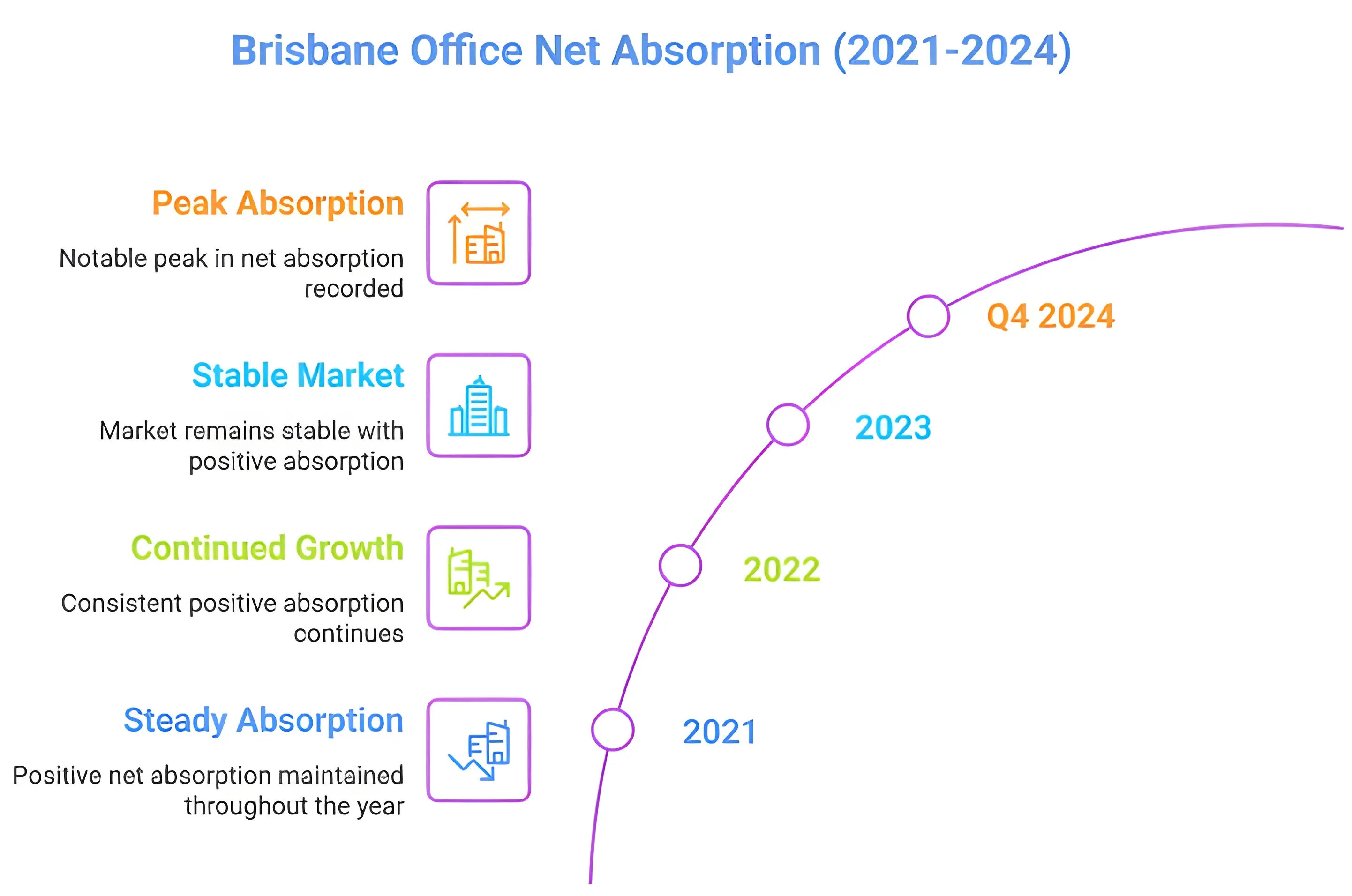

Premium office spaces were especially popular, with only 7.4% empty in the last three months of 2024. According to CBRE and Herron Todd White, the number slightly increased to 10.2% by January 2025 due to slight changes in the market or some new offices becoming available. Meanwhile, JLL’s survey showed a resilient and optimistic demand for businesses wanting office space in Brisbane's CBD over four years (from 2021 to 2024).

