2024 Canada Flexible Office Market Report

While major metropolitan areas like Toronto, Vancouver, and Montreal continue to dominate flexible office market demand, regional cities are also emerging as attractive destinations as companies decentralize and expand across Canada.

Key Highlights

- Hybrid Work as the New Normal: Remote and hybrid work trends have changed how businesses use office space, reducing demand for traditional long-term leases.

- Surge in Flexible Workspaces: Demand for coworking and serviced offices is rising, especially among startups, SMEs, and satellite teams of larger enterprises.

- Shift Toward Suburban Markets: Office demand is expanding beyond city centers to suburban areas, driven by affordability and employee preference for shorter commutes.

- Technology Integration: IoT, AI, and smart building tech transform workspace management, boosting tenant satisfaction and operational efficiency.

- Sustainability Takes Priority: Green-certified and energy-efficient buildings attract eco-conscious tenants and investors aligned with ESG goals.

- Impact of Small Tenants: Small office spaces (under 3,000 sq. ft.) face challenges due to remote work, but coworking offers a viable solution with flexible terms.

- Rise of Mixed-Use & Transit-Oriented Developments: Mixed-use hubs and developments near public transit are gaining popularity, supporting vibrant communities and reducing car dependency.

- Growing Investor Opportunities: Lower acquisition costs in some markets and adaptive reuse strategies present long-term value for forward-thinking investors.

- Need for Flexibility & Agility: Future-ready office spaces must offer adaptability in layout, lease terms, and technology to remain competitive in a changing landscape.

Market Share Analysis of Canada Flexible Office Space

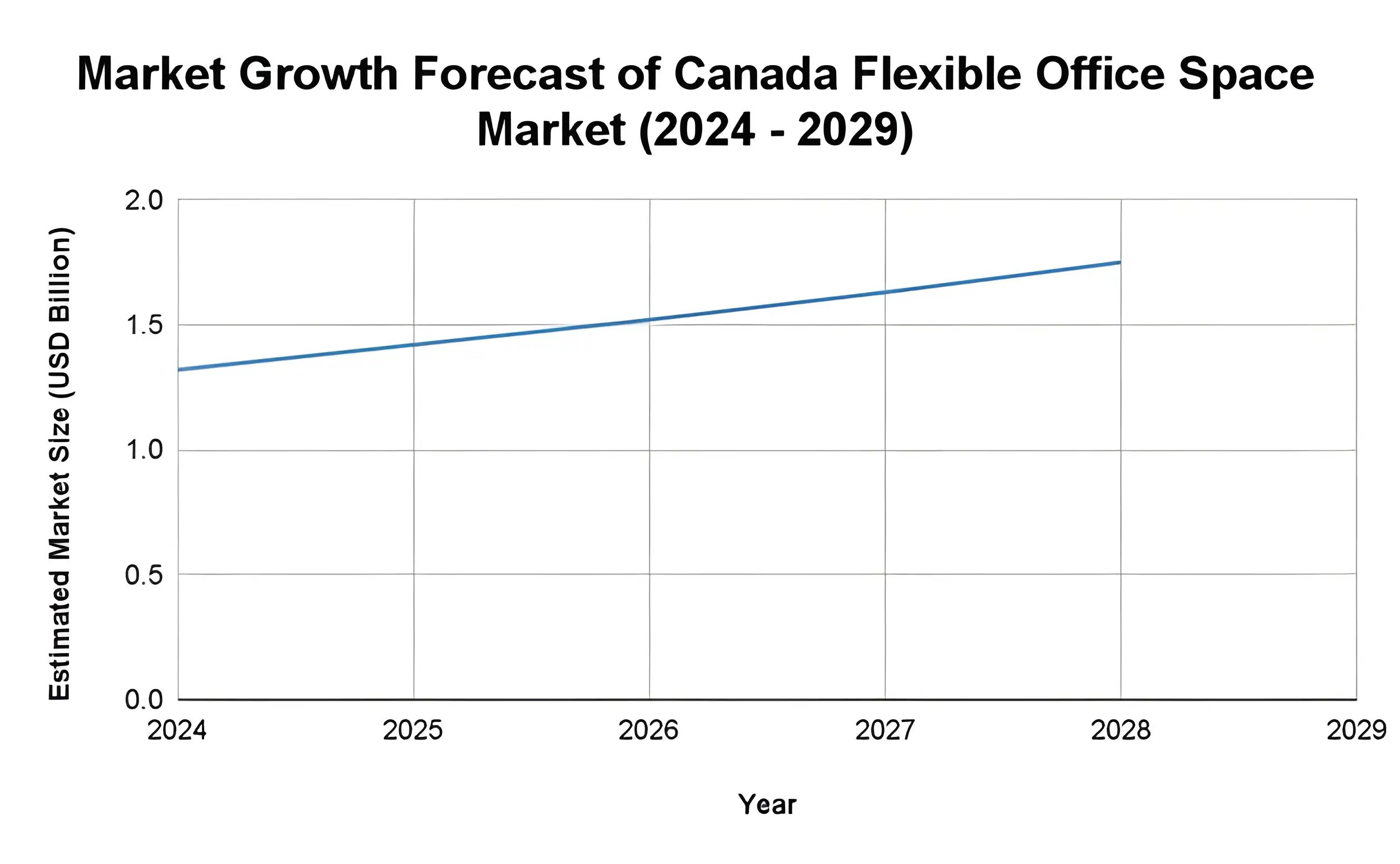

The Canadian flexible office space market is experiencing steady growth, with its value estimated at USD 1.22 billion in 2024. Mordor Intelligence forecasts that Canada's flexible office market will reach USD 1.75 billion by 2029, with a compound annual growth rate (CAGR) of 7.58% from 2024 to 2029. This growth reflects a broader shift in how businesses and workers view and utilize flexible office space in a post-pandemic landscape.

As uncertainty from the pandemic continues to influence workplace planning, more organizations are turning to flexible office spaces to support dynamic and adaptable working models.

Employers now face a delicate balance between employee expectations for flexibility and organizational goals for collaboration and productivity. Flex spaces in Canada offer a solution by accommodating these varied preferences, enabling companies to reduce fixed costs while supporting hybrid work environments.

This trend is particularly pronounced in Canada’s leading urban centers, including Toronto, Vancouver, and Montreal. These cities are home to thriving startup ecosystems and a growing population of remote workers, freelancers, and tech-driven businesses. These cities are also seeing increased adoption of coworking models from major players like WeWork and emerging local operators that provide niche, community-focused solutions tailored to specific industries.

However, while the demand for flexible and premium office spaces grows, Canada’s traditional office market is profoundly transforming. By the first quarter of 2023, vacancy rates in key markets had reached historic highs.

Toronto's downtown office vacancy rose to 15.3%, the highest since 1995. Vancouver recorded a 10.4% vacancy rate, the highest since 2004, while Ottawa (13.2%) and Montreal (16.5%) also hit all-time highs. This widening gap between outdated, uninspiring office buildings and modern workspaces accelerates the shift toward flexible alternatives.

Looking ahead, flexibility is expected to remain central to Canada’s office space strategy—not only in design and utilization but also in how and where people choose to work.

2024 Supply of Flexible Offices in Canada

The supply of new office space in Canada temporarily slowed down in 2023, reflecting market uncertainty and ongoing adjustments to hybrid work patterns. According to Statista, only about 2.5 million square feet of new office space was delivered across downtown and suburban markets that year, signaling a cautious approach by developers amid rising vacancy rates and shifting tenant expectations.

However, projections for 2024 indicate a rebound in office supply, particularly in the flexible space segment. As demand for modern, adaptable offices grows, driven by hybrid work, cost-consciousness, and a flight to quality, landlords and coworking providers are responding with renewed investments in flex-ready spaces.

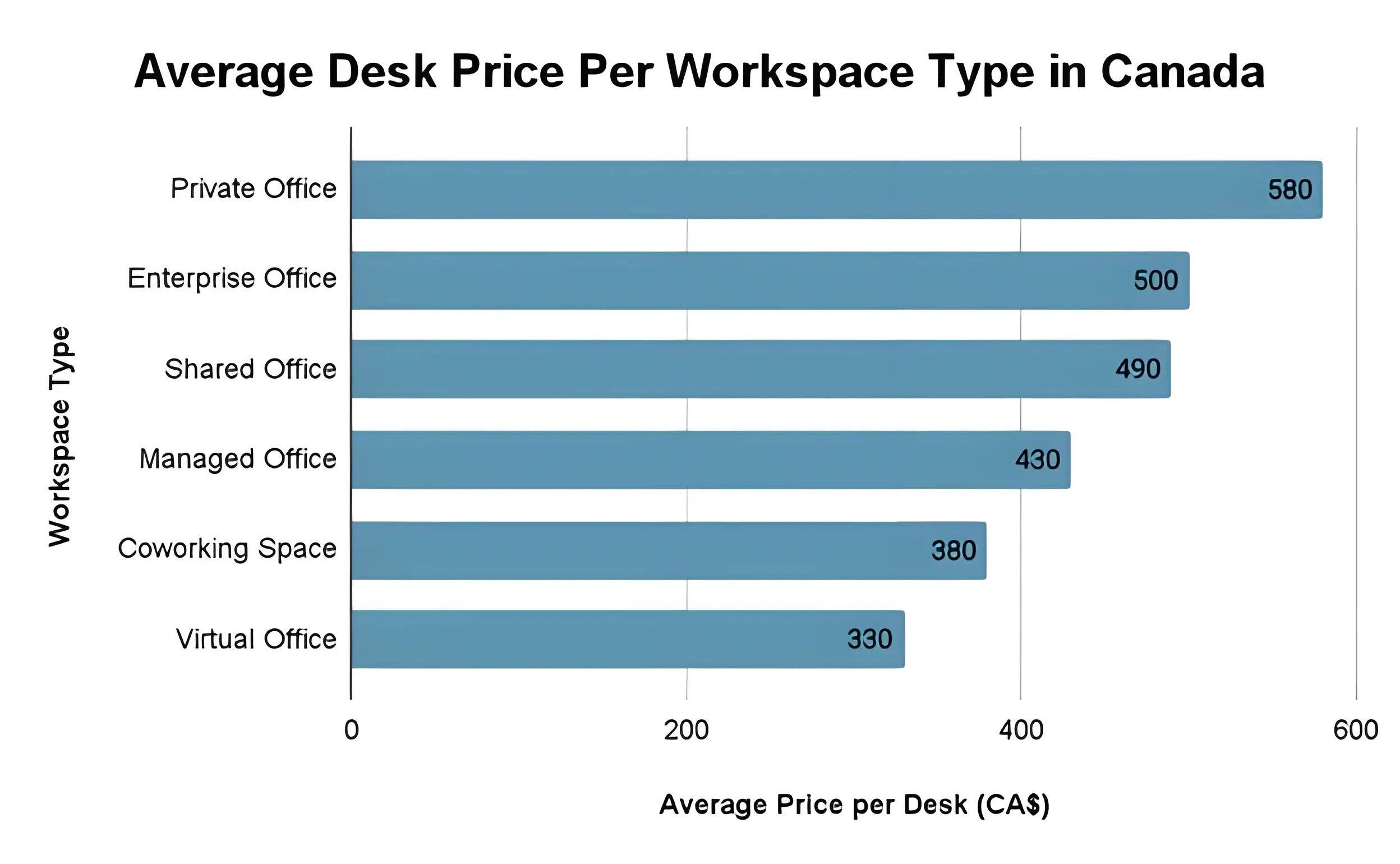

Average Desk Price Per Workspace Type

The average desk prices across Canada’s flexible office space types vary significantly based on the level of privacy, services, and customization offered. Private offices are the most expensive at CA$580 per desk, catering to professionals seeking enclosed spaces, while enterprise offices follow at CA$500, offering scalable setups for larger teams.

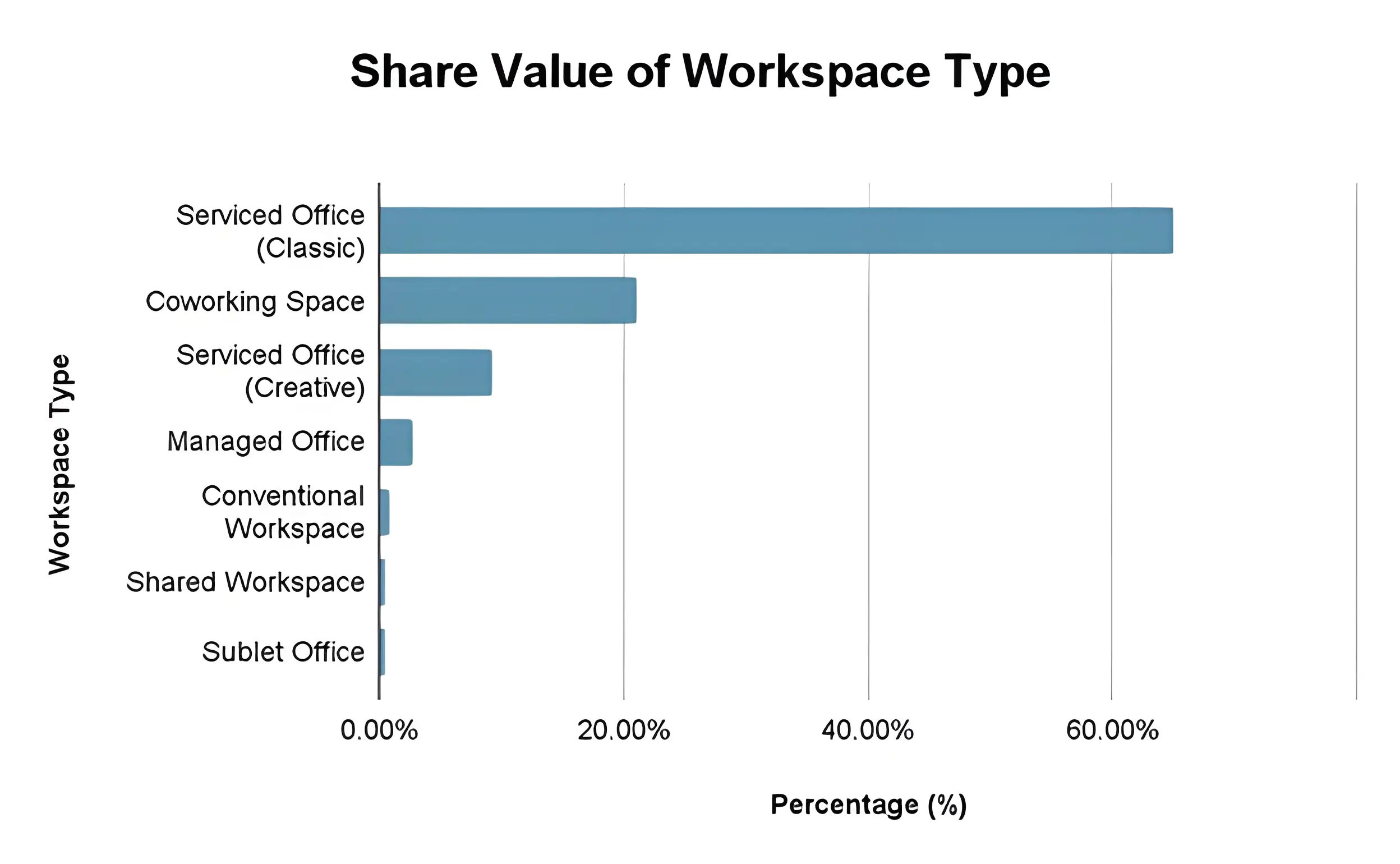

Share Value of Workspace Type

As of 2024, classic serviced offices dominate Canada's flexible office space market, accounting for 65.1% of all available workspace listings. These offices typically offer private, fully-furnished setups with reception services and shared amenities, catering to professionals and teams seeking a plug-and-play solution.

Coworking spaces hold the second-largest share at 21.1%, appealing to freelancers, startups, and remote teams looking for collaborative, community-oriented environments.

Other workspace types make up a smaller portion of the market, including:

- Creative Serviced Offices: 9.2% – characterized by design-led interiors and informal layouts for creative industries.

- Managed Offices: 2.7% – fully customized and scalable spaces typically leased by mid-to-large enterprises.

- Conventional Workspace: 0.8% – traditional leased office space with limited flexibility.

- Shared Workspaces: 0.5% – desks within a larger office used by different companies or individuals.

- Sublet Offices: 0.5% – short-term leases within a company’s unused space.

This distribution reflects a clear market preference for flexible, fully serviced solutions, especially as businesses seek cost efficiency and agility in their real estate strategies.