Even though some reports from CBRE showed that slightly less office space was occupied overall in the CBD towards the end of 2024, Colliers and JLL noted that Brisbane's office market is generally seen as performing better than other major cities in Australia and the Asia Pacific region, especially when it comes to how quickly rents are recovering.

Brisbane's strong office market is also supported by Queensland's healthy economy, making it more stable despite economic ups and downs. According to research estimations by JLL, the rate of people without jobs in the state went down to 3.9% in December 2024, and the population grew by 2.3% in the year leading up to June 2024, mainly due to people moving there.

Similarly, the demand for large office spaces (bigger than 1,000 square meters) mostly came from government and public service areas, which expanded by 71,200 square meters across Brisbane from 2022 to 2024, with 12,400 square meters of that in 2024 alone.

Another major reason for the popularity of flexible workspaces is the increasing trend of hybrid work, where people work partly from the office and partly from elsewhere. According to a report by Colliers, flexible hybrid/management leases have risen from 4% in 2019 to 10% in 2024.

Businesses, especially new and small to medium-sized ones, choose flexible options because they save money, can easily change their space, and can access shared work environments. According to Expert Market Research, this idea of "less, but better" means that flexible office providers must offer high-quality design, technology, and facilities to stay competitive.

Brisbane's office market hasn't seen many new buildings being completed, causing vacancies to decrease and rents to increase. There are only three future projects planned for the CBD, and many of the spaces in these buildings have already been committed: 205 North Quay (fully committed for 2025), 360 Queen Street (75% leased for early 2026), and Waterfront Brisbane North Tower (51% pre-committed for 2028), JLL stated.

Despite the lack of traditional new office buildings, flexible offices meet the demand for adaptable, good-quality workspaces that the conventional market isn't currently providing.

Hub Australia, working with ACS and River City Labs, moved its innovation hub to Anzac Square in January 2024. WeWork, a major company, operates three flexible offices in Brisbane's CBD and plans to open a fourth. Other well-known flexible office providers include WOTSO, The Cove, and Regus. Rubberdesk also noted "a string of new openings across Brisbane in late 2024 from operators such as Workspace365 and GPT Space & Co".

Rents for office spaces in Brisbane grew strongly in 2024 due to landlords setting higher prices for better-quality spaces, as noted by Colliers and CBRE. The rental rates for offices in the CBD increased by 3.8% compared to the previous three months, and by 13.8% compared to the same time last year in the last three months of 2024, CBRE reported.

According to Rubberdesk, the typical cost per person for flexible offices was $642, and the typical cost for a coworking desk was $440. The average desk rate in the wider Brisbane area stayed steady at $600 per desk in the first three months of 2025, with a slight increase in the CBD to $628 per desk. Similarly, serviced offices in Brisbane started at around $750 per month for a single office, according to Corporate House.

CBRE reported that investment in Brisbane's office market recovered in 2024, with the total value of transactions increasing by 54%. Total sales worth over $10 million reached $1.1 billion, added by Knight Frank.

Large investors are coming back, and groups that pool money for investments are actively buying properties in the CBD for quick returns, Colliers stated. While the returns on prime properties slightly decreased to 7.06% in the last three months of 2024, CBRE and Knight Frank reported that the increased activity and investors preferring Brisbane over other cities indicate renewed confidence in the market.