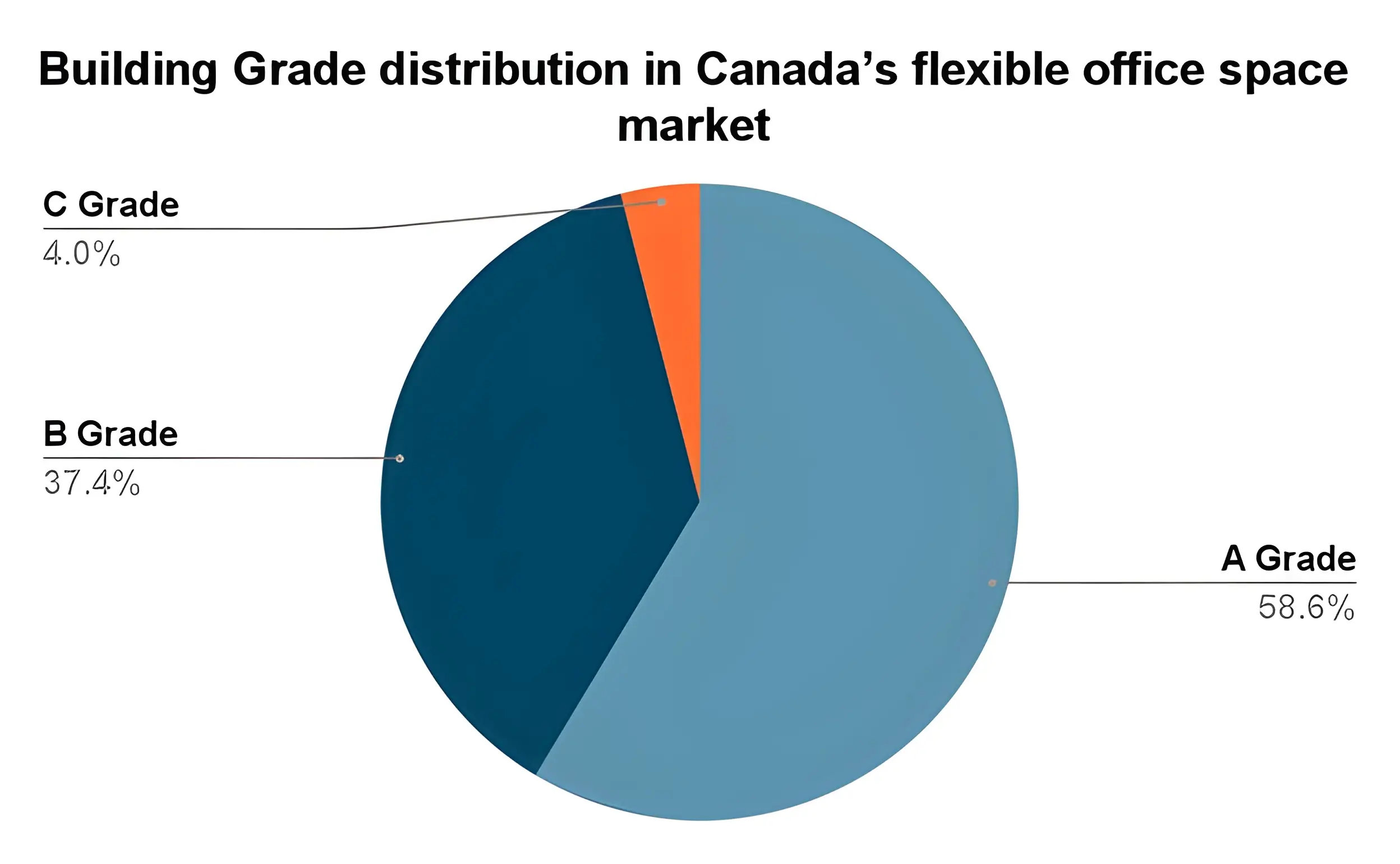

Building Grade in Canada’s flexible office space market

After assessing building services, amenities, and the quality of foyers and common areas, it is confirmed that in 2024, 58.6% of all flexible office buildings in Canada are classified as A-Grade, offering premium facilities, modern infrastructure, and prime locations.

B-grade buildings make up 37.4%, typically providing functional spaces with moderate finishes and good service levels. Only 4.0% are C-grade, generally representing older buildings with basic amenities and limited upgrades.

This distribution reflects a strong market leaning toward higher-quality office environments.

Infrastructure & Workspace Trends in Canada Flexible Office Market (2024)

1. Fragmented Market with Diverse Players

Canada’s flexible office space sector is highly fragmented, comprising a mix of international providers and local operators. Major players like Regus, Spaces, iQ Offices, Hedhofis, and HQ compete with newer entrants offering cost-effective, tech-enabled solutions to meet evolving business needs. This variety allows companies to choose from various workspace formats and pricing models.

2. Rise of Tech-Driven and Affordable Workspaces

To adapt to shifting work patterns and tenant demands, developers are introducing low-cost, plug-and-play spaces supported by proptech innovations. These include AI-powered booking systems, IoT-based space management, and hybrid-ready layouts that accommodate remote and in-office workforces.

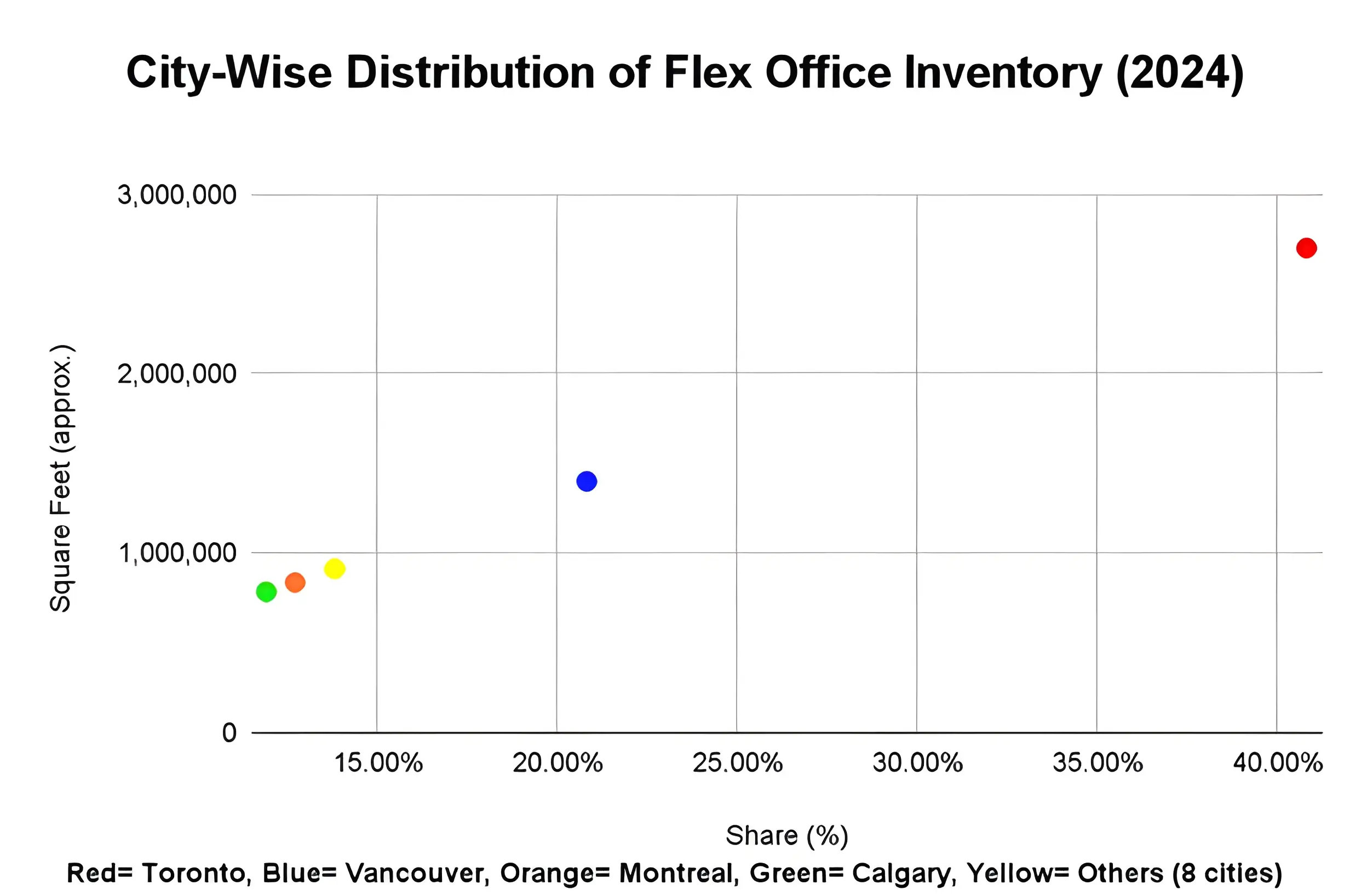

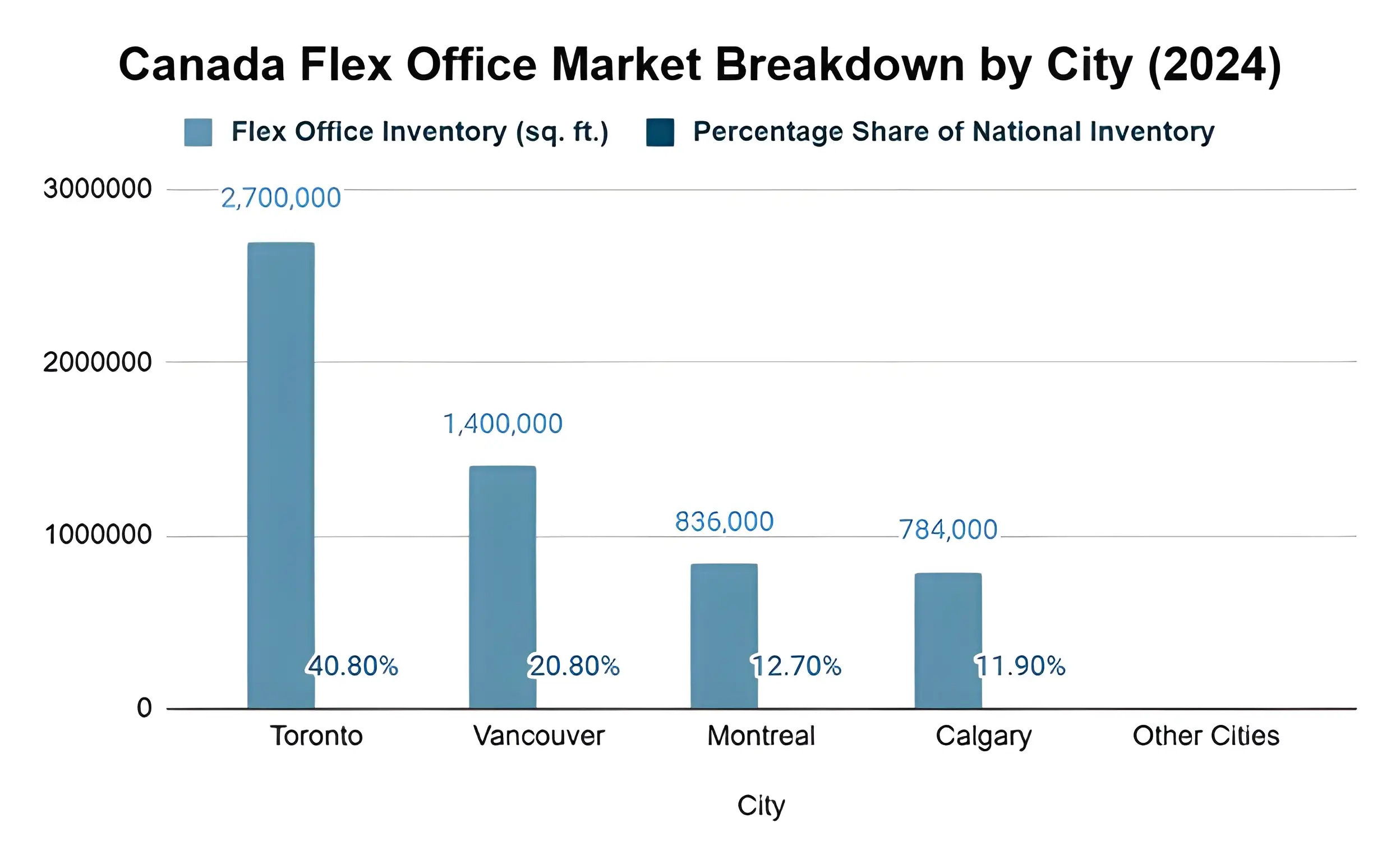

3. City-Wise Inventory Leadership

According to the Mordor Intelligence report, Toronto dominates the Canadian flexible office landscape, holding 40.8% of the total flex inventory (~2.7M sq. ft.). It is followed by Vancouver (20.8%), Montreal (12.7%), and Calgary (11.9%), highlighting regional variation in supply and maturity levels. Eight of twelve Canadian cities still have less than 300,000 sq. ft. in flex inventory, showing room for future growth.

4. Startup Ecosystem Boosting Demand

Canada’s startup boom—fueled by programs like the Startup Visa, tax incentives, and access to global markets—has created consistent demand for scalable, flexible offices. Tech hubs such as Toronto, Vancouver, Montreal, and Ottawa are seeing an influx of innovation-driven tenants looking for agile leases and collaborative spaces.

5. Infrastructure Growth and Premium Developments

Toronto is experiencing significant infrastructure upgrades with major Class A developments like CIBC Square (1.5M sq. ft.) and IBM’s innovation center at 16 York Street. Despite some market softness, there are signs of recovery, such as rising tour activity, higher asking rents (e.g., CAD 41.9/sq. ft. in Downtown Toronto), and low vacancy rates (4.0% in 2019) in core submarkets.

Canada Flex Space Market in 2024: Insights from Office Hub

Surge in Supply: Canada’s Flex Space Market Momentum in 2024

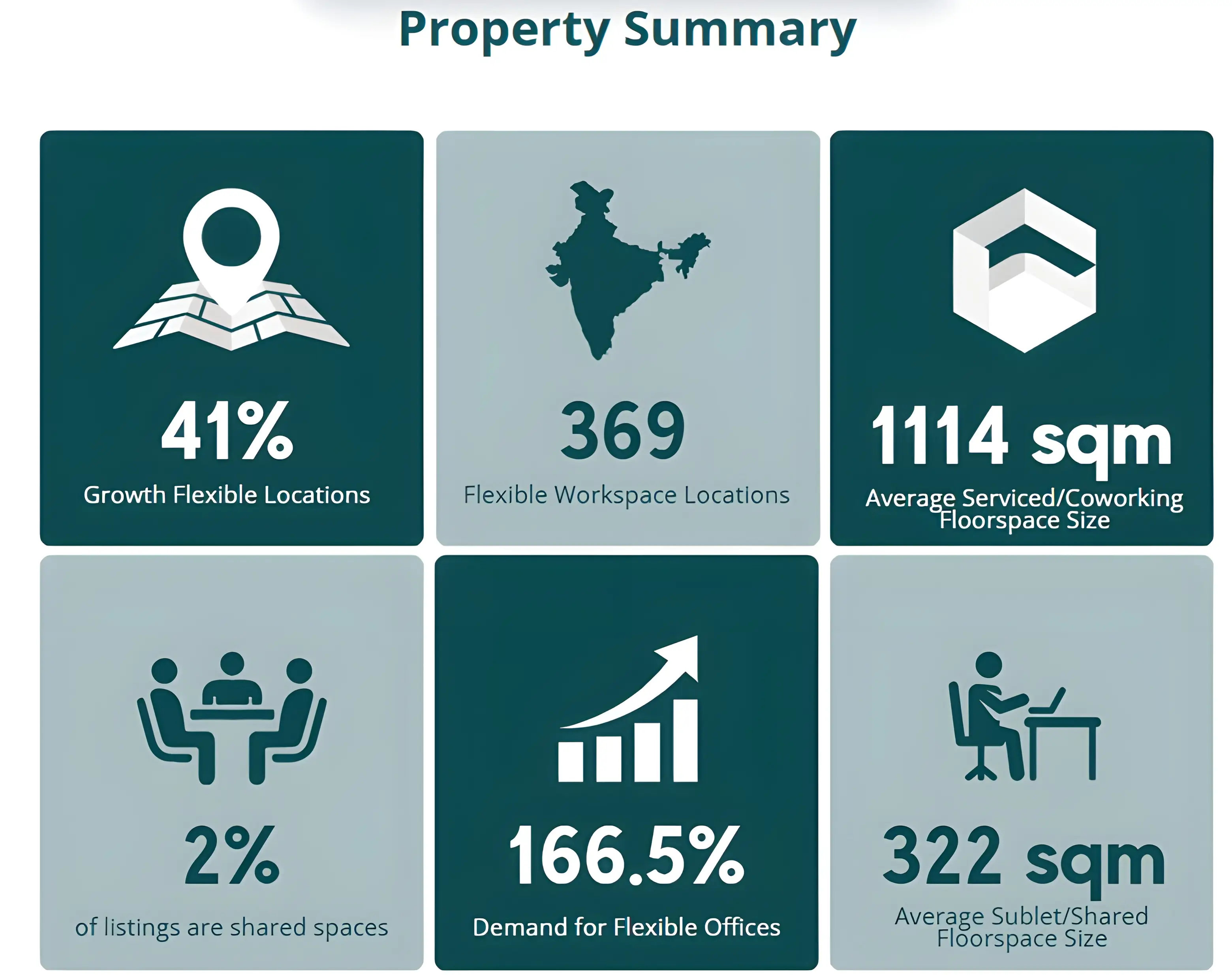

According to Office Hub data, Canada’s flexible workspace market witnessed a dynamic leap in 2024, with a 41% annual increase in available workspaces and an extraordinary 166.5% surge in tenant inquiries. A total of 369 live locations, comprising 362 serviced and coworking spaces, and just seven are shared and sublet offices, reflect a clear preference for turnkey, professional environments. Interestingly, only 2% of listings involve private companies subletting their space, indicating that the sector remains dominated by formal operators rather than casual sharers.