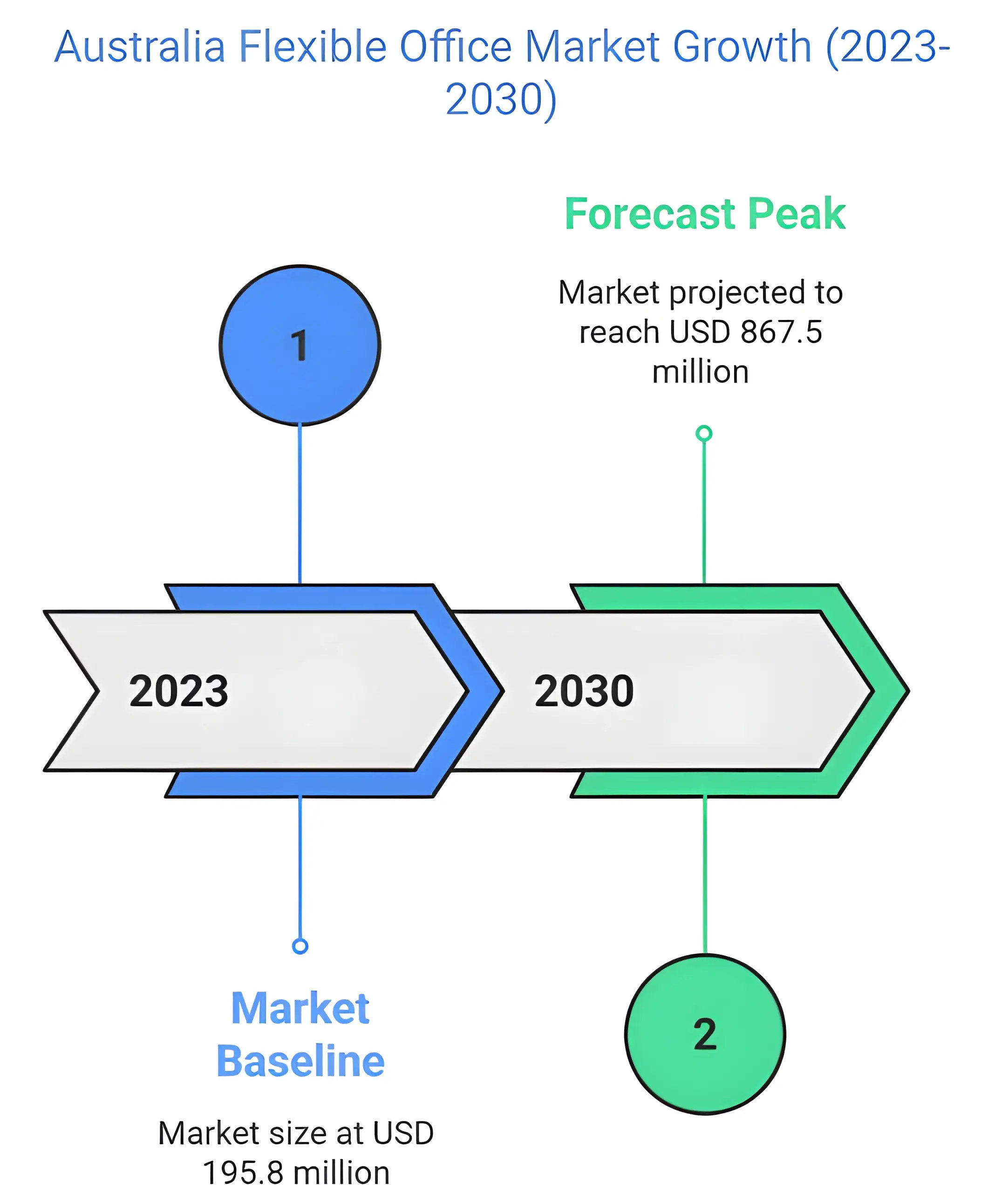

Looking ahead, Data Insights Market said that the Australian flexible office market is expected to grow significantly, with an average annual growth rate of over 8% from 2025 to 2033. Next Move Strategy Consulting also added that the coworking market alone is predicted to reach USD 867.5 million by 2030, with an average annual growth rate of 23.6%. Across the country, the rate of empty office spaces might reach its highest point in 2025 before starting to decline, CBRE reported.

In Brisbane, even though there might be a temporary increase in empty spaces when new buildings are completed in 2025, the market is expected to become tighter again by the middle of 2028, according to Knight Frank. CBRE predicts that the vacancy rate for the best office spaces in Brisbane's CBD will drop to 6.1%, and the total vacancy rate will be 8.4% by June 2025.

Rental growth is expected to remain positive, with Knight Frank forecasting that the gross rent for prime properties will grow by 2.2% in 2025.

Overall, the market will continue to be influenced by hybrid work models, with businesses focusing on saving costs, improving productivity, and promoting collaboration.