Listings Snapshot: Key Metrics Defining Canada’s Flex Office Market

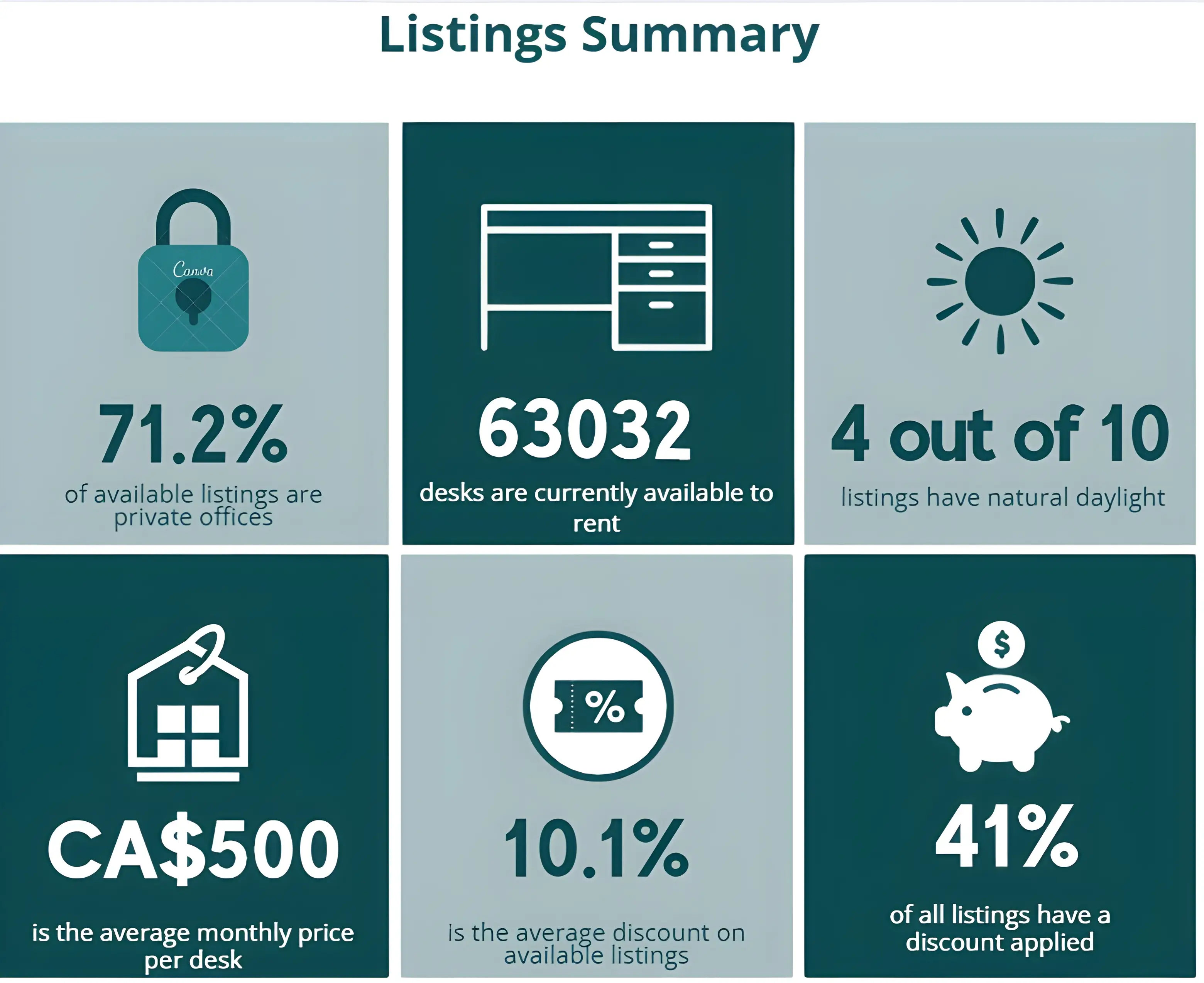

As of May 2025, private offices dominate Canada’s flex office market, accounting for 71.2% of all listings and offering 63,032 desks available for rent. The average monthly price per desk stands at CA$500, underscoring the balance between affordability and quality workspace offerings as demand rises across major cities.

2024 Demand for Flexible Offices in Canada

Flexible office spaces in Canada are seeing increased traction, driven by the widespread adoption of hybrid work and the downsizing of traditional office spaces. These changes reflect a broader transformation in how businesses approach workspace strategies.

Overall Demand and Peak Month

In 2024, flexible office demand in Canada increased significantly, especially in metro areas. According to data trends, June 2024 marked the peak demand month. Most businesses sought coworking and managed spaces, which offer adaptability, shared amenities, and short-term leases.

Inquiries and Conversion Rate

According to Colliers, 21% of companies surveyed in 2024 consider flexible office spaces as part of their real estate strategies. This reflects a rise in inquiries compared to 2023. The conversion rate was particularly strong among businesses in suburban areas and those shifting away from full-time in-office work models.

Workspace Shifts and Preferences

There is a visible shift from long-term leased offices toward coworking, managed, and suburban flex spaces. Many businesses adopting flexible offices in 2024 previously operated from traditional downtown leases, especially those in Class B and C buildings, which suffered the most in occupancy.

Occupancy and Leasing Rates

- Average occupancy for flexible spaces remained above 80% in major metro areas in 2024.

- Leased space in Class A buildings reached 11.6 million sq ft, compared to only 2.4 million sq ft for Class B and 540,000 sq ft for Class C buildings.

- According to Colliers, flexible office stock is estimated to make up 8% of total inventory.

Industry-Wise Demand Share

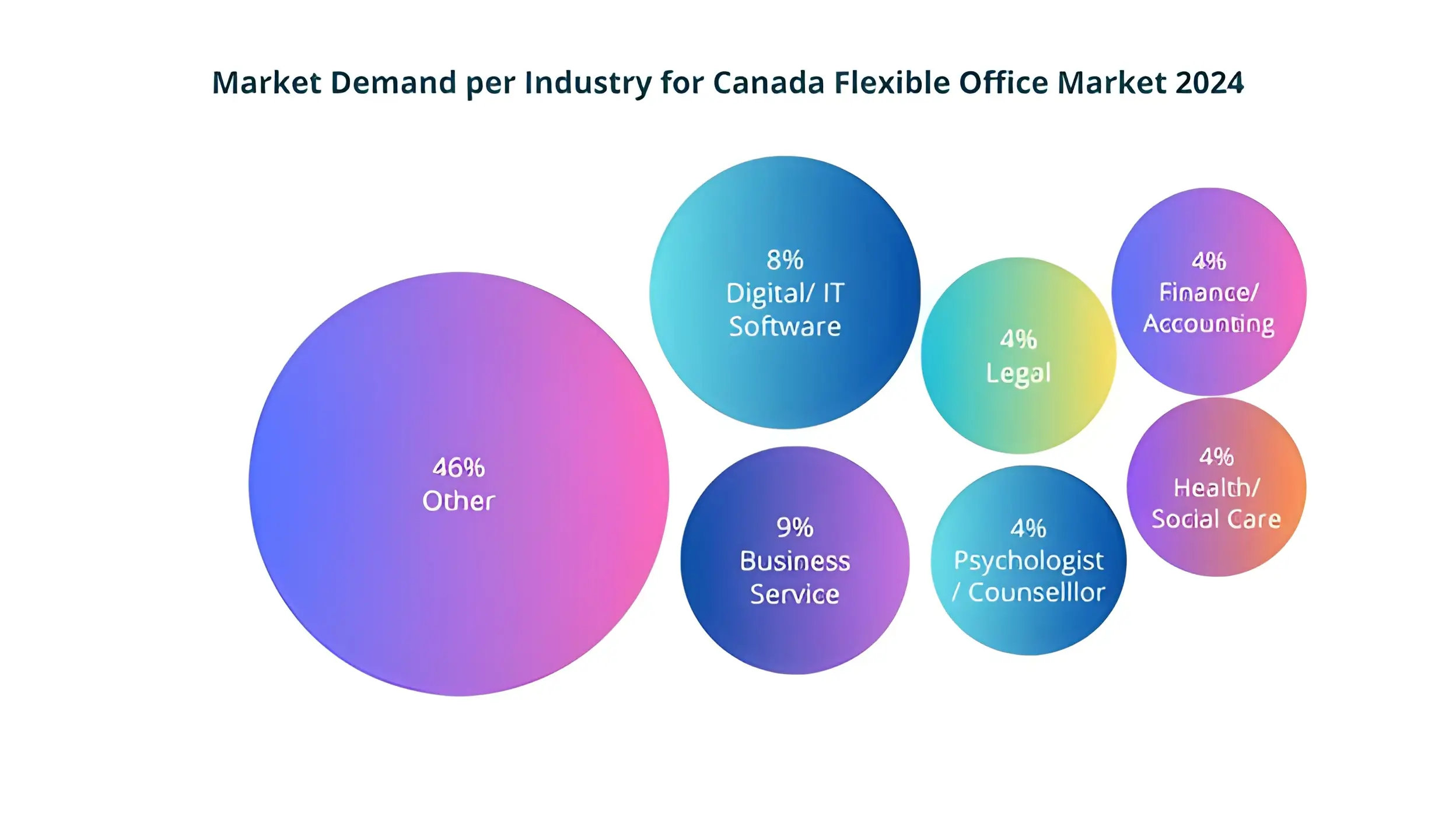

The top sectors using flexible offices in Canada during 2024 included:

- IT & Software

- Professional Services

- Startups & SMEs

- Fintech and Consulting

- Non-profits and Remote Teams

These industries preferred flexible leases for cost efficiency, access to shared infrastructure, and scalability.

Canada’s Evolving Workspace Preferences in 2024

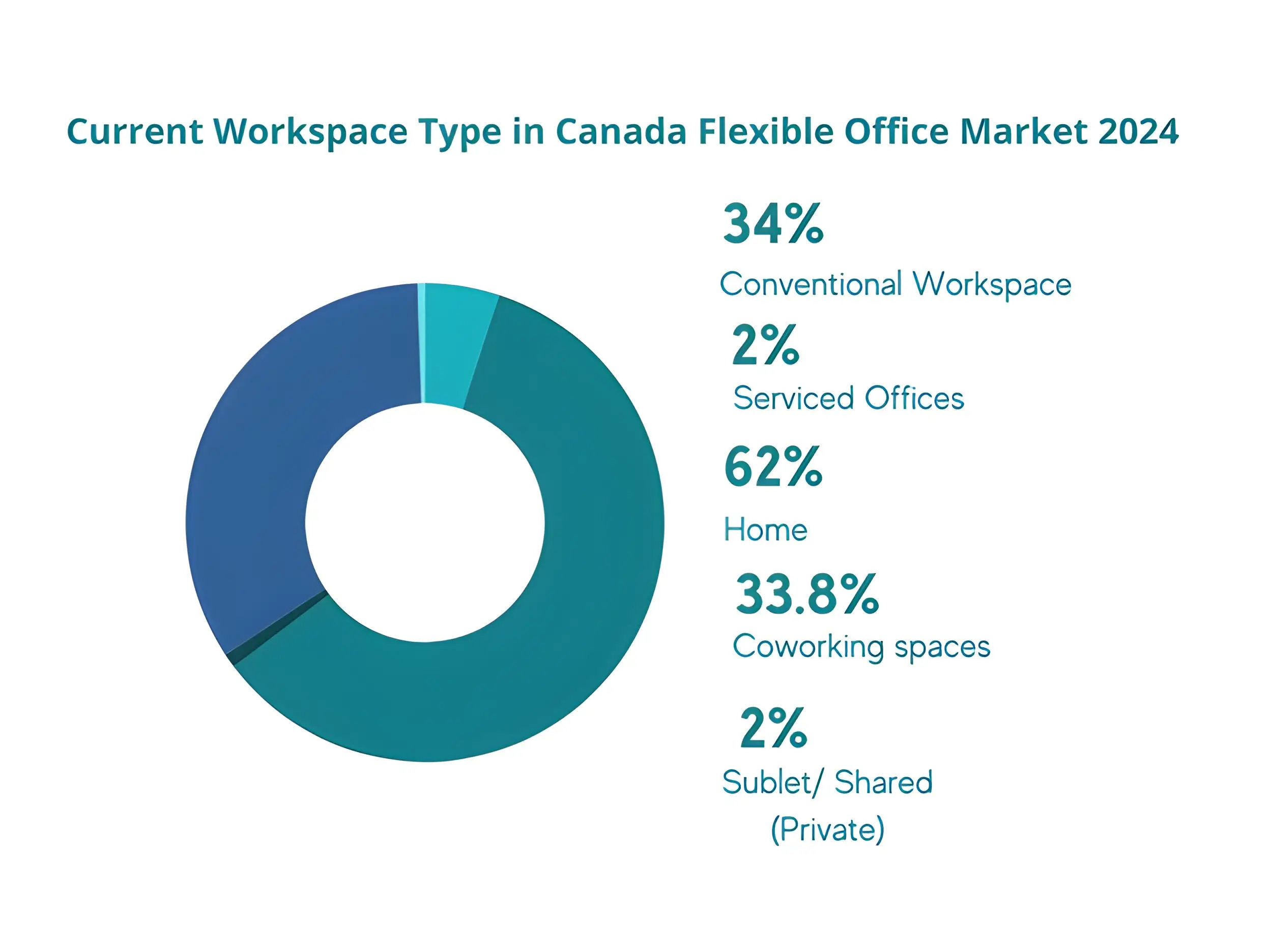

A major shift is taking place in the Canadian office space market. While 62% of companies operate from home, 33.8% have shifted to coworking spaces. However, 34% stick to conventional offices, indicating a strong preference for traditional workspaces.

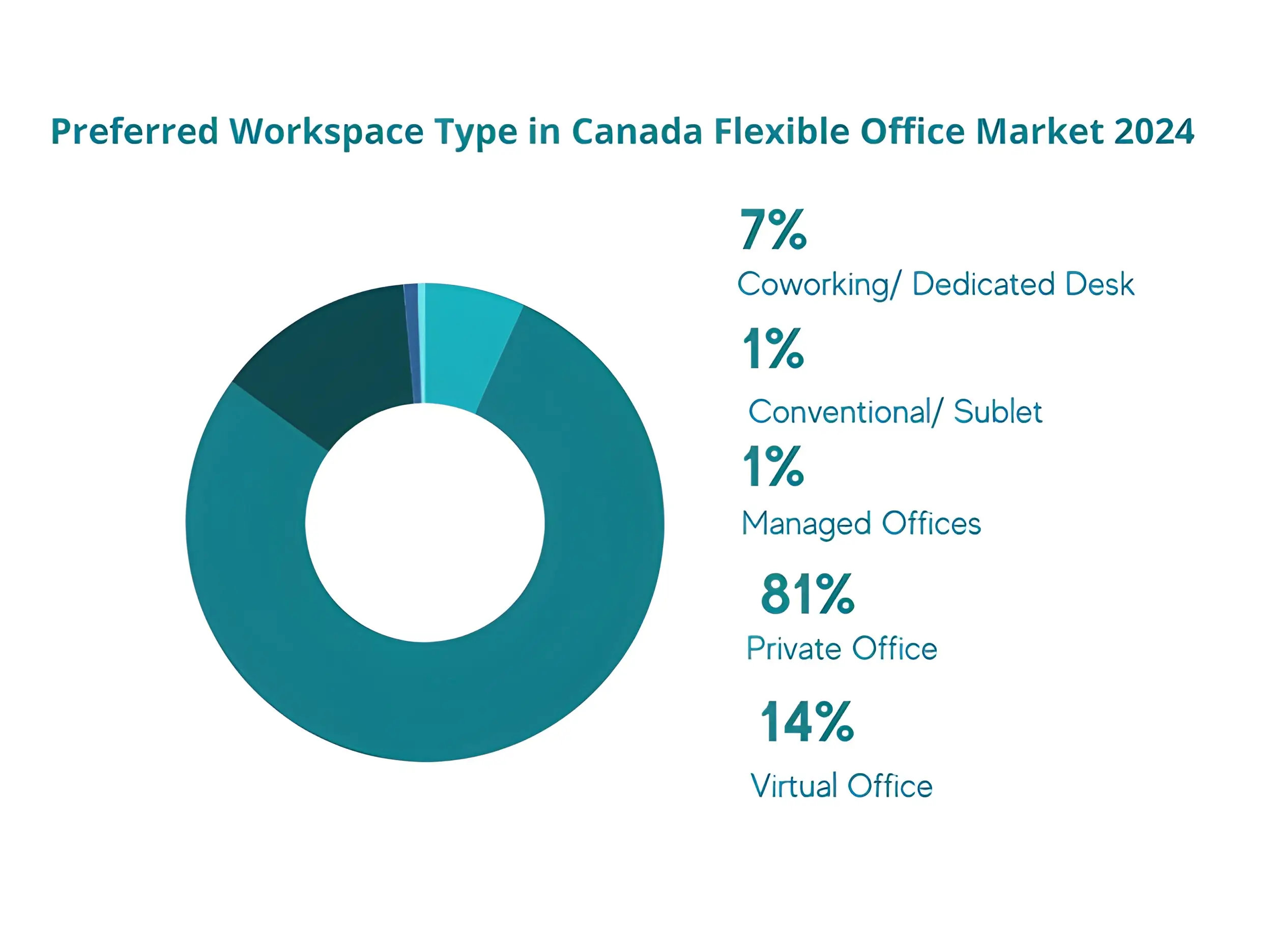

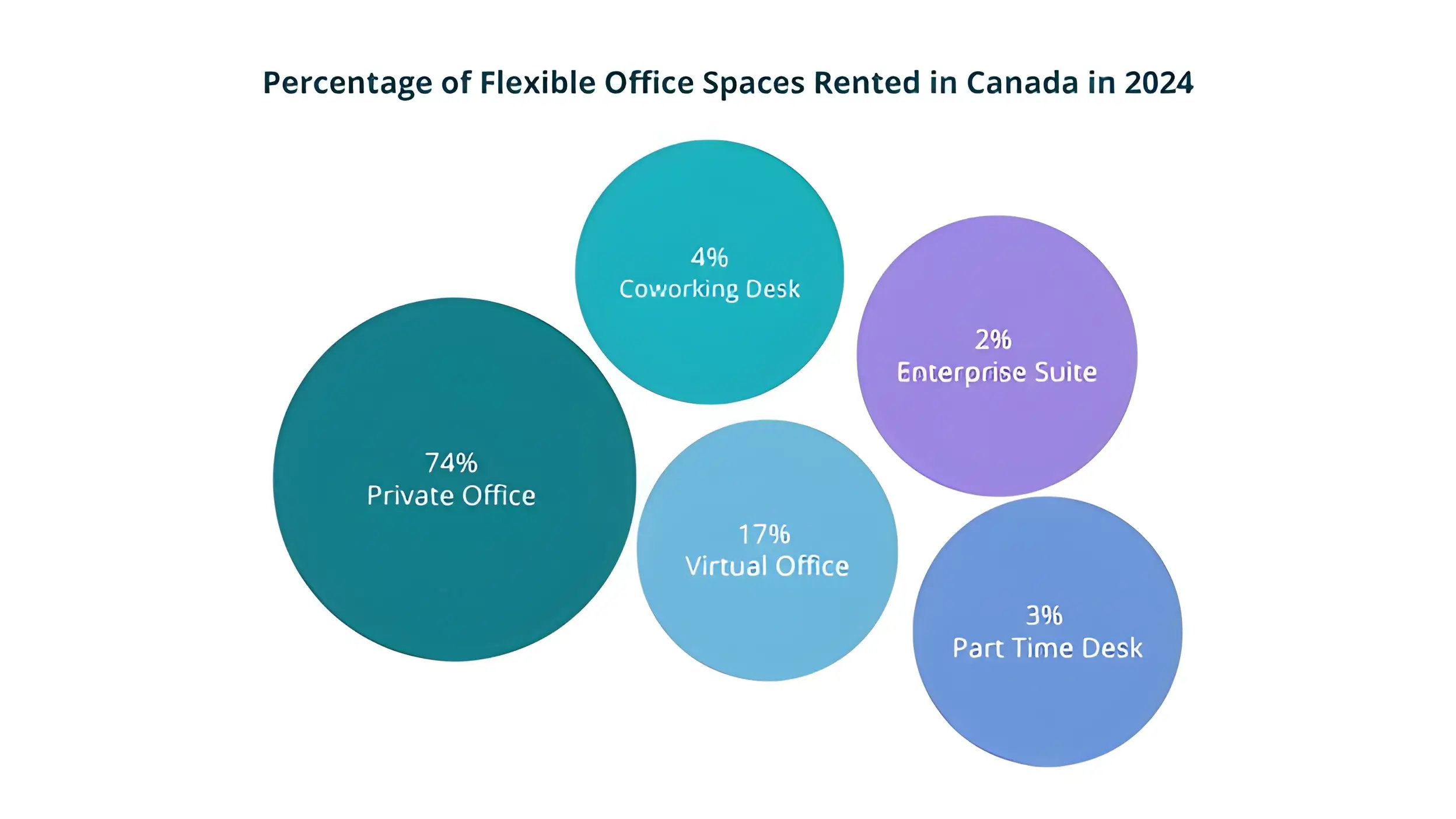

The preferred workspace type setup is heavily influenced by private offices (81%) and virtual offices (14%). This highlights a growing desire for structured but also hybrid and remote environments.

Flexible Workspace Demand by Industry Segment in Canada

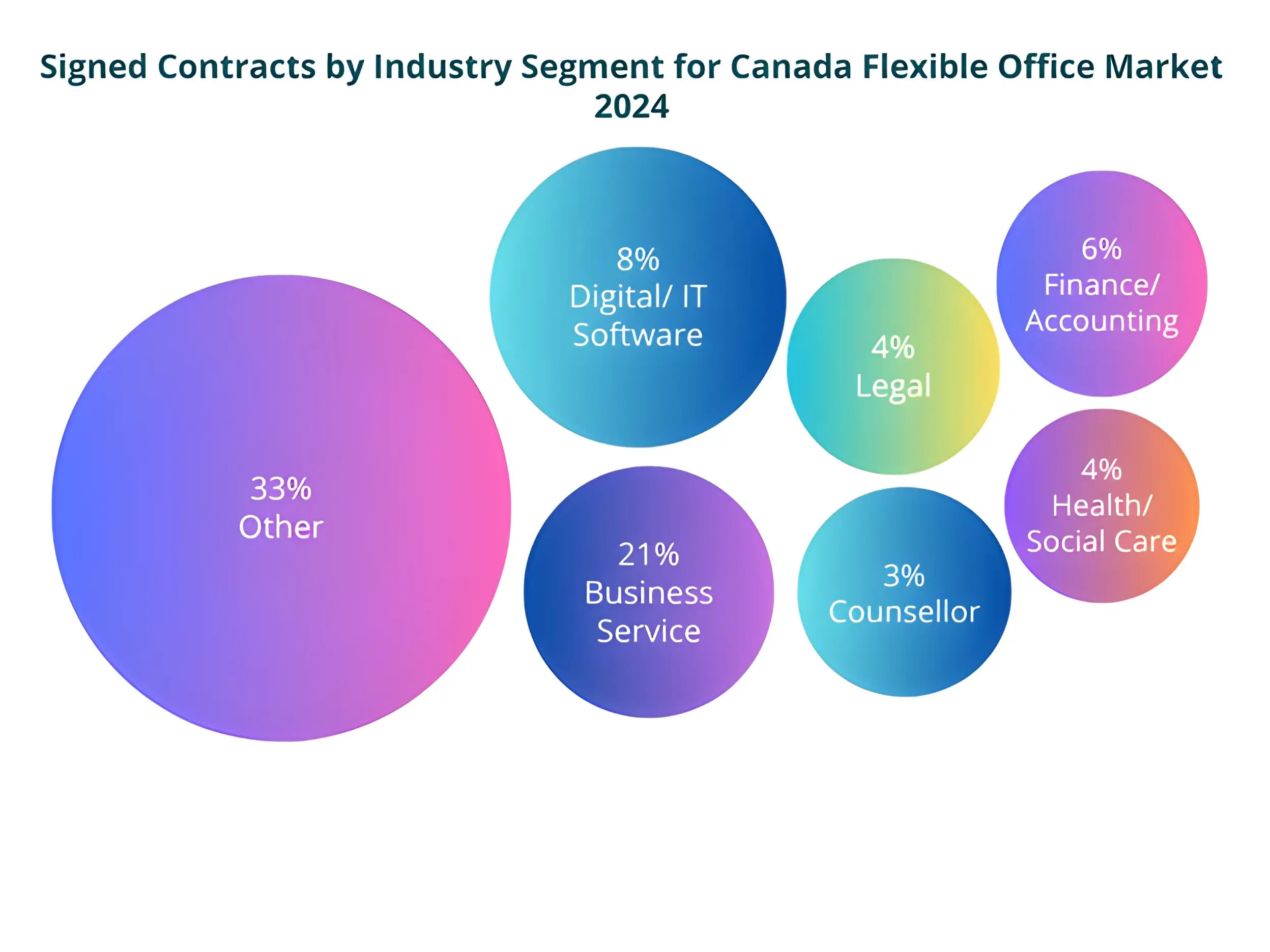

In 2024, interest in flexible office spaces came from various industry sectors across Canada. A substantial 46% of inquiries came from sectors categorized as "Other," followed by 9% Business Services ,and 8% Digital/IT/Software industries, indicating growing demand from non-traditional or mixed-use business models.

Why People Move to Flexible Offices in Canada?

Businesses in Canada are shifting to flexible offices for cost savings, adaptability, and shorter lease commitments. These spaces also support hybrid work models and reduce long-term overheads.

Key Motivations Behind Renting Canada Flexible Office Spaces in 2024

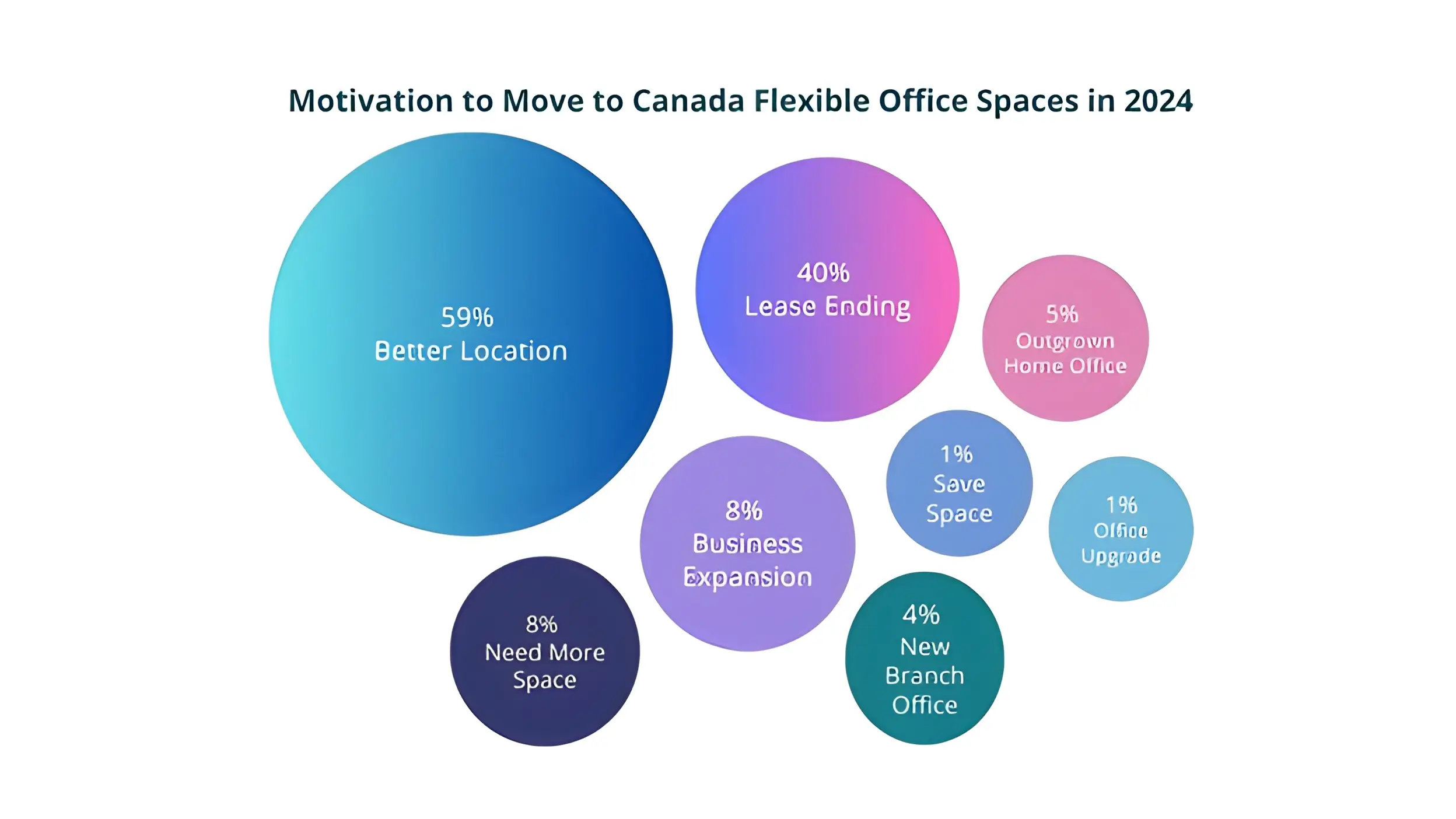

In 2024, the top reasons companies in Canada relocated their offices were driven by practical needs. About 59% moved for a better location, while 40% shifted due to their lease ending, highlighting flexibility and convenience as primary factors.

Desk Preferences and Budget Insights for Canada Flexible Office Space Market - 2024

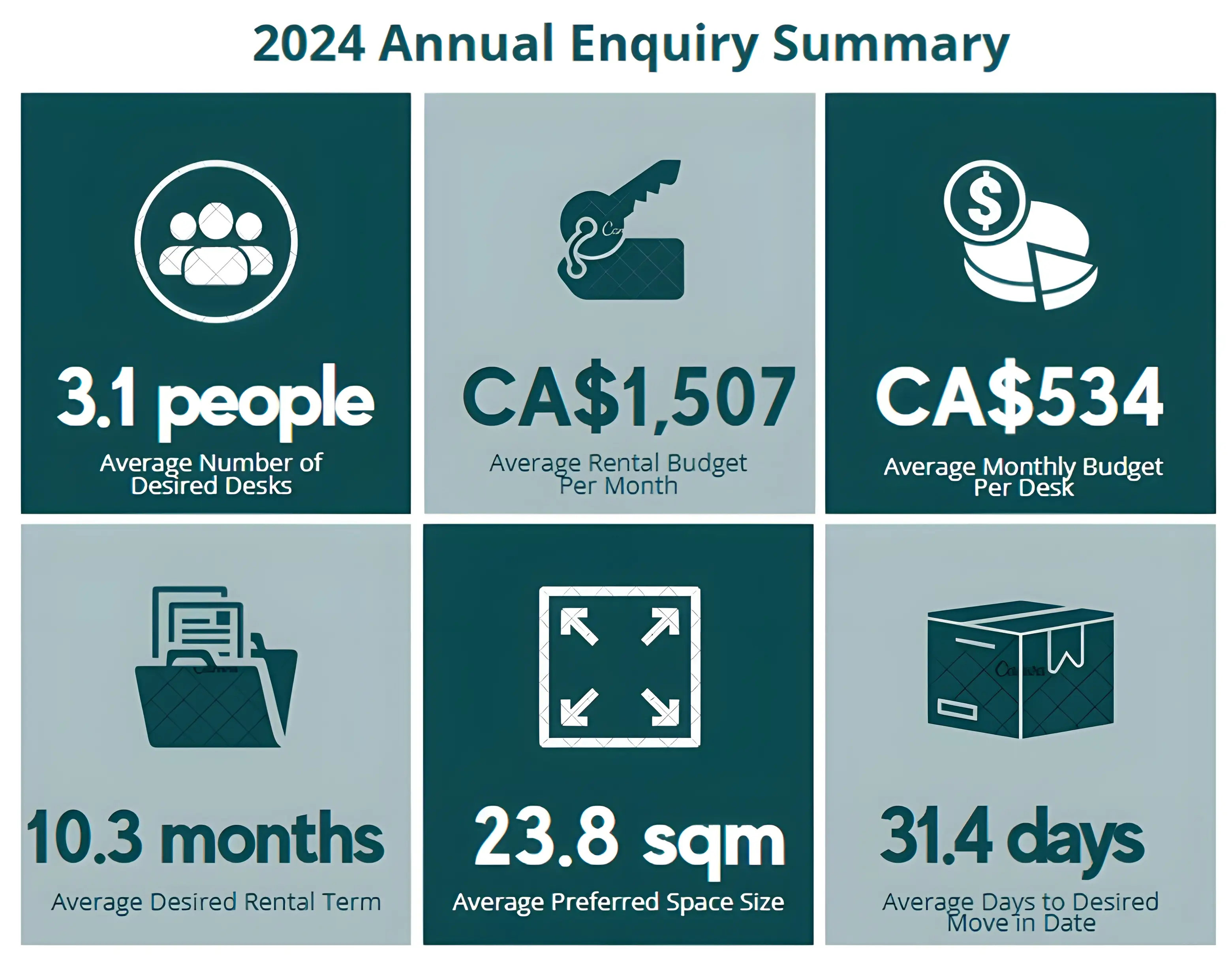

In 2024, businesses searching for flexible office space in Canada showed clear patterns in budget and move-in timelines. Based on thousands of real-time inquiries, these insights highlight average rental expectations and planning behavior across the market.

Trends of Canada Flexible Office Space Market Demand in 2024

The Canadian flexible office space market in 2024 reflected strong shifts toward hybrid work, downsizing, and cost-efficient solutions. Businesses prioritized private offices, better locations, and short-term commitments, significantly departing from traditional leasing practices.

Surge in Flexible Workspace Demand

The demand for flexible office spaces in Canada has continued to grow, driven by hybrid work models and cost optimization strategies. More companies are shifting from traditional long-term leases toward adaptable, short-term office solutions.

Strong Preference for Private Offices

81% of Canadian tenants searching for space prefer private offices. This shows a strong move toward privacy and dedicated work areas, likely influenced by a need for professional environments post-pandemic.

Home Offices Still Common but Declining

While 62% of current workspace users still operate from home, this share is gradually dropping as businesses seek more structured environments that support collaboration and client-facing work.

Location and Lease Expiry Driving Moves

In 2024, 59% of companies cited "better location" and 40% cited "lease ending" as their primary motivations for switching to flexible workspaces, showing how mobility and contract flexibility remain top priorities.

What are the Top Features and Facilities People Looked For in Canada's Flexible Office Space Market in 2024?

In 2024, the top features people looked for in Canada's flexible office space market were printing facilities, reliable electricity, high-speed internet, business support services, and kitchen amenities.

Regional Breakdown of Canada's Flexible Office Space Market in 2024

In 2024, Canada's flexible office space market is witnessing strong regional dynamics, with Toronto emerging as the undisputed leader. Toronto, holding nearly 41% of the national flex inventory, is notable for its strong tech sector and increasing demand for adaptable workspaces, according to a Mordor Intelligence Report. The city’s strategic developments and modern infrastructure, such as IBM’s hybrid cloud center and CIBC Square, further cement its dominance.

Vancouver, Montreal, and Calgary follow with significant shares, while other Canadian cities remain in the early stages of flex space adoption. The shift toward flexibility is not just about design but also about geography—allowing companies to position themselves closer to talent hubs and client markets. Urban centers with higher-quality amenities and modern office features outperform outdated premises as vacancy rates diverge.

2024 Inquiry-to-Deal Summary of Canada's Flexible Office Space Market

In 2024, flexible office deals in Canada moved swiftly, averaging just 19.5 days from initial inquiry to contract signing. The average monthly desk rate stood at CA$511, with the average contract value reaching CA$16,552. Notably, 6.5% of all inquiries successfully converted into signed agreements, reflecting a healthy and responsive market.

Signed Contracts by Industry Segment for Canada Flexible Office Market 2024

The distribution of signed contracts in Canada’s flexible office market for 2024 highlights a diverse mix of industries adopting agile workspace solutions. Business services led among defined sectors, while 33% of contracts fell under the "Other" category, including niche and emerging sectors. This trend reflects the increasing flexibility and broad appeal of coworking and private office options across various professional domains.

Percentage of Flexible Office Spaces Rented in Canada – 2024

In 2024, private offices led the market, accounting for 74% of all signed contracts in Canada. Virtual offices followed at 17%, while coworking desks, part-time desks, and enterprise suites made up the rest.

The Future of Flexible Offices of Canada

The rise of remote and hybrid work models, accelerated by the pandemic, has reshaped the demand for office spaces. Flexible offices, including coworking and serviced spaces, are central to the future office landscape.

Rise of Remote and Hybrid Work

The pandemic accelerated hybrid work, with remote arrangements becoming standard. As businesses embrace flexibility, traditional office space demand, particularly in small offices, has dropped.

Impact on Traditional Offices

Companies are moving away from large, fixed office spaces. Instead, they opt for smaller, adaptive layouts that prioritize collaboration and flexibility over traditional desks.

Coworking and Serviced Offices on the Rise

Coworking spaces provide flexible, cost-effective options for businesses. Due to their scalability and short-term lease options, companies of all sizes now prefer coworking or serviced offices.

Suburban and Satellite Offices

As remote work grows, companies are exploring suburban and rural office spaces. These locations offer employees shorter commutes, lower costs, and improved work-life balance.

Technology as an Enabler

Technologies like IoT and AI are transforming flexible offices. Smart buildings improve energy efficiency, enhance security, and support hybrid work setups more easily.